Small eye health company Harrow Health Inc (HROW) has priced the previously announced baby bond issue.

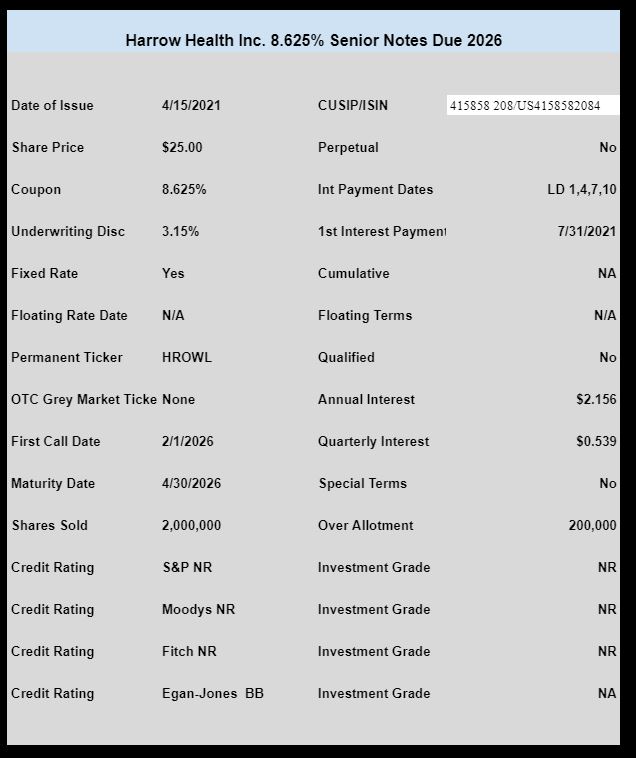

The company has priced 2 million shares (bonds) with a fixed rate coupon of 8.625%. There are 200,000 shares for over allotment.

This issue has a maturity in April, 2026–short dated maturities are in high demand.

The issue is rated BB by Egan Jones.

There will be no OTC trading on this issue, but it will begin trading in the next week or two under ticker HROWL on NASDAQ.

The pricing term sheet can be found here.

trading today. 24.11 – 25.00 so far.

So with the quarter over, why do they give such a wide range for revenue?

NASHVILLE, Tenn., April 14, 2021 — Harrow Health, Inc. (NASDAQ: HROW), an ophthalmic-focused healthcare company, today announced certain preliminary unaudited financial results for the first quarter ended March 31, 2021.

Preliminary Estimate of Results for the Three Months Ended March 31, 2021

Total revenue between $14.9 million and $15.5 million.

Any bets where they come in?

Furcal asks: “So with the quarter over, why do they give such a wide range for revenue?”

Furcal, not all investors realize that companies have a degree of latitude on what top line sales they report. Auditors allow some discretion on what is reported while staying inside GAAP (Generally Accepted Accounting Rules). From here, we cannot tell what tradeoffs Harrow is considering, but there are a few common ones.

1) Some companies want their top line sales to increase every quarter, as opposed to having an up quarter followed by a down quarter. Let’s say the company has enough visibility into the next quarter and it is not looking too strong. They might take a “sales reserve” to lower this quarter’s sales while planning to “release the reserve” next quarter to make things appear smoother. Within reason, auditors allow this.

2) Sometimes companies want to report their absolute best quarter for whatever reason, maybe to pump the stock up. They have their sales people essentially pull next quarter’s sales into this quarter. The degree this is done can go from slight to pure criminality. The auditors, if they are doing their job will push back on this at some point and not allow the company to report the sales this quarter.

3) Some customers are flaky and may NOT pay for what they ordered. An extreme case of this just occurred with Greensill Capital in Europe. They created fake invoices and counted them as sales. A more moderate case is where you sell a real product to a real customer, but maybe the customer might be headed towards bankruptcy. Think about Boeing selling an airplane to American Airlines last year. Was Boeing 100% sure they will get paid for the airplane before AA goes bankrupt? In cases like this, the company might take a sales reserve that is blessed by the auditors. Another great case is the recent Texas power outage. You billed a residential customer $15,000 for that months energy. You are NOT likely to collect the full $15k in the next 30 days or ever, so you could take a sales reserve and NOT report the full $15k as revenue this quarter.

There are several other cases, but these are some common ones. Earnings that get reported have even more discretion than the top lines sales number. A lot of it comes down to how much you trust management. I have no divine guidance on Harrow’s management.

If one is buying crappy companies with big coupons on the bet it will bounce on the launch – that’s fine so long as you set your take-profit and stop-losses and stick to them.

In the current environment a HROWL flop on launch is unlikely, but set a stop loss you’re comfortable with in case.

Oh, and importantly, do recognize you’re gambling, and not investing. Determine that “in this market environment I’ll allow X-percent of my portfolio as gambling positions.” Be deliberate and prescriptive about it.

The flipping strategy is based on stacking many small profits. It only works if there aren’t also many losses. Big losses, though rare, can kill the entire strategy.

I don’t like this one at all. Too much risk for my arguably “conservative” strategy.

I actually bought this stock for $1.45 several years ago and recently sold the first 10,000 for $11 per share. I waited for $14 per share since their margin went up and produced actual profit and passed the high of $11.99.

The idea of joining several Med. Co. Incorporating a batch of unique Co. With projected bright future is good in my opinion.

I checked and Harrow Heath has very good, dedicated employees with unique idea. The key is to buy and sell at the right time. Study the daily performance. Have patience. It takes years.

Negative retained earning, never made a dime, business model changes every few years, office relocations, bankruptcy. What’s not to like?

This one has, as they say, negative convexity. I’d sooner give it to the fellow with the tin cup sitting outside Home depot.

Yield chase environment positive? Check… Is coupon high yield? Check… Company actually currently showing a profit? Check… Company common stock rising? Check… Revenues growing? Check…

Im in for a small purchase flip for me and then pass the hot potato onto someone else….

Already been thru Ch 11 before? Check… Never been profitable before? Check? Profitability due to PPP foregiveness??? Maybe… Good for a purchase flip in this environment? You betcha. In a world where a delicatessen in NJ with 35k in sales can be valued at $100 mil, anything’s possible… See Barrons Up and Down Wall St article this week with mention of Hometown International [HWIN] and David Einhorn’s take on it.. https://www.barrons.com/articles/irrational-exuberance-todays-wacky-markets-could-be-beyond-that-51618620928?mod=past_editions

RE: HROW –

“Until 2018, we incurred losses in every year of our operations. As of December 31, 2020, our accumulated deficit was $(77,400,000). Our current projections indicate that we will have operating income and/or net income during 2021; however, these projections may not be correct and our plans could change”.

2WR, You didnt see me say sock drawer, lol… Yes, I know it went bankrupt then. So did GM, and horse buggy factorys and tulips were the rage at one time also. Heck, no I dont like this type of issue. That wasnt the point, and bad companies ride investing waves in an up market, and top notch companies ride waves down on bad market. The company may be on upswing who knows, Im just playing the “greater fool trade”. They tend to work on these things as long as there is no bad announcement. And I hope to be gone before then.

Risk reward for me only, it looks like a nice quick in and out burger casino play for me. And I did say small play so that means I aint hitching my wagon onto this. But I will throw a few bones out there on a quick ride if I can get in at par or so. If not, I will patiently wait at the station for a different train to roll into town. They always do.

48 mil in revenue. 48 mil in operating expenses. Then they have 3.5 mil in interest payments with debt already, and this will add another 4 mil in interest payments on top of that = no thanks for me. Good think they don’t pay dividends. If they issued this note a few years ago, this might have been a 12% note.

You guys are exactly right. Especially from an investing prespective I 100% agree. But if The Man upstairs said you gotta make a bet higher or lower 30 days from its $25 issuance; and if you are wrong your “coming home”. I bet you would say over based on how things are going, no?

As I said this is just a bet trade. Like my $500 bet I made last Sunday to win $420 before tee time the Japanese golfer (cant spell his name off top of my head, ha) was going to win The Masters. That 4 strokes in pocket was an advantage to take the bet.

The market is mad now chasing crap. Look at the nasty AHT preferreds. D is almost back to par and they dang near went under less than a year ago. And still arent in good shape.

I don’t see it as a 50/50 proposition. Over by a small amount or under by possibly a large amount, I need a lot more than 50% odds to play. And we don’t make even bets in this casino we like playing with a rigged deck. We’re the card counters of Investing.

Martin, “Over by a small amount or under by possibly a large amount”. That is the typical possible outcome with any preferred being the eventual pricing gravitational pull that anchors preferreds. . But…yes I totally get what your saying and agree. But most importantly one should stay with their strategy.

I generally do, but can be open minded. I didnt want to touch the Sachem baby bonds with a 10 ft pole, but (Citadel, if memory serves, apologize if I am wrong) kept pounding on the benefits. He wore me down and I made 2 nice flips on it from a fairly aggressive amount. This one is just a bet which means 100 shares; 200 tops. This is another Hideki Matsuyama fun bet to win, Im not sticking my neck out here. So this is a very small play. I didnt like TGHLF but I liked it more than this so I bought more. Sold out at 26.10 repurchased at 25.80, and wondering if I should pull the cord soon again. As this was meant to be a flip trade.

Grid, you are probably right. This one does have a lot of fleas, but the government is raining down flea powder to coat these dogs. I would not bet against the mob right now grabbing anything to invest in. My greed-o-meter is near the high end, so I am playing the fear card right now.

Mr. C, there is no doubt this is a flea bag. In fact your original post stated it the best about Egan giving it a BB. When have we ever seen that? I thought BBB- was their lowest rating, lol.

My dog had fleas once…not an experience I want to be involved with again.

Grid, a note on flipping IPO’s. I have not published the data yet, but preliminarily the IPO’s of baby bonds/term preferreds do NOT have as large an uptick as regular preferreds. It looks like the “big” money is made by buying the Grey Market ticker, holding until the long term symbol is assigned, then waiting for the masses to bid it up. Not exactly earth shattering news to III readers. That said, the yield chasers will flock to anything with an 8.625% coupon in today’s market. So I agree with you, this issue will probably rise after IPO. Buy early, buy often, pocket a few steak dinners then leave it others to wait for Harrow’s next negative “surprise.” Although I am not sure any negative news from them could be considered a surprise.

Grid – yeah, I get it…. like I said and meant – you betcha it’s worth a flip shot – as long as it doesn’t turn into a slap shot against you… lol As you said to Bob, flexibility helps in deciding to jump in on something like this just because the timing’s right.. It’ll be an opp I’ll miss given my lack of same

I have now seen my first Egan rating of BB. Pretty cool.

Is anyone going to buy this?

No…

I’m guessing B. Rily thinks so given they upsized the deal to 50mil… PT Barnum would have thought so too……

Yes…in small tranches. The 2026 maturity fits nicely into my ETN ladder.