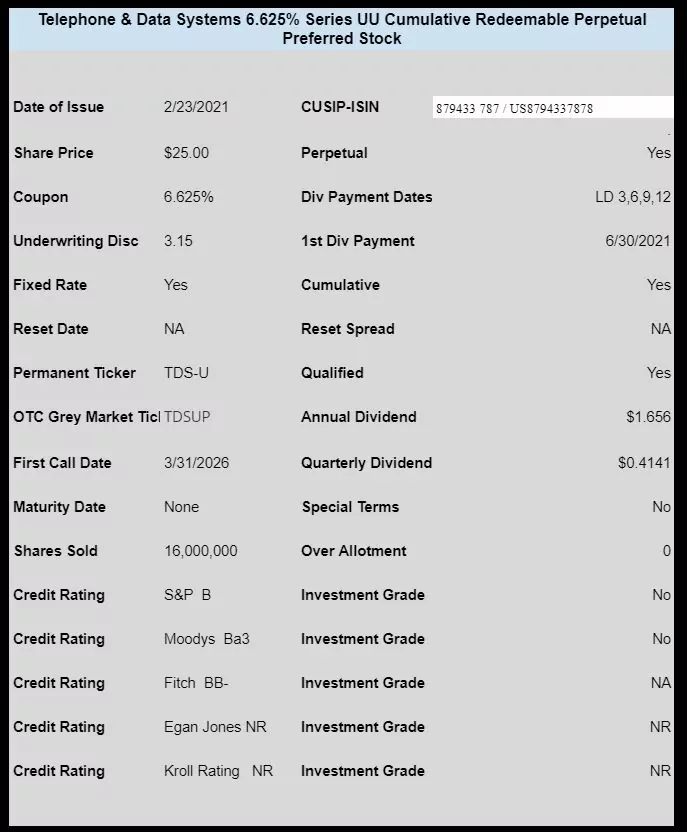

Telecom Telephone & Data Systems (TDS) has priced a new issue of preferred stock today.

The issue which is qualified and cumulative, prices at 6.625%.

The company has a number of issues of baby bonds outstanding, but this is their 1st preferred stock issuance (at least in many years). All of their outstanding issues can be seen here.

The issue will trade immediately under OTC temporary ticker TDSUP.

The preliminary prospectus can be read here.

The pricing term sheet can be found here.

J had this early today with a number of others chiming in.

Took profits and closed out my postions in the new TDS issue. I’m happy with a years+ worth of gains in about 30 days

Good move. Telephone is a rapidly changing sector these days. None of them are long term holds in my opinion.

Agree. It was always a “short term’ buy. Rose faster than I thought it would.

I too sold half of a big holding bought in $24s when issued and now YTC is 5.1% – too little for this ‘s&p B’ rated pref. Do not know why Moodys rates it higher…

Any word on UZE ex-dividend date? thanks

In for a some of TDSUP at Fidelity at $24.79

Vanguard reflects trades at 24.80ish, except it says it is a stock valued at less then .01 and thus need to call an 800 number. On hold for 5 min listening to sales pitches. Could not purchase. About time to leave me thinks.

Vanguards platform looks at the PRIOR day’s closing price, meaning zero on the day of issue, and thinks it is a penny stock and won’t allow it to trade without a phone call. I have given them a working over on this dozens of times. They acknowledge the error but they don’t fix it. New issues are almost always buyable off the platform at opening of trading the day after.

If I want to get in as early as possible I use TDA as they get them up very quickly. They do ding you for a commission however.

tks bob

Fido had it online this a.m., opened positions in a couple of accounts. Thanks for the heads up, Tim.

Wells Fargo filled my order at 24.77. I received an email confirmation of the order execution. The TDSUP fund was listed in my account. I go back into my account 5 minutes later and the fund is no longer there and the order is not showing executed any longer.

I call Wells Fargo and ask why they unfilled the order. Wells Fargo confirmed that my order filled and an email confirmation was sent. Wells Fargo also confirmed that my order was unfilled. The explanation I got was since Wells Fargo is a booking manager on this preferred that they were not suppose to allow any orders to fill on this new issue prior to 10:30 EST.

Anyone ever have this happen to them?

I picked up 400 shares thru Wells Fargo advisors. Took some time to fill, 4 orders at 100 shares a pop @ 24.78. Still shows in my account. I got the e-mail confirmations as well. My order filled at 12 noon though.

I was able to get another order filled at 24.79, but I have always wondered why my orders don’t fill on new issues at Wells Fargo in a consistent manner. Appears if Wells Fargo is one of the booking managers on the issue they are controlling what gets filled and the price.

2020, all day long.

TDSUP is trading below par and bought some at $24.79.

Surprised it is not trading higher like their TDA and TDI – anyone has an explanation?

Acquired some TDSUP on Fidelity at $24.80 myself. Tried to use Vanguard but they are having an issue. I guess I could have called like Zarley but I dislike those long telephone conversations.

No issue trading at Schwab via website.

Schwab & TDA seem to be having problems today- very slow – finally after about 75 min got it at 24.78 Spectrum internet here is running very slow -sometimes not at all- supposed to last another 45 min or so.

Perfect crap storm.

I was able to buy 100 shares @ $24.80 from Schwab about 10 min ago. Could not do it through StreetSmart Edge, but possible through the website.

Possible recent upward tick in interest rate yields and non-investment grade.

I did buy some on Etrade at 24.75, might tick up once it leaves the OTC.

BB

I’ve noticed that on both TDE and TDA preferred stock that the dividend payment is changing a bit each quarter. For example, the stated payment of TDA is .367188 a quarter ($1.46875 yearly), but the upcoming dividend payment declared is only .359028. All this is based on what I see on Fidelity.

I see a similar history with TDE

I thought preferred stock dividends were fixed?

Mark, I cringe at the word preferred stock being used here because TDE and TDA are not preferred stock. They are senior note issues. They are contractual debt not capital which is really what preferred stock is.

This is a contracted fixed interest payment that most be paid as reported by prospectus. It does not adjust in any way. Maybe the change is the computational period the interest was reported on. Such as ending periods on weekend, holiday, etc. Just guessing there as the annual yield is fixed.

Interest on the Notes will accrue from November 23, 2010 at a rate of 6.875% per year and will be payable initially on February 15, 2011 and thereafter quarterly on May 15, August 15, November 15 and February 15 of each year (each an “Interest Payment Date”). On an Interest Payment Date, interest will be paid to the persons in whose names the Notes were registered as of the record date. With respect to any Interest Payment Date, while the Notes remain in book-entry form the record date will be one business day prior to the relevant Interest Payment Date.

The amount of interest payable for any period will be computed on the basis of twelve 30-day months and a 360-day year. The amount of interest payable for any period shorter than a full quarterly interest period will be computed on the basis of the number of days elapsed in a 90-day quarter of three 30-day months. If any Interest Payment Date falls on a Saturday, Sunday, legal holiday or a day on which banking institutions in the City of New York are authorized by law to close, then payment of interest will be made on the next succeeding business day and no additional interest will accrue because of the delayed payment, except that, if such business day is in the next succeeding calendar year, such payment will be made on the immediately preceding business day, with the same force and effect as if made on such date.

Thank you for your time and explanation.

This is one I am interested in

Any thoughts on the rating? S&P ‘B’.

Furcal, I havent read S&P reasoning, but in the traditional sense they and Moodys both went unusual. Typically preferred stock is rated 2 notches below senior unsecured. Moodys just slotted it one notch and S&P three.

This TDS preferred is bottom rack stack. As the US Cellular debt sits above TDS debt in cap stack. Company is in decent shape financially according to Moodys, but will run cash flow negative several years from the 5G build out.

I really cant look at this issue because I am already overloaded in higher stack UZA and cut under that with TDE.

Ba3/B/B- On new issue from TDS