The previously announced new preferred issue from Capital One Financial (COF) has been priced.

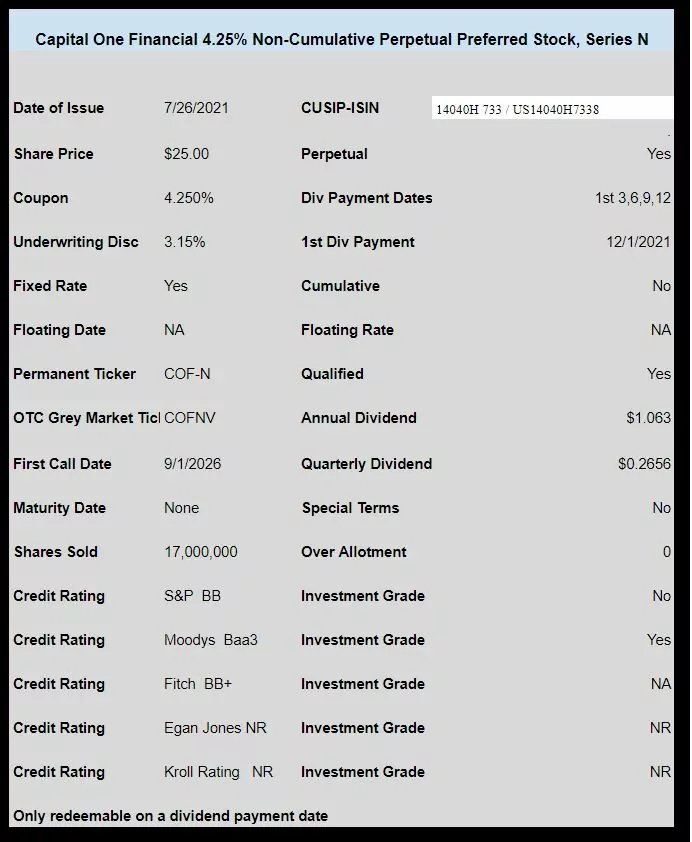

The company has sold 17 million shares with a coupon of 4.25%.

The issue is split investment grade – S&P is BB and Moody’s is Baa3. Fitch is BB+.

The issue trades immediately on the OTC grey market under temporary ticker COFNV. Watch for possible changes in the ticker as lately most have been changing after the initial announcement.

The pricing term sheet can be read here.

Still trying to get Fidelity to straighten out the mess with the JPMMV/JPMML symbol problem (going on 3 days) and now the Capital One Preferred is sitting in limbo there as well. They claim that they are waiting for an intermediary to notify them of the change. Based on my previous experience with Fidelity’s “back office” that should only take 4 months!

Fidelity sucks…..pull your money out yesterday.

Not sure why that is. My JPMML shares at Fidelity were in limbo one day when the ticker changed. I did not do anything, didn’t contact them, etc and after a day the ticker was corrected to JPMML

Shares are available and tradeable in my account. It was just a one day hiccup at Fidelity for me due to the ticker changing (I read there were similar glitches with other recent new issues at other brokers – all due to the ticker changing from -V to whatever). I can live with a one day hiccup, I wasn’t flipping them that fast.

You are luckier then me. Three days, four calls and 2 hours of my time and I’m still waiting for some resolution on both the JPM and COF Preferreds. I’ve not had many problems with Fidelity over the years but as soon as their back office is involved it turns into a disaster.

It’s not doing much today. My order is sitting as pre submitted

Just read the comment below abt the ticker change. We try to resubmit with the correct symbol

Symbol changed to COFNL. Schwab will let you place an order but is refusing to fill it.

COF pfds have always been a little sideways. Not much action. Lower yields, not publicity or press. You have to buy them right. I looked at the 4 3/8 and 4 1/4 existing issues and the new one didn’t light me up.

Why would anyone buy COF at 4.25% when the 4.2% JPM was available yesterday at par?

You can buy this COFNV lower – currently trading at $24.8x and below where the 4.2% JPMMV (now changed to JPMML) traded so far.

Both likely decent candidates for a quick $0.25-$0.75 flip soon…

I live a long walk from COF HQ and know plenty of people who work there. It’s a great company but managed to prioritize growth not safety.