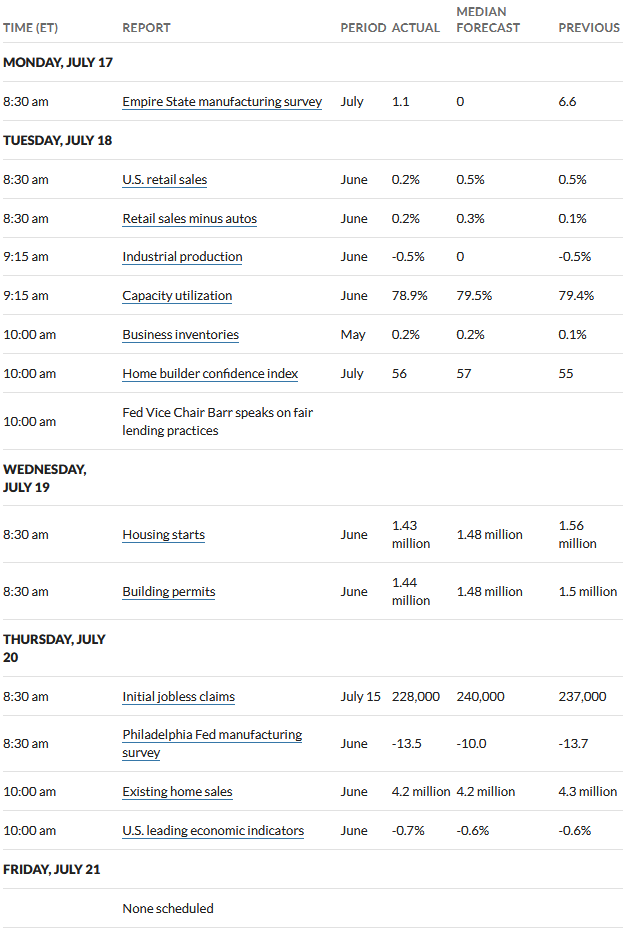

The S&P500 moved higher once again last week – but at a modest pace – up .7% – this week we have lots of earnings reports which will move the market plenty. Of course with the interest rate hike to come on Wednesday we all know markets will be moving.

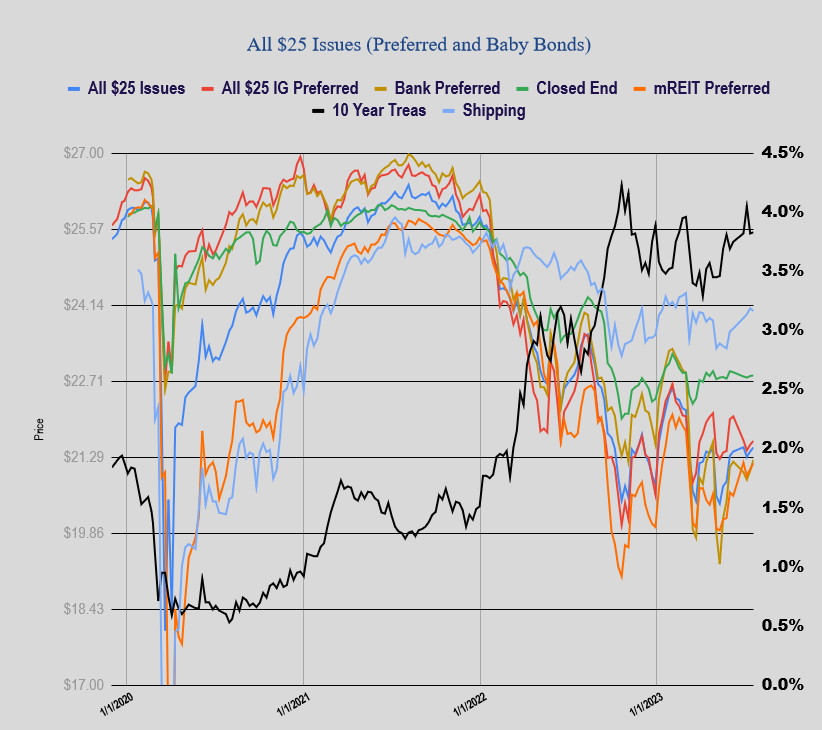

The 10 year treasury traded in a relatively tight range – 3.74% to 3.87%, closing up just 2 basis points on the week. We know that markets are waiting on plenty of economic news this week with the FOMC meeting starting tomorrow and then later in the week we have the inflation gauge personal consumption expenditure index (PCE) being released.

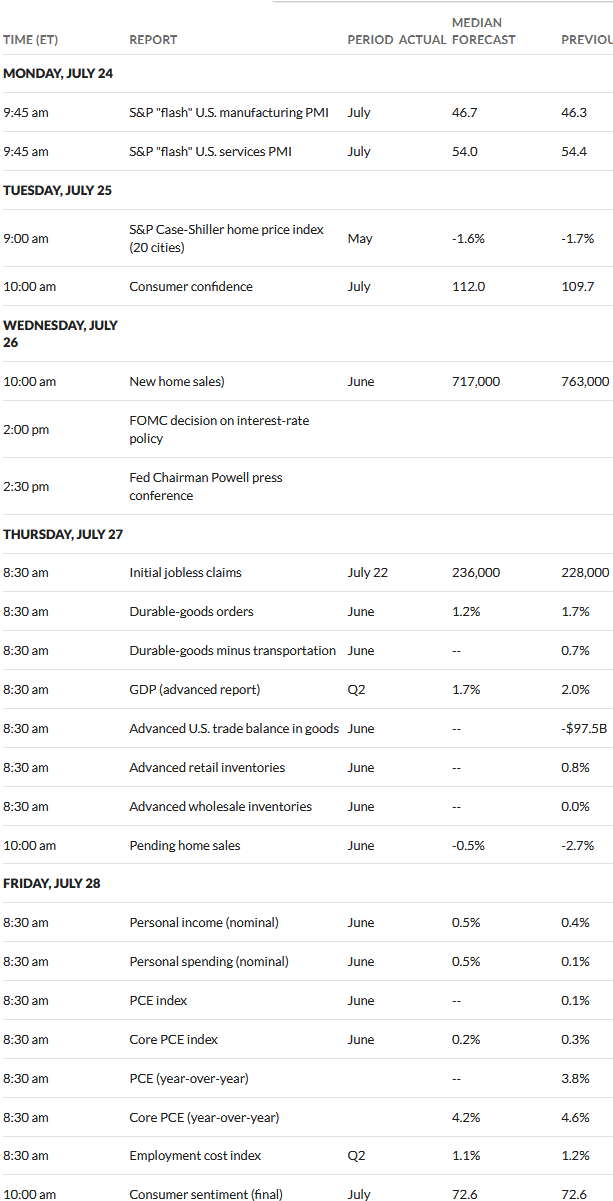

Last week we had economic news that was generally softer than forecast. Housing sales numbers were below forecast, seemingly caused by a lack of available properties for sale.

The Fed balance sheet resumed the move downward with a runoff of $22 billion to $8.27 trillion in assets.

Last week the average $25/share preferred stock and baby bond moved higher by 8 cents. Investment grade issues moved higher by 7 cents, CEF preferreds were up 1 cent, mREIT we up by 11 cents. The star again this week were the banking preferreds which were up 21 cents–trading at their highest level in 12 weeks.

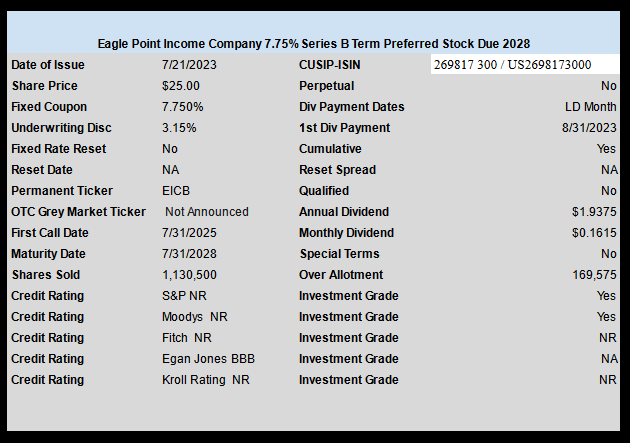

Last week we had 1 new issue preferred priced. Eagle Point Income (EIC) priced a new issue of term preferred with a fixed rate coupon of 7.75%. The issue is not yet trading.

We are in our Goldilocks moment. Neither too hot or too cold. Looking ahead we will see what August and September bring. There are storm clouds brewing and the budget battle hasn’t even started.

Trim your sails ( sales) and batten down the hatches, keep some dry powder and be prepared for battle.

Really interesting times

Whatever happened to the truism?

“The Fed’s job is to take away the punch bowl when the party gets really going”

The party is certainly going….

Just read that we are almost at the point of erasing the bear market which resulted from the fasted increase in interest rates since WWII

Goldilocks indeed

The main culprit is there is still too much cash running around. The government is being the enemy to the Fed, so it is fighting with one hand behind its back. Its like me and my then wifey way back in the day…I was in charge of the budget, and she was in charge of the credit cards. Guess who won that battle? The budget didnt stand a chance, ha.

And higher rates still havent had a chance to choke much. Less than 10% of homeowners have a mortgage rate of 6% or more. Any fixed debt hasnt had a real chance to reset yet. Some pockets of businesses will feel the burn soon though. And consumers can put a $1000 on their CC and pay $500 back each month for an indifinite more amount of time. I think the process just needs more time to unfold.

Grid—you are right on the nut here. The amount of money out there is crazy and now investors are displaying alot of FOMO driving prices up and up regardless of the potential recession (maybe?) – everything is overvalued but taht is of no real relevance in the short term,

You had a wife at one time? That is new to me.

25 plus years ago, ha. Have had the same lady for over 17 years and we live together. Might as well be married as its the same thing without the paper to mess a good thing up, lol. She got the rock, a life insurance policy, and the house if I croak. And I am on her robust health insurance insurance plan for free. No need to go to the courthouse, ha.

Sounds like you moved up from the common marriage plan to the preferred level.

I think the bond desk screwed me over on my deal!

Grid—I will have been married 60 years next month. I handle the finances and she handles everything else. If I don’t do what she wants, I don’t get any hot dinners for a month—sandwiches, salads, take-out. A man my age loves his hot dinners—so I do what she wants.

Randy, Congrats on 60 years! That is a heck of an accomplishment. There isnt enough years left for me to ever catch you! A hot cooked dinner prepared at home? Im jealous. I have to drive 90 miles to visit my stepmother to get that.

Scott, that was good stuff. Humor in securities form, I like it.

Congrats. Randy – We’ll be 57 years also next month. I handle the finances coming in and she handles QVC…….I do get hot meals daily. She hates cooking but is good at it, but also good at defrosting…..

Wow. There is no crime you could have committed where you couldn’t be paroled in less than 57 years….

Seriously, congrats. We will be 40 years next month. People are often surprised when I say that (I married up, and I know it).

I get to handle investments, but she pays the bills. I used to, but I was late paying a bill once about 38 years ago, so I lost my check writing privileges.

My wife loves to cook and is great at it (and I have the waistline to prove it), plus she makes a lot of meals (3-4 days a week) for people in the neighborhood or in our church congregation (elderly, etc.). House looks/smells like a catering kitchen half the time. No complaints here, other than having to keep upgrading the kitchen – double ovens, second refrigerator, commercial stand mixer (who doesn’t need to make 10 dozen rolls at a time?), Cambro hot boxes for delivery… Plus she still has a full time job.

Randy that 60 years is a big deal. Congratulations to both of you. Wishing you many hot dinners.

Thanks, Tim

Marvelous summary of what we should be aware of.

You are terrific

Thanks Westie!!