Each day common stocks go higher and higher–where it stops no one knows–really NO ONE.

I can find all sorts of fundamental data that would show that the never ending climb higher in equities is silly–but really who cares about fundamental data? We all know that we have a new type of investor in the market–they are young and wealthy–they think totally different.

For years one believes they have cracked the code to earning a nice 6-7% annual return–but the rules change and I am back to being as dumb as I was 25 years ago. If I was really smart I would be up 25% this year instead of hoping I can reach 5% If I was really smart I would hold nothing but speculative equities that have no earnings, but they have sexy names. Oh well not to be–I feel good about staying the course of working to get that 5% (or maybe 6-7%) year after year through conservative investing.

In the Monday Morning Kickoff this week I wrote “I wouldn’t bet on a stock market tumble now”. In spite of the silliness in stocks 2 key indicators point to higher prices.

I have taken to watching the Fed Balance Sheet as well as the Personal Savings Rate (let’s call it PSR).

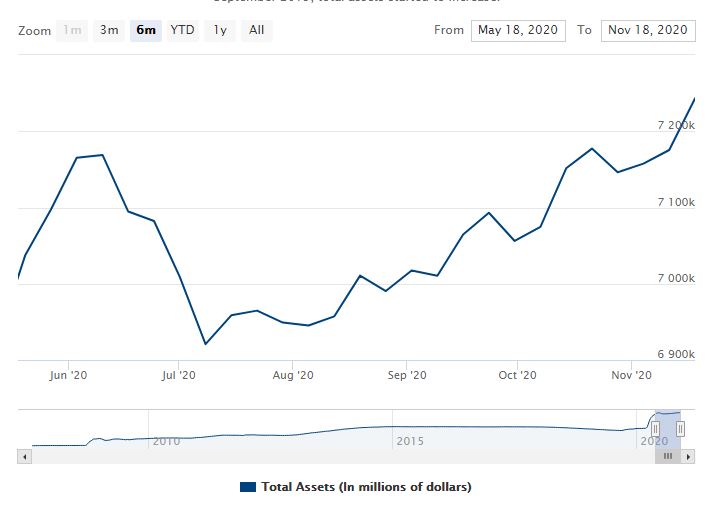

The Fed Balance Sheet is going higher and higher–now at record levels. While the balance sheet took a dip in June it is now rising steadily as the FED buys all the excess assets that they can sop up. Now whether I agree or not with the FED policy it matters not–as long as the assets are moving higher they are manipulating markets to where they want them–interest rates and thus equities.

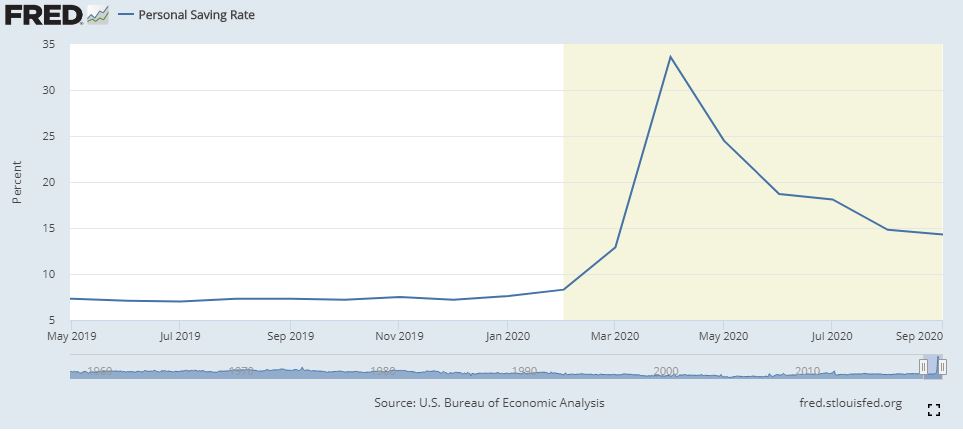

Now I being to look at the Personal Savings Rate–the definition being personal income less outlays for expenses and taxes.

You can see that the normalized level on this chart is around 7%, but in March it started to sprint higher with helicopter money flowing freely–peaking out at 33.6% in April–wow. Now the drift lower begins and now we are at 14.3%–still a huge increase from the norm. To say that the consumer is well ‘funded’ right now would be a huge understatement.

So the question is simply will markets continue higher with the FED manipulating interest rates and with the consumer having more cash than they know what to do with? Will the party continue until consumers get back to the normal savings rate? Or will it continue until that ‘black swan’ shows up one day?

What do insiders know that we don’t?

Insider selling has exploded in the last month.

Expectation of higher taxes?

you aren’t going to get that with that Senate, no matter who wins in GA on 1/5/21.

More likely their earnings are not recovering as fast as their stock price, and see this time as the best time to cash out.

“The trick is, when there is nothing to do, do nothing.”

I think there will be good buying opportunities over the next few months. Now the market is ruled by extreme greed so there is nothing to do on it (if you are not daytrader of course).

ANNALY CAPITAL MGMT INC SER D CUMULATIVE REDEEM PFD PERPETUAL 7.5%, CUSIP 035710805, is scheduled to be redeemed on 2020-12-23.

This may have already been reported here, but please note the divie payment is scheduled for the last day of Dec, but this redemption is on 12-23, so it may not pay that dividend (or pay a partial)?

Will pay a partial.

Quarterly payment date is end of December so you should get an almost full payment.

Ex-div date is November 30 and some sites are showing full payment which may not be accurate. Current trading price of $25.41 is probably within a couple pennies of what you’ll receive.

Hi Tim,

On the Master List , ECCB is not showing a maturation date.

Thanks JB–will get it.

Sentiment is extremely frothy at the moment in the indicators that I watch. Would not be surprised to see a pullback over the next few weeks and then the Santa rally. ATB

All: I would like to wish everyone a happy Thanksgiving during these difficult and trying times. At the present time, it appears we have two or three vaccines that may work – so hopefully we will get back to “normal” in the next year. Wishing continued success to everyone here on the board.

Remember Feb ’16, remember Dec ’18, remember March ’20. We have had 3 big buying opportunities in the last few years and another shall come before we know it. The more it seems like it won’t drop again is exactly when the market is most vulnerable. I’m keeping some powder dry and making a shopping list so I can act with conviction when the opportunity arises.

I’m 40% cash and gradually increasing every time the market goes up more. I may be too early but sometimes it’s better to be early than late.

Martin, I am exactly with you. I am usually less than 1% cash. However, the past month I have gone to 56% cash with a few more sell orders pending. I may have been early but I will be ready for the fall in prices of income securities.

Gary and Martin,

And I’m another who has taken profit on probably 20-25 PFDs in the last couple months – where I had intended to hold to at least the 1st call date out 4-5 years. My criteria is simple: if my cap gains are > 1.5 yrs of payouts, take the profit, and I assume that the price will return to my original buy price within the next 1.5 yrs wherein I can take another pop at it.

Tim, thank you for your hard work in putting all this information together.

This is same strategy concept I use. I had been doing “if price goes up greater than 5 years of dividend payments sell it” but then reduced that # to 3 years. 1.5 may make even more sense given the environment. So crazy!

Stock market rise makes sense to me. Market is forward looking, so even if the next few months are weak, vaccine points to full recovery in 2021. Other key dynamic is the pandemic has been a major transfer of wealth from smaller companies to larger ones. Public companies are generally larger, so they will see higher market share as many smaller businesses go under or have trouble fully recovering.

I am waiting for Elle McPherson to call me because all of my other fantasies were realized this week. What a month for cyclical investors!

I have just been skating to where the puck is going, and it is going towards the higher yield preferred stock trash bin. So that is where I have largely been skating at…For near term anyways.

Tim are we sure Gridbirds credential haven’t been hacked? This can’t be real!!

If you Prefer, The difference between involvement and commitment is like ham and eggs. The chicken is involved; the pig is committed…. Im the chicken in the high yield chase. I am involved, not committed!

But a couple months ago it was becoming apparent the “super safe” stuff just didnt have much possibility of much northward movement. Now I kind of have walled off the safe stuff from the yield chase so I dont cross pollinate the funds.

I dont discuss politics as its a waste of time as no one is going to change anothers beliefs. But I do try keeping an open mind on preferred debates and am amiable to change my opinion. For example a private discussion with Preferred Stock Trader convinced me to jump pretty hard on QRTEP in lower $90s, and then I doubled down in upper $98 range for the divi spike play, and will reduce position again in a few weeks.

And there have been several discussions here that forced me to have a change of heart and wade in on ones I previously dismissed outright. It certainly has been the right call…At this moment anyways, lol…

I’m an unabashed rate hog so I’m just saying. It’s an big arena. I can remember doing another head snap when a treasury zero trader friend contemplated pfds too!

I wouldn’t buy something if I’m worried about them. But they are bottom of the totem pole and periods of stress watch out. I had Ford and others that test 10 and lower.

Most all are 27+…..So I’m starting to move down in coupons.

If you Prefer, I generally can be more fearful of risk and can assume the worst without definitive proof. This has kept me from getting in on some nice opportunities, but on other hand it has always kept my frog legs out of the boiling water. Its always tradeoffs isnt it. I didnt have the nerve to buy issues like Ford or Mreits down at $10 or under, in March but I had full confidence in buying utes that hit in $15 and $16 range selling any illiquid not nailed to the wall and loading up to the gills.

Its not the cure for cancer, but I can pick my spots when I see common stock rising, and company on upswing, or at least stabilized I can justify jumping in on some. I have about reached my personal bottom of the barrel with my last purchase this week of LEVLP this week at 25.50 for a shameless plus 7% QDI yield chase. Banks are really are just a leap of trust when buying due to their leverage and complex financials. I have enough now to babysit, so I will do “watchful waiting” with this scruffy bunch, while on the other side look to exploit any price drops and rises on the quality side to grind out more cap gains to assist the low yields.

Banks and Insurance are where most my positions are. Somehow I had moved out of most energy names. But yeah I was in Mcreits. After having moved out in 2019.. . Up to some 5% like exposure. I thought they were a good area for yield!

All the rates in the world were DOWN. US mortgage markets seemed poised to benefit. I thought it was a good bet! I looked at some mc reits with stable 10 years pfd history. And with OPEC floundering I especially thought mortgages would benefit.

And then Ginnies went from 3.25 in 1 week back to 3.95. And many GNMA and CMBS positions were leveraged. It was like 2008 all over again in 10X speed. Now most are back to $20-22 type of pricing.

The only areas I’ve really avoided are shipping. And most small cap companies. Under a certain size makes for thin markets. I can’t deal with that. Still sometimes I need to put on the asbestos gloves when opening new ideas….

IMHO – The market is not as complicated as people make it. In a bull market you buy the dips and sell the rips. In a bear market you go to cash, bonds and or short the market. Tim is right about the Fed. The liquidity is flowing and the money has to go somewhere and when you put rates at zero for three years, assets are going higher. Happy thanksgiving, ATB.

TimH–agree with all you wrote. Happy Thanksgiving to you as well.

I think the market is celebrating a vaccine plus the shaping of a new administration – a double whammy and quite a party.

The free money will have to be paid for – will investors anticipate a raise in the cap gains rate and dump in December or will they wait until January with a clean slate to work with? Hang on either way.

I lightened up on a few issues today.

Sold EMN – which I had bought on 4/21 at $52.94. This has the typical cyclical nature of a basic materials/chemicals company. But also had a good yield with a strong dividend safety rating thanks in part to the relatively low payout ratio and BBB credit rating. I had to cash in once it hit $102.50 today. Still a solid company but with the price doubling, the yield is now below my liking.

Sold CNP – this was a long time hold for me. Alas I was asleep at the wheel and got complacent, not selling it in early 2019 when I should have. It tumbled this spring with everything else but has now recovered most of that and given what it is now yielding, I figured now is a good time to cash out

Both were in a tax deferred account

The real unhedged risk to the markets going into the election was….. FOMO

Say what you will the melt up is real.

FOMO, yes, and TINA. What are you going to do with your savings, put it in a savings account or CD that gets 0.6% ??? There Is No Alternative — so the money flows into the market. For now, it makes everything look great. The unanswerable question, though, is if (or how long) it can last. Maybe it’s the new normal and maybe many of the old rules are gone. Or maybe we’re crusin’ for a big brusin’ when something tips the first domino.

A few years back I had a ‘mouthy’ friend beating me up over low MM rates. He was in an account that could not transfer easily. The . Not 1 percent ..one one hundredth of 1 percent. So we bought a pfd. He made like 4100 in 6 weeks. I called him and said “You just earned 41 years on MM interest in 6 weeks now shut the —– up!”

Not sure why it’s ‘silly’. There are plenty of solid earners on the common stock side of the board that are moving higher and higher because they are in the right place at the right time. I’m no longer seeing a lot of urgency in dumping money into sub 4% preferreds with rates pinned to near zero for the forseeable future. Strong dividends plus cap gains make the common stock side much more appealing. It just does… At least for now. To me, the Personal Savings Rate charts are interesting, but largely irrelevant. These younger generations continue to operate on the “it’s burning a hole in my pocket” theory and continue to spend just as fast (or faster) than they bring the money in. Why not? Certain folks are telling them that they can have free rent, free college tuition, free this, free that. Bad examples set give bad results.

Not really surprising. A lot of folks in their older 20’s and younger 30’s in high value industries like tech can make half a million dollars a year as a mid-senior individual contributor when you factor in equity compensation that in today’s market is almost guaranteed.

LTVS, I agree. Both my children are in their 20’s and making 6 figures and trying to make a difference with volunteering for their social concerns. But they and their friends complain about the tax laws that appear to favor the elite and they question their futures unless some balance is reached. They are not looking for anything free, only a fair playing field. Happy Thanksgiving!

Happy Thanksgiving, everyone!

Really – what tax laws are those that favor the “elite”?

This is the problem with today’s younger generation – they have been brainwashed into thinking the system is against them. You have 5% of taxpayers paying over 59% of all federal income taxes – while 50% of taxpayers pay a total of 3% of all federal income taxes

If your kids are earning 6 figures – they are in the top 10% of income earners.

Maverick, I suspect one of the “flash points” some people have is “working income” is taxed more than “passive wealth income” is. Im taking no sides here, but this what Warren Buffett said a few years ago when he said his secretary pays more percentage in taxes than he does….CEOs getting paid in stock options which result in smaller cap gains tax than income salary does, Hedge fund managers also, Dividends and cap gains taxed at lower rates, etc. But I will admit, I like my investing income more than my then working income and now pension income because I pay a lower tax rate on that.

I dont have an answer that fits all perfectly. As percentages and point of view can justify either side of the fence. It kind of goes back to one of my personal favorite sayings and admittedly I kind of support…”Dont tax you, dont tax me. Tax that fellow hiding behind the tree!”

Yeah Grid but that impacts so few people (ie those with passive wealth income are such a small part of the picture compared to those with “working income”. ) And philosophically, a person already paid a higher rate of taxes during their life on their “working income” to accumulate the capital to invest and generate “passive income”. Plus there are economic and other reasons why capital gains tax rates are what they are.

But that all said, you are right in that most people want the other person taxed and not themselves.

To me – while it will never happen – the best thing would be to blow up the tax code and have everyone pay the same flat % on all income. No deductions. So everyone has skin in the game, whether you earn $10k or $10 million. Pay your 10% tax or whatever and that is it

But since that will never happen, time for me to be greedy – lol. Having paid significant taxes while I worked, I am looking forward to being a taker now – living off passive income and paying no taxes plus getting subsidized healthcare. First time in my life the government will do something for me. Ha.

Taxes have largely become irrelevant. MMT is the present and the future. It does not make any difference if we agree with MMT, but it is already here. We just created $1.8 TRILLION with the CARES act and nothing bad happened with inflation and/or interest rates. Combine that with the literally other trillion’s that the Fed created. No taxes were raised to pay for all of this which proves to the casual observer they did NOT need to be raised. Before the Covid crisis the US was running roughly a $1 TRILLION annual deficit. COVID just turned on the afterburners and we took the F22 vertical. (And yes a F22 can literally fly straight up.)

So all of this talk about how much any group pays or does not pay in income taxes is missing the point. Nobody has to pay income taxes! We have proof!

We have to divorce our beliefs about how things should work from how they actually work. So all of this talk about “raise taxes” to pay for all of the spending is another Aesop’s tale. Ain’t happening.

And before anybody suggests this is Dem or Repub speak, disavow that thought. When it comes to spending like drunken sailors, we have a one party system in Washington.

Que the music:

Our mission, should be decide to accept it, is to figure out the best investment path we can take going forward. We aren’t going to change Washington, so we have to focus on what we can control.

A4I–of course you do know, I am sure, that the purpose of some of these things I write is to stimulate conversation and viewpoints.

Tim, I would like to congratulate you for a great site and say thanks for stimulating discussion. I suspect many of us (especially me) are susceptible to group think or ‘echo-chamber’ effect which often leads to difficulty is appreciating other viewpoints. Just because some of us may not be aware of the effect the economic situation is having on many families should not preclude us from trying to remain open minded and empathetic to those in less favorable situations than us posting here. Broad over-generalizations, whether about people in their 20’s or people of opposing political view, appears an easy way for some to make sense of the world but misses the wide range of diversity and nuance that exists in real life. The older I get, the more I appreciate that life is not black and white, but many shades of gray. So a shout out for a continued civil discussion and a Happy Thanksgiving to all.

Thanks furcal

Well said.

I miss nothing… It’s all about the facts. I understand that you’re speaking for yourself.

“Certain folks are telling them that they can have free rent, free college tuition, free this, free that. ”

And maybe they’re right and reasonable, and we are wrong and crazy. In a zero- (or negative-) interest-rate world, where enormous government and CB debt is perhaps likely to create enormous inflation, maybe the smartest and most reasonable thing to do is to borrow for rent, borrow for college, borrow for this, borrow for that, and it will all turn out to be free.

David,

Isn’t that likely how they ended up where they’re at? Take little to no responsibility, borrow, borrow, and borrow again. Then rinse and repeat?

And maybe where they’re at is a very good place, and just more evidence that they’re right and we’re wrong.

Tim,

You run a great service, but you’re conservative by fixed income standards, so its not surprising that you have discussed this topic. Still your behaviors served you well in March so what is going on is two extremes that happened in the same calendar year.

zero interest rates is a reality now and a game changer.

LTVS–no doubt I am very conservative–and the older I get the more I have to force myself into certain investments. Now if I was into the mode of drawing from accounts for expenses I would look at it a little differently.

Has anyone noticed CORR is up over 20 percent today with no news

reported. CORR-A (7.35%) is also up over 10 percent. It appears David Tepper sec filings show he is investing more in energy stocks and pipelines such as Energy Transfer

Energy prices such as Brent Crude going above $45 despite tepid demand

upcoming in the USA due to increasing lock downs. Any thoughts on the increase in energy preferred stocks? This year, until now, energy preferred stocks have not done well.

I sold all my Corr-A today.

I deleted it from my “Current Holdings” watchlist.

I did add them to the watchlist “Stuff I sold”

I think oil is setting up for good times in May or June when the Vaccine has

been widely distributed. We can then leave the confines of our caves and take to the road again.

For that matter Weight Watchers should see a surge once we look in the mirror.

I looked in the mirror today and saw a fat old man. I asked my wife for a compliment to lift my spirit and she said you’re eyesight is 20/20.

RIP Rodney

Thanks Newman, that made me smile.

Good one Newman–my wife keeps saying ‘do I look that fat’ and I keep asking her if I look that old.

I told my wife I AM in shape. Round is a shape.

Tim – With you having written what you have, I feel like I don’t have to……

2WR–we have folks of all walks here–some of us think kind of alike–obviously not all of us tho.

This too shall pass, no one knows how, still no crystal ball on Wall St., or Main St. either.

Tim, your “Now if I was into the mode of drawing from accounts for expenses I would look at it a little differently” comment peaked my interest as I’m in that category for a portion of our expenses. What would you be doing in this market if that statement were true for you?