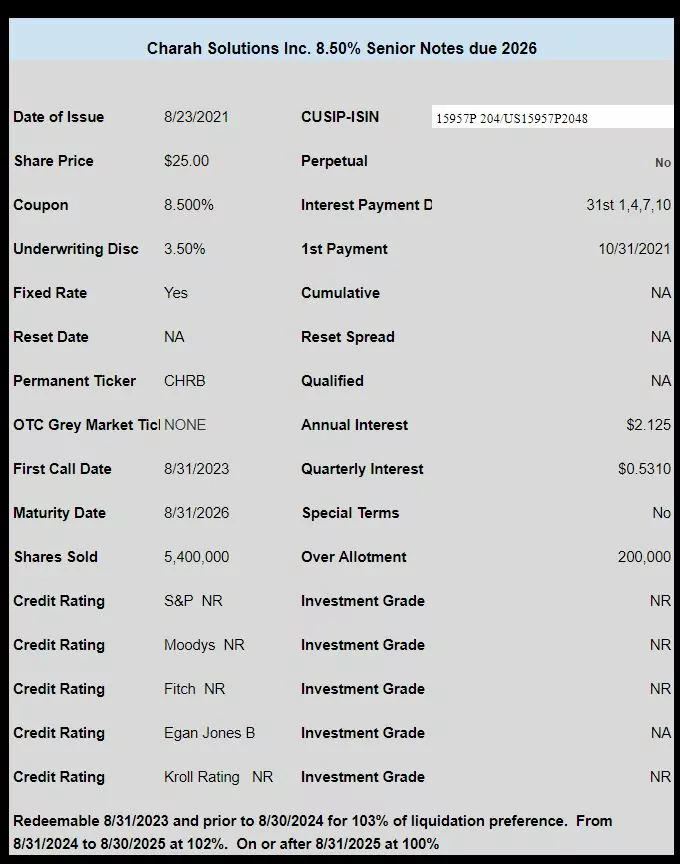

Charah Solutions Inc. (CHRA) has priced a new issue of baby bonds with a maturity date in 2026.

The issue will be redeemable starting on 8/31/2023 on a sliding scale bonus rate for 2 years before reverting to the $25 liquidation preference up until maturity.

For what this is worth the notes are rated ‘B’ by Egan Jones.

The issue is note trading and won’t likely trade til later in the week or next week. There is no OTC grey market trading.

The pricing term sheet is here.

The original registration statement can be found here.

xerty posted this one this morning–likely someone posted last week by it was no noticed.

First off, outstanding website.

Major kudos to Tim and the rest of you awesome posters.

This one seems a bit risky for me considering going concern, backstops and no income. All of this resulting in the 8% coupon.

I will pass.

Thanks USC CPA–glad to have you here!

From what I read on their website they are also in nuclear with some new multi year maintance contracts. I might buy some

Jos–not profitable,, but I did think their business looked interesting.

Tim,

I have dug some more into Charah Solutions. I believe what is going on as it relates to profits is a private equity management company owns a controlling chunk of the common stock. I think Charah’s profits are mainly flowing to the parent company as reflected on the sections of the financial reports as losses attributable to Charah and the stockholders? I also see several of the board of directors are from Bernhard Capital Partners Management LP, which is the entity that owns a major chunk of the common I think. They are the same company that owned them outright and did the IPO in 2018. BCP is an interesting outfit also, but being private there is very little out there on them. Even their website requires a password. They seem to specialize in the energy sector. I doubt Charah is going out of business, for one thing they have been around for 30 years according to their website. I also don’t think they have been sucked dry of money by BCP as they seem to be growing. As you mentioned their business is “interesting” and my take is they are in a good niche as coal fired power plants are being shut down. Wish I understood those financial reports better! I am still digging through the various terms I am not familiar with. Just some more thoughts on Charah. Still thinking about a small bite.

my general rule is not to buy the prefered or the bonds of a stock if the common is under $5 a share.

If teh stock is that cheap theres usually a really good reason and IMHO that makes the debt to risky

I know right. Taking risk here is a horrible idea. I’ll just shut up and buy some TY- to take me to riches untold!

But in all seriousness, depends on how much common stock the company sell even if it is weaker. Look at FCEL. They bolstered their cash position with so much common stock selling that they can easily buy out or pay out on the preferred for a very long time.

I get what you are saying, but with a reverse stock split and price can be anything they want, right? I look more at the trend of the common than specific price.

This one has caught my eye as they are into coal ash remediation for coal fired power plants, which is a hot button right now. They also provide maintenance, shutdown assistance, and staffing for the power industry. Sounds like a pretty stable business. Charah Solutions has been around for 30 years or so, but were private. They did an IPO in 2018, but I think the company that owned them still has a ton of the stock. They had ton of debt in 2018, which they didn’t pay down much with the IPO money. Evidently they have run into trouble with their credit facility, failing to meet the leverage test among other things. They are issuing these notes to pay off the credit facility and terminate it according to their press release. Guess the 8.5% is cheaper and less hassle than dealing with the bankers. My thinking is they may be worth a closer look at and maybe a small position. It does appear to be a stable business. Any other thoughts out there? I also see they mention a Series A preferred stock on their latest report, but I can’t find it in the master list. Did I miss it?

To be honest, I’ve not put much work into this one, but enough to make me question my confidence in RILY and my position in both common and notes…. This makes me feel as if they consider themselves infallible – it also reminds me a bit of the wheeling/dealings of a guy named Milken. just a gut feel response not based on deep down reading.

Why does it make you question your confidence in Rily?

Libero – Unquestionably RILY has been riding a wave on their investment banking side by taking on heavy equity and other positions on very riskily financed companies such as this one probably with the idea that their presence alone will have a large enough positive impact on the target company to help turn them around. Then, they put their reputation on the line with what I can only assume is primarily individual investors by putting their name on underwritten issues such as this one…. This has worked well for them and for most of the companies involved in an up market, but it wouldn’t take much to stain their rep should the markets momentum stall and some of these risks turn sour. To me, and this is purely a personal opinion, this one just seems like it could easily turn out to be a jumping the shark kind of issue for them… Look at the Recent Developments section of https://www.sec.gov/Archives/edgar/data/0001730346/000119312521249739/d216162ds1a.htm and tell me you don’t walk away gasping at all the risks they’re taking on…. and as I said when this first was announced, it just feels to me that by underwriting this one to the public, they are telling prospective buyers that Charah has no idea how they are going to pay off their existing Credit Facility as it comes due but we’re going to lay that responsibility off on you instead on an unsecured basis and make it your problem not theirs… Read the DESCRIPTION OF OTHER INDEBTEDNESS section and see how they’ve had to negotiate amendment after amendment just to stay in compliance with existing covenants..

So to me, they’re palming off a tough situation thru this underwriting to take advantage of the market’s insatiable quest for yield no matter the risk… That could eventually come back to bite RILY in the butt when they discover they’re not infallible once the market changes… Mind you, despite saying all this, I’m holding strong in my RILY position and with owning 3 of their notes…..