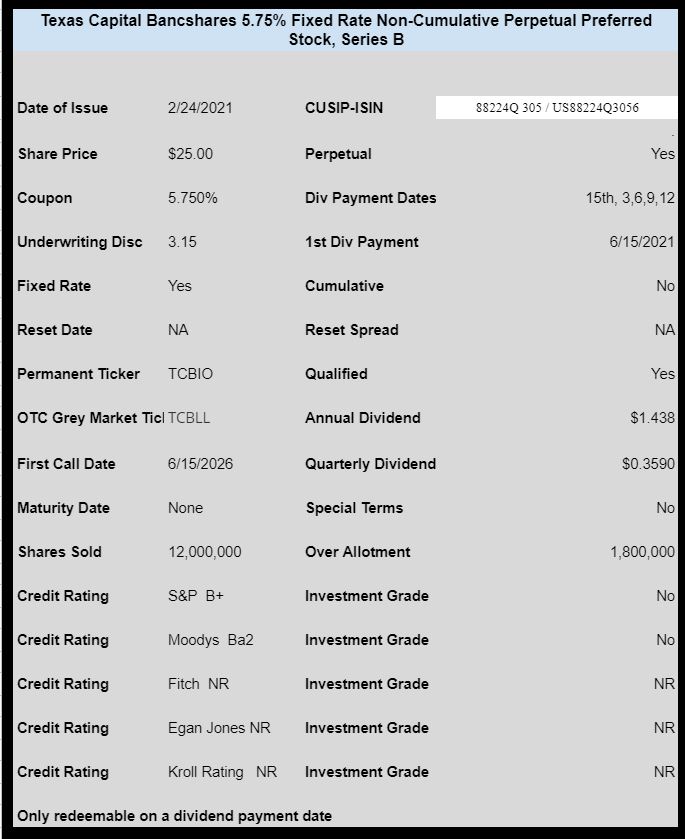

Texas Capital Bancshares (TCBI) has priced their previously announced new preferred stock offering.

The issue prices at 5.75%. The issue is non-cumulative and qualified.

The new shares are rated B+ by S&P and Ba2 by Moody’s (both below investment grade).

Shares will trade immediately on the OTC Grey under ticker TCBLL.

The pricing term sheet can be found here.

TCBLL is trading at $24.35 with the market drop. Looks like a good price to me. Comments?

Wilson, see the sister thread to this one, https://innovativeincomeinvestor.com/texas-capital-bancshares-announces-new-preferred-issuance/, for more discussion.

According to Fidelity this issue has been trading before today and

currently trades below par.

TIM. I don’t know if this is the spot to ask a question but I use Google Sheets alot. Since there is no key, what is the yellow highlite on a few issues.

I have been following you for years thanks for all the hard work and info…

Hi Jeff–I think the only place I am using it consistently is on fixed-to-floating issues that are currently floating.

“The issue is non-cumulative and qualified.”

Sorry to ask but what does it mean that the issue is qualified?

Thanks in advance

Learning high dividends from Flanders 🙂

https://www.investopedia.com/terms/q/qualifieddividend.asp

danke schön 🙂

Any advice you could give me for european/belgium investors?

In belgium we have 2 taxes (30% tax + 15% dividend tax)… brussels needs his piece of the pie…

Only with babybonds and Preferred Shares we can avoid the dividend tax.

Any advice is welcome

Thanks

Tom,

Welcome!

I’m not quite sure what you’re looking for. Do you want the other investors here to suggest some preferreds and BBs which you might be interested in buying?

Hi Tom. First of all, my condolences, because being a tax resident in Belgium is a great misfortune. While in other countries withholding tax from a foreign source is deducted from the total amount of tax payable, in Belgium the amount paid from a foreign source only reduces the amount of taxable income. That is, for example:

you received a $ 100 dividend from a US company. The broker (as an intermediary) will withhold from you $ 15 withholding tax in favor of the United States. So you get $ 85 from him. The Belgian dividend tax for the Belgian beneficiary is 30% (in our case, $ 30). And if in other countries the $ 15 already paid at the source is deducted from these $ 30 and the state takes the remaining $ 15 (an approximate example because different countries have different tax rates on dividend income), then in Belgium the state takes from you 30% of the remaining after tax at the source of the amount (that is, $ 85 * 30% = $ 25.5), and thus from the $ 100 dividends you received, you have $ 100- $ 15- $ 25.5 = $ 59.5 net. Let’s leave aside the currency revaluation, which can also affect the amount of taxable income.

———

Thus, the only possible optimization is to avoid withholding tax at the source. This can be done in two ways:

1) you buy shares of companies that are located in jurisdictions where there is no withholding tax. Let’s say UK, Bermuda, Bahames, Monaco and so on.

2) You buy US (or Canadians) securities which are pays not dividends, but interest. These are primarily bonds and baby bonds. Also, this category includes many trust prefereds and shares (as commons as well and preferreds) of BDC companies and others that receive and distribute income from credit. Each of these companies must be studied separately, reports are available on their websites in the “Tax Information” section.

For example, consider the report of TCP Capital: https://s23.q4cdn.com/834201599/files/doc_downloads/taxInfo/2020-TCPC-Tax-Status-of-Dividends.pdf They immediately write that “92.41% of all distributions qualify as “interest-related dividends” for non-US shareholders ”. That is, withholding tax will not be withheld from them.

P.S. In addition to interest payments, withholding tax is not withheld from income from capital gains, returns of capital, as well as from royalties.

P.P.S. Dividends from classic preferred shares are subject to withholding tax!

OK, yurly you got me wondering – what’s your background – why do you know this stuff???? lol

I am from the EU and at one time I have worked for an US asset management company that had many retail clients from there. And in general, by education and by profession, I am an economist (so not quite an tax advisor, but close to that).

thanks, yurly – good to know…….