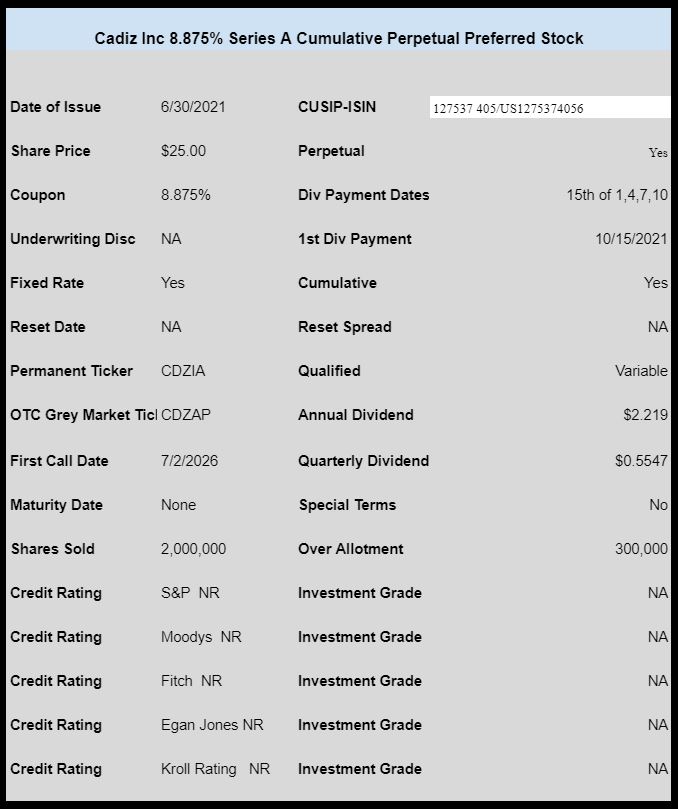

Water resource company Cadiz Inc (CDZI) has priced their new preferred issue.

The issue prices at 8.875%, is cumulative and non-qualified (at this time). The issuer of preferred stock can only pay qualified dividends if they have income–CDZI not only doesn’t have income, but barely has revenue–for now dividends will be ‘return of capital’.

The issue is now trading on the OTC grey market under ticker CDZAP (originally announced differently) and trading around $24.56.

The pricing term sheet is here.

LOS ANGELES, July 7, 2021 Cadiz Inc. (“the Company,” NASDAQ: CDZI) is pleased to announce the closing of a new, long-term $50 million, 7% senior secured credit facility agented by B Riley Securities, Inc. (the “BRS Credit Facility”), successfully completing a $107.5 million financing package that has enabled the Company to reduce its total outstanding debt, lengthen debt maturity and provide capital resources for continued asset development activities.

The net proceeds from the BRS Credit Facility, combined with the net proceeds from its recently closed underwritten registered public offering of $57.5 million of 8.875% Series A Cumulative Perpetual Preferred Stock (the “Series A Preferred Stock”), represented by depositary shares which are expected to be begin trading on NASDAQ under the symbol “CDZIP” within 30 days, were utilized to repay in full the Company’s senior secured term loan with Apollo Special Situations Fund, LP(the “Existing Credit Agreement”), fund a segregated dividend account and provide working capital.

Here’s an article detailing some of the hurdles Cadiz Water was facing in early 2020, including some $140 million in debt coming due in two tranches. The author speculates that the debt + opposition to their water pipeline project from environmental groups would cause the company to go bankrupt.

https://seekingalpha.com/article/4314320-behind-idea-cadiz-structurally-unprofitable-burdened-senior-secured-debt-and-tied-up-in

The article is worth reading to get some background on the issues surrounding the company and the players involved, even though the author’s prediction of imminent demise did not come to pass.

If I were inclined to dumpster dive I see better 9% opps out there. To cite a couple recent mentions LTS notes and Phoenix bonds. Both are dark but they are paying.

Why, even Rida’s 20% WPG bonds may end up looking good.

Is This a solid company and stock ?

my wife generates more revenues than this company in 2020 and 2021.

having said that, I’ll take a small bite.

-james

While Schwab and Fidelity analysts consider this small company “neutral”, I will pass, San Bernardino County is one of the poorest dessert county. This does not necessarily mean that water is NOT the most precious commodity in California. After I missed the SRSPF on Day 1 (had an appointment with my glaucoma genius specialist in La Jolla, CA, I will bet on Gridbird’s FATBP as he has opined in SiliconInvestors.com. With WTI rising (article by Lyn Schwartzer) and shipping stocks all at near market top, there are high yield options. BTW, two articles on Rida’s WPG, I sold all my preferreds for dirt but kept small number of unsecured senior note (interest already suspended).

BTW, OPP-A seems to get some upside. I believe that Rida is pumping the common closed end fund, OPP. Actually OPP has a high pro forma dividend and the price chart clearly shows noticeable improvement. Because of YIELD, I have made some bets on FATBP in recent trades.

Bottomline: difficult to forecast whether this high yield water company will be jewel or unloved such as ATLCP following my Dallas online friend and ratings from both Schwab and Fidelity on the issuer (7.625% QDI). He was correct on HROWL bought in Day 1 or 3 plus another high yield unrated shooting to way above $25. LOL.