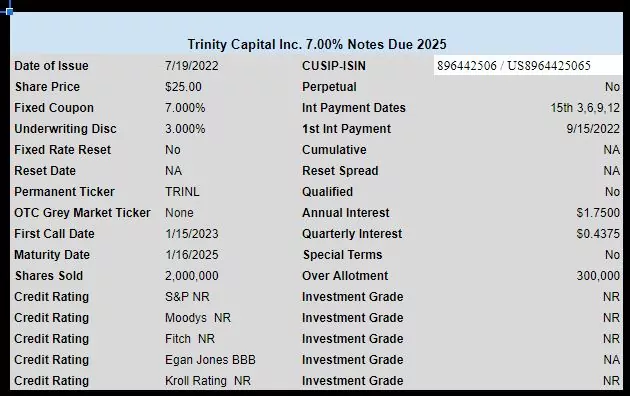

BDC Trinity Capital (TRIN) has priced the recently announced issue of 7% notes. The issue comes to market right around $25/share

The permanent ticker is TRINL and it will trade in the next week or so–there will be no OTC trading.

NOTE—this is not a new issue–but it is new to exchange trading. The company had previously sold 6 million shares (notes) in January, 2020. So in total the company will have around $200 million in these notes outstanding after this offering.

The pricing term sheet can be seen here.

My sources show a 10k share print yesterday 7/26 at 25.5

Still unable to buy at Vanguard or Merrill Edge

This guy started trading this am, at 25.35 at the open. Good company with a nice issue.

Anybody have any opinions about the company?

I’m not sure that this is the time to randomly throw money at BDCs.

And how did BDCs fare during the last recession?

Six months until first call date seems a little short, doesn’t it?

Gunfighter, the short call is because this issue is only a 2 1/2ish year maturity. I called Vanguard and Merrill Edge today to see where the shares were trading and neither would allow me to trade TRINL “until Friday”. This is another issue I have with the SEC (they are supposed to protect EVERY investor, the institution firms are allowed to trade this term note preferred and get an advantage of being able to purchase the shares prior to any lowly or plebeian investor like me. Here is a link to todays trades that all of us were not able to be apart and play in their sandbox https://finra-markets.morningstar.com/BondCenter/BondTradeActivitySearchResult.jsp?ticker=FTRCI5213059&startdate=07%2F20%2F2021&enddate=07%2F20%2F2022 BTW, the last trade/close was $24.92.

“Don’t tell me where your priorities are. Show me where you spend your money and I’ll tell you what they are.”

I am Azure

The bond is trading this morning. I set limit price at IBKR.

Alas, not at Fidelity!