This is a topic which I have written about many times and was reminded of it when reading some comments on long term bonds (baby bonds) in one of the threads.

When you are fearful–worried about risk to your capital the place to turn to is either ‘term preferreds’ or short dated baby bonds.

When long term bonds are being hammered by rising interest rates in almost all cases issues that are out there with a ‘date certain’ maturity in the next 1-5 years will move only a small fraction of the price movement of those bonds which have maturity dates out in 2050, 2060 or way, way out. This is exactly why in the past I have held exclusively term preferreds and short maturity baby bonds (that is not currently the case).

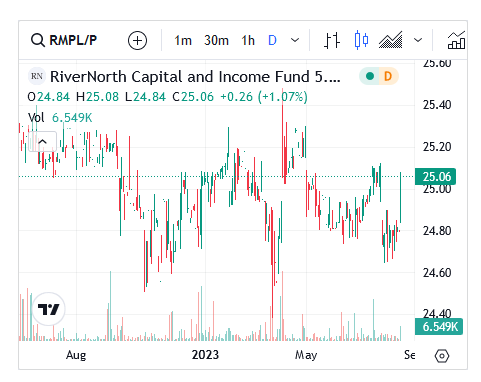

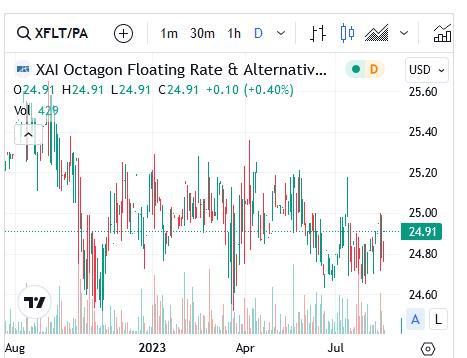

My best example is 2 term preferreds from CEFs that I own (overweight on both). These 2 are the RiverNorth Capital and Income Fund 5.875% term preferred (RMPL-P) and the XAI Octagon 6.5% term preferred (XFLT-A).

You can see below that over the course of the last year these 2 issues have traded in a tight range of less than $1/share. The RiverNorth issue has a mandatory redemption in about 14 months (10/31/2024) and the XAI issue has a mandatory redemption in 31 months (3/31/2026).

One will give up some coupon for the pleasure of have a more stable capital investment. Obviously one wants to purchase these in the lower part of their trading range–and in no case should one pay over $25 or your yield to maturity will fall.

I have a page of the term preferreds and short dated maturity baby bonds which one can find here. Of course regardless of the issue one must do their due diligence on the issuer–short or long dated maturities will make no difference if the company files for bankruptcy.

Just an FYI. Overnight, eTrade credited the $25 plus interest into my account for FRGAP. I had bought it for an avg of $24.91 last week and looks like they paid just north of 16c in interest. A few dollars on the 25c/share for a short hold it seems.

I am expecting rates to go down in 2024 and beyond (and so are the CD ladders I look at.)

In the Money Market / CD / Treasury portion of my portfolio, I have been going beyond buying just CDs on roll-over and instead, buying new issue bonds, either corporate or GSE’s, to hype my yield. 1 to 5 years is my preferred slot. There is often an issue of early call dates, so you have to be happy with them either way. I look for issues with rates higher than a comparable term CD (say 6 month CD rate versus a 6-month call date) that are also higher than comparable rates at longer points on the ladder.

I buy marginable bonds, which CDs are not. Some GSE’s are state tax exempt, which can help if your state has cut-off maximums on benefits.

FYI – there are some quirky issues out there, so a read of the prospectus is a must. Just my opinion DYODD.

Bear, I am hoping they will next year, also. I bought a lot of 2031-35 noncallable bonds last October and they still havent returned to the high yields they were last fall. But I still have added a bit more. I also have a fair amount of CDs maturing 2024-2028 with more weighted on the back end. Some IBonds, GBIL (short term treasury fund), and a little Tbill and now TIPs thrown in for good measure. Have a few perpetuals, but still weighted considerably more in live floaters. Trying to keep a bit of skin in the game, but yet tilted ever more with a wink and a nod towards protecting my hard earned gains the past 2 years despite it being a tough income market.

“marginable bonds” could mean several things here. As I suspect you may well be smarter than the average bear, I’m inclined to think it could be referring to a self-imposed liquidity screen of sorts, where you are piggybacking off the work brokers do to create their marginable security lists to reduce their risk of getting stuck with illiquid junk when the debtor blows-up, or whatever they do on their road to debtor’s destitution/prison. Another benign possibility, could be it is a euphemism for a preference to own shorter-term fixed-income instruments, since, I assume, the interest costs on an actual broker’s margin account could/would be ruinous long-term to the typical margin borrower’s strategy using bonds in unsettled times. Further supported by, “1 to 5 years is my preferred slot.”

As for tempting The Fates with my Interest Rate predictions, I’ll just copy & paste this quote, “… researchers identify four eras of low real interest rates: prior to the Black Death in 1311–53, after the Great Bullion Famine in 1483–1541, during a credit boom in 1732–1810, and during the foreign exchange transition era of 1937–85. Each of these eras ended abruptly”, from https://www.nber.org/digest/202212/real-interest-rate-decline-long-historical-perspective

So the question we have to ask ourselves is just how “interesting” are the times we live in? And the corollary, just how long will we, as individual investors, actually be living and breathing in said times? Admittedly, my actions are not dissimilar than yours, but, I’ve started to dumbell the short with more long. Just not sure what the optimum short:long ratio should be. Now that the scoffing has died down from the quote above I guess it’s safe to add that I’m aware there were no Central Bankers in the days of yore, at least, not ones we might easily recognize as such today. But, there have always been ‘movers and shakers’ since the first forms of “storable/transferable wealth” hit the scene. Today’s seemingly less overtly rapacious and violent movers and shakers aren’t likely to put our heads on a spike where the democratic rule of law hasn’t been sufficiently weakened, so, in our milieu, that leaves interest rates, and the ever growing variations on new ways to manipulate them. Being JPOW & Co’s primary tool in the box, it beggar’s belief they won’t be aggressively zirpping away at some point in the next 10 years. Consider too, the Pols, and the twisted takeaways they’ll have grokked from the ZIRP era. For example, down Argentina way, a new pol, a libertarian of sorts, probably along the lines of bitcoin-bros like Musk I suppose, just popped up that wants to raze his CB to the ground and end their perceived shenanigans by adopting the US Dollar. I repeat, this pol wants to wipe out his despised CB and then replace his country’s currency with a currency ‘managed’ by the most powerful CB on the planet in the history Homo economicus! Twisted? Bent perhaps? Or is it just yet another beautiful/interesting example of the primate-mind’s capacity to hold and believe two diametrically opposed ideas in it’s head simultaneously? All the more so, beautiful/interesting that is, when it is done knowingly! Then there is the powerful ‘Status Quo’. A potent force, utterly dedicated to it’s own preservation at almost all costs until forced, usually under threat to life and limb, to try something new. It amassed vast wealth under ZIRP and it’s members are all on the Pol’s closely held private Rolodex’s, and, it seems, most of SCOTUS’s as well. It beggars-belief to think lowering rates won’t return at some point. But, I’m not sure I want to double-down on 2024 getting down to ~3.5% or lower. We need to be prepared for our desired scenario(s) to take longer to play-out between setbacks is all. Either way, I sense, if one doesn’t panic in the coming years and sticks with a judicious dollar & value averaging reallocation out of cash back into a diversified FI right/risk-sized allocations heavier than pre-Covid (not to imply an entirely new variant of Covid from last year won’t dominate this winter, cuz it already is) times their capital will be okay, barring asteroid strikes, nuclear wars, mad men, and inflation. Watch those nibbles because they add up fast. … Funny how, once one writes them down, how recognizably conventional one’s strategies really are. Not necessarily a negative. After all something only reaches “conventional” status by surviving. Part of why it can be very potent, once your safety is assured and basic needs are met, as they were a long time ago for most of us with the luxury to be reading about hybrid securities, to pay more attention to the “rule” than the “exception to the rule.” The exact opposite of what much of the popular ‘news’ media does when it focuses endlessly on statistically irrelevant occurrences. Blah, blah, blah … 😉

Grid, there’s so many factors that can come into play. I am seeing here and in the news about deflation in China and the value of their currency. We can’t discount something like that happening here. 80 years ago the purchasing power of the dollar seemed to be a lot stronger than it is now.

I think there is a lot of people rethinking holding the old preferred as evidenced by that $5.00 drop in the UEPEN

The same goes for others like TY P etc.

If you look at CNTHO you can see my buy today, I am not sure if it was the right thing to do but I am not regretting it. (Yet)

Charles it ultimately doesnt matter if something is old or not. Outside of trading volatility that may or may not occur in any issue, the perpetuals compete against the long end of the yield curve. Take your bets on when to get an entry point. For me I try to nibble some, but only the ones way below par. All things being equal they are the ones that could bounce more whenever that may or may not ever occur.

Grid, I just did a sideways trade. You are correct about illiquids with trading volume being a risk factor.I was in a local bank I just sold out of today that started out as what I thought was going to be a long term hold with a chance of appreciation. Bank’ been in business 133 yrs and only 2 times has it ever lost money. But it’s ended up being a trading stock for me as I’ve flipped it 3 times. With the recent uncertainty with local banks I’ll take the same dividend from a utility even though there is less chance of price appreciation. Especially for the same amount of money I can get twice as many shares and less to stress about.

Charles, I still love illiquids. The ones I follow just are too expensive for me relative to their yield and what Tbills now yield. Most are still in that 5.5%-5.7% range, no matter what price they are selling at. That doesnt make it right or wrong, but it just isnt my wheelhouse. I need a 6 handle and deeply off par to get the investing loins perked up for me to run a trade.

Charles, I’m fully embracing the higher-quality older preferreds.

If we recognize “timing” as an impossible strategy, we can still remain in control of entry price and yield via a standing commitment to add more to a position whenever an issue trades below our basis.

Have been employing this strategy for many years through market peaks and valleys. Even after recent market swoon near every position is trading over basis. 40-something trigger-happy standing bids ensure basis continues to decline whenever market provides that opportunity.

Whether market-up or market-down, the inexorable (chart-able) trend is lower basis/higher yield of holdings.

Alpha, I maybe jumping the gun on some of these at a 5.7 to 5.8 yield but I can average down if they dip into the 6% area as Grid says is his target. Something like CNTHO is a better swan that EXSR ( there I said it ) even though I know there is nothing wrong with holding banks except the dividend can be cut or suspended. Why I think I made a good sideways move.

Alpha and Charles, after a horrible round of golf today, I came home and ran some percentages as I have not really done this before. Mostly to amuse myself. And since I am not wealthy enough to participate in the richest man in the graveyard contest, it didnt overtax me to do the math, ha. Anyways here they are rounded to make 100%.

CDs 32%

IBONDS/TIPS 10%

Bonds (5-12 year duration) 23%

Perpetual fixed QDI preferreds 8%

TBills 4%

Floating rate/reset baby bonds 21%

Fixed rate baby bond 2%

I see you’ve apparently cashed out of EPD…

Camroc, yes but I did probably just several weeks after you goaded me into it. It went from something like $21-$22 up near $28 pretty quickly and I cashed out. That was way over a year ago. If my instant thought memory is correct that was the last common I have owned.

0% cash….how are you gonna jump on the next bargain?

I actually dont have a lot maybe 10k today in my accounts which I didnt bother to add in since I dont consider it an investment. But that doesnt really matter. As typically I just use my liquid investments such as GBIL or more relatively stable issues like ALL-B (which I own too much of anyways) to cover the trade and get back in later. I could also go on margin or tap home equity account instantly for a short time if I found a real good bargain and wanted to figure out what to sell later. Could even sell off IBonds too. I have never considered not having any cash laying around a detriment to buying something I want.

Charles, For the quality items we can go to the mat over and over and over without concern. We cannot do that with the risky ones.

Case in point, had one hit twice today, small but meaningful bites of a very old ute straight into new 52-week lows, second bite a buck under the first.

Times time, these add up.

Charles, 6% illiquids are gettable if patient. Trust me… I just bought 150 of AILLN at $81.50 today for 6.02%. What it traded at back in early 2000s. Having under 10% of my stash in fixed QDI perpetuals affords me some leeway to accumulate more again. But Im not in any hurry.

I just saw this post after going through the ills/sock drawer stuff. At 6% ish yields in some cases I am starting to add. I am ok with 5.9% or over 6% if you go fishing for a while with that bid. I mostly just look for reasonable deals and buy a plug to chew on. Over time the amounts owned add up if you keep at it.

I think I want to go back to boring again but with that said I tend to take a small bite of new stuff being offered.

FC, Alpha is probably best at setting the trot lines and letting the fish bite the hook to pull them in. For me, Im not totally committed to the process yet and a bit lazy. But yesterday morning I noticed AILLN had a bit lower ask around $89 than others and a low bid of $80 I could jump. So I set it at $81.50 yesterday and it hit today. Its not a trade that will end world hunger, but that is at turn of century pricing. Actually its better because Ameren didnt acquire Central Illinois until 2003 and it had a weaker credit rating before being acquired. So if rates dont go appreciably higher, it should holds its own here longer term at this entry point. We shall see.

Definitely subjective and no right or wrong. I have a full position of CTA-A at plus 6% and it’s an old illiquid. Plucked a little more BBB rated Canadian Utilities today at $12 USD at almost 7%. It’s harder for me but I slowly plug along.

I have been buying a bit more CTA-A as the price has been falling. I may get to a full position yet.

I had been buying more late last year, but stopped and sold some for a few bucks profit when the price spiked. I have a bad habit of flipping things I had planned on accumulating.

Private, dont worry, its not anything that will cause a long term health problem, ha. I do it too. I bet I have done that a half dozen times alone with LANDP/LANDO past couple months. Just bought it back today with O at $18.80. At about 8% I can hold if it drops, but if it bounces more it might be sold yet again. To steal a line from a former poster BeaBaggage (come back Bea if your reading) “Todays buys may be tomorrows memories”.

I flipped into LANDO expecting it to be equal to LANDP. But it keeps falling lower than P and I’m getting old waiting for the correction. I don’t care about the price level if I can stack those nickels again. Like the old SB-C / SB-D swaps.

Interesting for me, out of all my LAND trades only one was swapping. The others were mostly catching LANDP bouncing around. Though the last two have been dine and dashing on LANDO.

Grid the moth to the flame. Don’t get burned, We may see lower lows yet. Lets see what is implied Friday about another 1/4 pt rate hike. Vix is at an all time low and the market indexes are coming off 1yr highs.

Yes, I am being cautious when there is a lot of talk about trades and I have been talking and doing a few myself. But like Tim I have been selling and locking in some profits

Charles, I have about half my stash in CDs, IBonds, and Tbills and if I throw in my bonds that will mature thats almost 3/4. I really cant be much more conservative without just shutting things down, ha. Actually I have been basically spinning my wheels since probably April. Up about 14% on the year and largely been there since spring. Making a few profitable flip trades to counter balance the sagging in my bonds. But those brokerage a-holes can wholesale value them all they want as all it means is I will just get a bigger return when they mature.

Funny we all been buying that one.

This may be a case of acting after the move has already been made. Do the opposite if you suspect rates will be lower in a few years.

My biggest concern is if rising rates will cause defaults. If not I’ll continue to collect dividends while riding out the price fluctuations. And still make some trades between long dated issues. It’s not a losing trade if you swap for something similar that also fell.

That is also a concern for me. Credit defaults can cause credit spreads to widen which ultimately effects all issues. Credit spreads are painfully tight now. There isnt much meat on the bone for prices to rise from any further credit spread tightening. But it sure has historical possibilities to widen a lot more.

I understand the benefit of term-dated issues.

What I have never understood is the difference between a baby bond and a “normal” preferred issue that is NOT term dated. Both can be called after 5 years and both can be called dozens of years down the road. From a maturity perspective, I do not see a difference in the risk profile. Things like interest or dividends and the tax treatment are the only real difference, I see.

Can anybody explain?

Steve, with a term dated issue, the assymetric risk is not dumped on you. You know exactly your YTM as it has an ending date (provided the company doesnt go bankrupt). Give you an over the top example to show how term dated could matter. Say you are a real old dude and bought UEPEN in 1940s. 80 years later this 3.5% $100 par issue is trading at $65. You can never get out of this and get your principal back. Even from 80 years ago.

Now to me, I see no relative value in some term dated issues. Like RMPL- now. Considering its very short duration, I dont see any spread value in it over just owning a 1 year TBill at nearly 5.4% and avoiding any risk for the tiny amount of bps on gains in buying RMPL-.

Thanks. Fully understand what you wrote. Let me try to be clearer. Why does a baby bond have a higher maturity risk than a “normal” preferred that is NOT term dated? I do see a difference in the maturity risk which means I do not understand something.

I think I need you to flesh out your thought/question more before I can answer. From what I am interpreting, I dont think your assertion is true. Remember there are all sorts of durations of “baby bonds”. Some baby bonds are issued with 5 year durations, but some dont mature until 2060s and 2070s. And the latter have the same asymmetric risk as a perpetual preferred. Meaning the baby bond can be redeemed after 5 years if it favors the company to do so, or leave it outstanding if that scenario benefits them.

Here is why I do not see the maturity risk. That might help you understand why I don’t see the risk. When I look at the baby bond spreadsheet, I do not see more than a few that we issued very long ago. I take the 1st call date and go back 5 years to estimate the issue date. I can find a few but I also find a preferreds that go back in time.

Seems like companies call them in based upon the financials of the issue

You need to remember the last 15 years have been a secular decline in interest rates. So invariably when first call date came they had a financial benefit to redeem. Yeilds are nearing 15 year highs, so the inverse would apply now. There is no financial reason for an early redemption. Unless of course their financial condition improved considerably from a deep junk status, getting bought out, desire to deleverage, etc.

Agree but why would a company distinguish between an undated maturity on a “normal” preferred or a long-dated maturity on a baby bond? Perhaps different accounting treatments on their books and financials? Companies are always going to look to call things that maximize their advantage. Just trying to fix out why one is considered more of a maturity risk than the other.

What do you mean by “maturity risk”? Leaving it outstanding (duration risk) or the opposite an early redemption (call risk)? Bonds are liabilities, preferred stock is capital. Term dated preferreds generally are treated as liabilities not capital since they have to be redeemed. But when you get into “bonds” you have all sorts of cap stack levels (junior subordinated, subordinated, senior unsecured, senior secured, mortgage backed, etc. ).

Most times their financial situation, need, or credit risk determine what is issued. One cant just make a blanket statement saying either a perpetual preferred or long duration bond is most likely to get redeemed first. It depends on many variables that mayor may not apply to each individual company. ….If one had an unlikely situation where all variables are equal, and no debt covenants are involved, the company would save more money by redeeming the preferred because they do not get to write off the interest expense as a tax deduction like they can a bond.

Steve – As Grid has pointed out, you need to define what you mean by “maturity risk.” That’s an odd term….. Once you define what it means to you then maybe we can figure out the disconnect. There is a difference to the issuer in accounting between bonds and preferreds and that sometimes does enter into the issuer’s equation as to their rationale to choose to CALL a bond or a preferred, but somehow I don’t think that’s what you’re getting at… Please define “Maturity risk.”

Guys let’s just forget my question. I cannot define what others post. I see on this board a reluctance by some to invest in baby bonds because they are locking their money in for too long. Then they post that they buy “normal” preferred issues. My read of the data, says there is no risk of longer maturities in your money being held in “normal” preferreds versus baby bonds. So, I will continue to buy BOTH with a tax preference for preferreds that have qualified dividends in taxable and baby bonds in IRA’s. To Tim’s point in the post, term dated issues have some real benefits.

Thanks for spending the time. I appreciate it.

Steve, I now understand enough of your question to state this. I dont recall reading what you have stated others have said in that direct context (but my memory may be at fault too). Your line of thinking however, is correct provided you are willing to accept duration risk from both the perpetual preferred and the long duration baby bond.

As long as you are matching up your preferences and goals to the appropriate issues, that is all that matters. Term dated issues arent anything special, other than they just protect one from duration risk. But if that doesnt matter or is not a goal (as one may have CDs or TBills doing that legwork anyways) then they serve no special purpose either.

It doesnt make it right or wrong, but presently I own no term dated issues. I have plenty of other short duration stuff that serves that purpose. Plus for me my 2031-35 bonds are also “term dated” for my needs. One can get short duration debt on the bond desk too for that matter if buy and hold is the goal.

Thanks Grid. Perhaps I misunderstood what others posted. We are aligned in our thoughts. I also do not own any term dated at present. The same view, I can find other short-term investments.

For the 1st time, I took Tim’s view of buying a high-quality CEF( RIV-A). I have ignored CEFs in the past.

Could be worse fellow mortal. Look at what old vampires have been dealing with: https://www.nber.org/digest/202212/real-interest-rate-decline-long-historical-perspective

It’s been downhill for Count Dracula since the Black Death!

Grid. Duration. Just bought a MCD BOND 5/26/45

Yields 5.3% and 5.75% YTM.

I Won’t live that long but I don’t see the harm in buying an IG bond from

A solid company like MCD. Why should I care what year it’s callable?

It will last longer than me.

Your thoughts? I respect your knowledge

Yes, King, I wouldn’t stress a second about getting properly paid with your McD interest payment that is certain. And there is certainly nothing wrong with balancing out duration risk with some longer dated issues such as this.

Nobody knows nothing about direction of interest rates down the road and that certainly includes me.

If you are just buying for income and dont worry about pricing volatility of the bond you are good to go. I dont personally have much lengthy duration issues that are fixed now. But its not because I dont want any. Im just a little gun shy in protecting the capital from mark to market losses. At some point down the road, I will need to purchase more long term income streams to assist my lady in her retirement income needs.

Good advice as usual, also have a BRKA 4.45% paying 6%. I can’t believe how cheap IG bonds are. I feel like I’m missing something. These companies will not default in my lifetime. MM at 5% I’m retired and have no interest in

Common stocks right now. Utilities have been a nightmare.

King, one thing that gives me pause is the BBB credit spread between to BBBs and the 10 year. Its only 1.56%. If looking at the chart below one will see its pretty low. Last October when 10 year broached this level, many bonds were even lower than today (higher in yield) because it went over a 2% spread.

Whether it matters going forward who knows as other variables matter just as much too.

https://fred.stlouisfed.org/series/BAMLC0A4CBBB

Maybe less thinking is better. Me and my buddy convinced his elderly dad to get all his cash paying basically nothing in a bank and putting it into rolling one and three month TBills. Those were chosen only because he insisted on being able to get to his money if he needed it (he wont ever). Anyhow his highlight of the month now is my friend printing off statement showing the thousands of dollars in interest received each month for his dad to see. He gets a kick out of it since he was only getting a few bucks prior. And now he almost trusts Treasury Direct despite the fact his money is off in the internet somewhere, ha.

Brka is Berkshire Energy. Rated A-. If I have to worry about Buffett then I

Quit the market.He buys treasuries every Monday. I buy the 6 month then at least I’ve got a good shot of outliving those. Good luck

SteveA, Not sure if this addresses your question or not, but let me give it a shot. Preferred stock vs Baby Bond.

Baby Bond: Not to state the obvious, but a BB is a Bond. It is a debt instrument and contractually obligates the issuer to pay specified interest in certain amounts on certain dates. The repayment of principal is also contractually defined. A BB can have various degrees credit quality and various maturity dates. The debt can be senior or subordinated.

Preferred Stock: Dividend payments are *not* contractually obligated and must be declared by the Board of Directors. This is a form of equity and debt payments must be made before dividend payments on PS can be made. PS is usually perpetual (does not have a maturity date), can be either cumulative or non cumulative. Sometimes it can have a maturity date (Term Preferred).

PS and BB are usually callable. When an asset is callable it means that the owner is short a call option on that asset. One should not think of this as an adjustment (or change) to the maturity date. This feature is a short call option. It is similar to writing a call option on a stock that you own.

Sometimes PS and BB can be puttable. When it is puttable the owner is long a put option on the asset.

There are a number of risks associated with BB and PS

Duration Risk – Duration Risk is best thought of as sensitivity to interest rate changes and is a function of time to maturity. When rates go up, bond values go down. The degree to which they go down is a function of duration and therefore maturity. The longer the time to maturity the higher the Duration Risk. Most PS has no maturity, so it has higher Duration Risk than a bond which has a defined maturity. A Term PS will always have lower duration risk than a perpetual PS from the same issuer.

Credit Risk – These days *all* bonds have Credit Risk. PS in company X always has higher Credit Risk than a BB issued by company X. This is because the bond is always Sr to the preferred equity in the capital structure. A Sr Secured bond always lower credit risk than a Sr unsecured bond and a Sr unsecured bond always has lower credit risk than a subordinated bond. All of these bond types can be issued as baby bonds, although you don’t typically see Sr secured baby bonds.

There are other risks such as Call Risk, Currency Risk (for foreign bonds), Liquidity Risk etc.

Not sure if this answers any of your questions, but hope it helps.

Thank you it was very informatve. To me, Tim should post this as a seperate article so it can be found again.