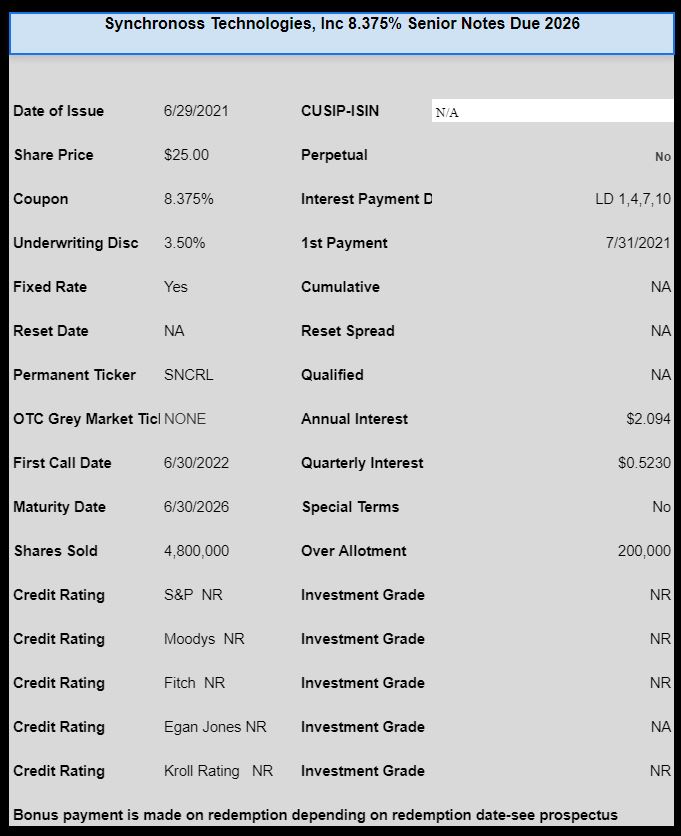

Smaller software company Synchronoss Technologies (SNCR) has sold a new issue of baby bonds.

The issue carries a coupon of 8.375%. The maturity date is 6/30/2026 and there are optional redemptions available to the company starting in 2022–the optional redemptions have bonus rates for early redemptions starting at $25.75 on 6/30/2022.

The issue is trading now on NASDAQ and last traded at $24.90

The prospectus for this issue is here.

For the last four years the ‘Net Income” has been negative…

With a market cap of 260 million bucks, I think this one needs a short leash.

BB- from Egan Jones?

BRIDGEWATER, N.J. , June 30, 2021 (GLOBE NEWSWIRE) — Synchronoss Technologies, Inc. (NASDAQ: SNCR), a global leader and innovator of cloud, messaging and digital solutions, today announced that on June 29, 2021 it closed an underwritten public offering of 42,307,692 shares of common stock, which included 3,846,154 shares issued in connection with the underwriters’ option to purchase additional shares, at a price to the public of $2.60 per share, for gross proceeds of approximately $110 million. The Company also announced that on June 30, 2021 it closed an underwritten public offering of $125 million aggregate principal amount of 8.375% senior notes due 2026, which included $5 million aggregate principal amount of senior notes issued in connection with the underwriters’ option to purchase senior notes. Gross proceeds for both offerings are exclusive of underwriting discounts and commissions and estimated offering expenses payable by the Company.

Synchronoss and the senior notes both received a rating of BB- from Egan-Jones Ratings Company, an independent, unaffiliated rating agency. The notes are expected to begin trading on the Nasdaq Global Select Market under the symbol “SNCRL” as early as July 1, 2021.

In addition to the public offerings, on June 30, 2021 the Company closed a private placement of 75,000 shares of its Series B Perpetual Non-Convertible Preferred Stock to B. Riley Principal Investments, LLC for an aggregate purchase price of $75 million.

The two public offerings and the private placement resulted in net proceeds of approximately $300 million after deducting underwriting discounts and commissions, but before expenses. On June 30, 2021, the Company used the net proceeds in part to fully redeem all outstanding shares of its Series A Convertible Participating Perpetual Preferred Stock owned by an affiliate of Siris Capital Group and to repay amounts outstanding under the Company’s revolving credit facility.

That this outfit is still going is pretty amazing. they fell from the sky

4 years ago. They have shown some improvement recently. Most of the

value of the company is Intangible Assets (approx 70%).

Heron250–this is another B Riley deal–Bryant is taking on tons of risk in many different companies