Well I think we are through the medical panic phase of this selloff, BUT now to deal with the massive losses that will occur domestically and globally by pretty much all companies. Now we will have a giant equity loss on todays open as folks come to grips with ‘who remains solvent’?

Last week we had the S&P500 move in a range 2478 to 2882 before closing the week at 2711. Of course it took a giant gain Friday to get to the 2711 level–and we will give some (or all) of it back today.

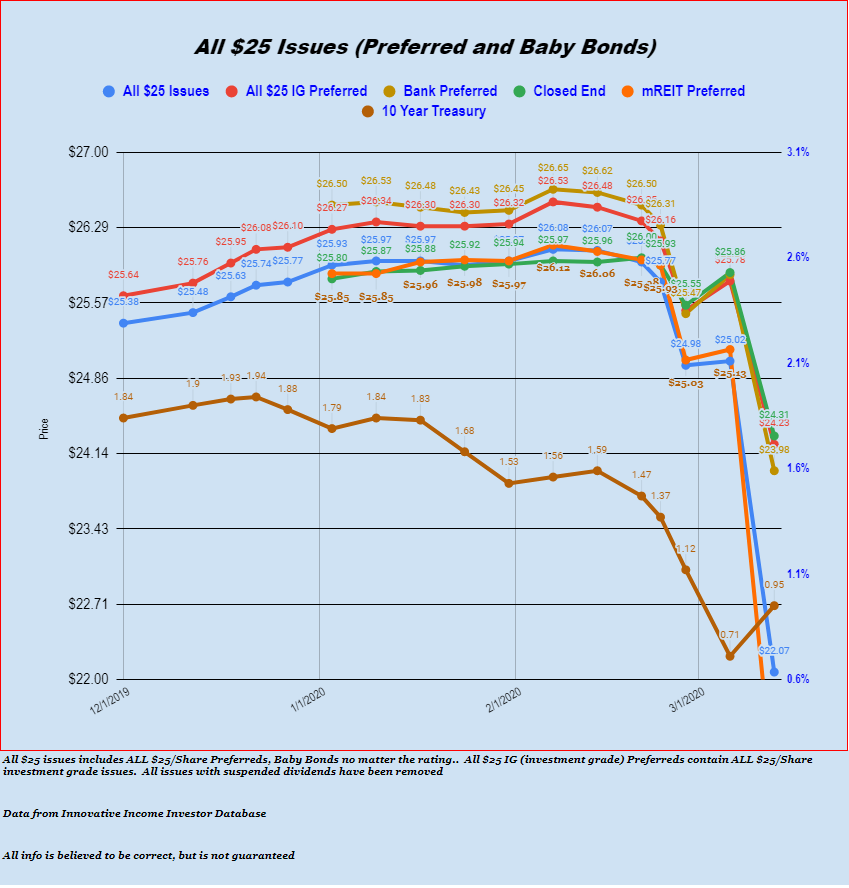

The 10 year treasury traded in a wild range of .4% to .99% before closing the week at .95%. Normally I like to watch the treasury markets for signs of economic softness–but their usefulness now – for the short term, is fairly limited.

The Fed balance sheet grew by $70 billion last week–no surprise. Of course it is going to grow massively in the weeks just ahead–and in my opinion the years ahead. With the FED already announcing at least $700 billion in QE (quantitative easing) there is only one way to go and that is up.

Last week we had no new issues sold as far as I know–I have suspended my continuous monitoring of my SEC RSS feeds as markets have kept me quite busy.

Last week was one of the most devastating weeks in recent memory as $25/share preferreds and baby bonds fell, on average, $2.95/share. CEF preferreds were off $1.35/share while utilities (not on the chart) were off $1.24/share. Shippers were off about $5.30/share and mREITs $4.23/share. The only item up last week was the 10 year treasury as it climbed .24%