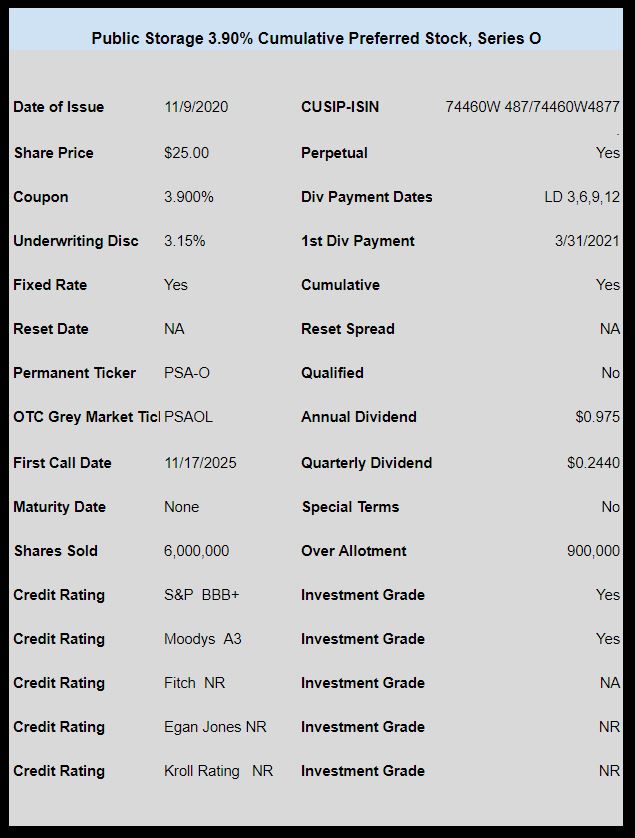

Self storage giant Public Storage (PSA) priced a new preferred stock issue right where expected.

The coupon is 3.90%–just 2 1/2 basis points above the last issue sold in September.

As with all REIT preferreds the issue will be cumulative, but not qualified for preferential tax treatment

It is likely there will be little ‘upside’ to the share price on this issue. The N issue with a 3.875% coupon sold on 9/29/2020 traded as low as $24.74 and as high as $25.31 while closing today at $24.95. On the other had if we get a continued spike in interest rates this issue, plus many other low coupon perpetuals, could take a sharp tumble.

We will see immediate trading on the OTC grey market under the temporary ticker symbol of PSAOL.

The pricing term sheet can be found here.

razorbackea had this pricing as early as 11 am this morning.

Not saying I’d buy either….but at such a low rate, I’d sooner buy the Common Stock than the Preferred.

It wasn’t too long ago the 10-year was at 2-3%. If we ever get back to that, these sub 4% preferreds are going to get walloped.

Looking at a bunch of these recent low rate coupons that have been released over the past year, most within a few months become available at a discount of varying degrees. Lately, it feels like a competition upon the feeding of a passel of rate starved hogs.

I like the tactic of shuffling divys to the “annuity-like” allocation and placing a discounted open buy order and just wait. I am still building a retirement portfolio as I am 63 and “working the design” over the next two years with all duties ceasing by 65 and Medicare becoming available. Anyone have a reliable date of death calculator available?

I see a few other issues that are older issues open to this same tactic, as well as a few floaters. This last week with interest rate pulse may be a harbinger of using a “collect and wait” tactic. There is quite a list of American float and resets to consider. Sometimes I try to take the long term perspective of an insurance company pool allocator whose job it is to come in everyday and use the cash to stay invested regardless of the market’s circumstance/news. It seems to be quiet work away from the hoopla of the trading floor.

I will let others do their own DD.

I appreciate the comradarie here at III. (Tim add a spell checker!)

RE: A reliable date of death calculator: Suddenly and Without Warning.

Hope that helps….it hasn’t helped me much.

Joel–maybe there is a ‘switch’ to throw–I’ll look.