As everyone knows First Republic (FRC) was seized by the FDIC and sold to JPMorgan over the weekend. Common and preferred shares will go to ZERO. If I held preferred shares I would sell them this morning if there is trading available–they will go to ZERO.

The S&P500 was up on the week–trading in a range of 4049 to 4170 and closing at 4169 on Friday. This is a gain of less than 1% on the week as markets have been focused on the FOMC meeting this week and their Fed fund rate hike decision.

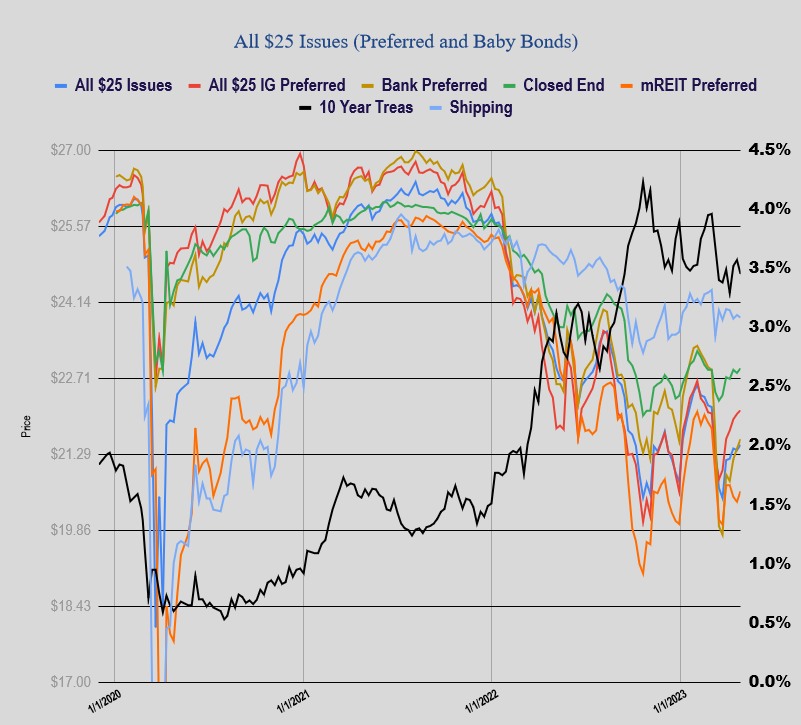

The 10 year treasury yield traded in a range of 3.37% to 3.55% and closed on Friday at 3.45%–right in the middle of the range, which honestly was a fairly tight range. Economic news has remained relatively mixed which has left investors a bit confused–recession coming or not–and when?

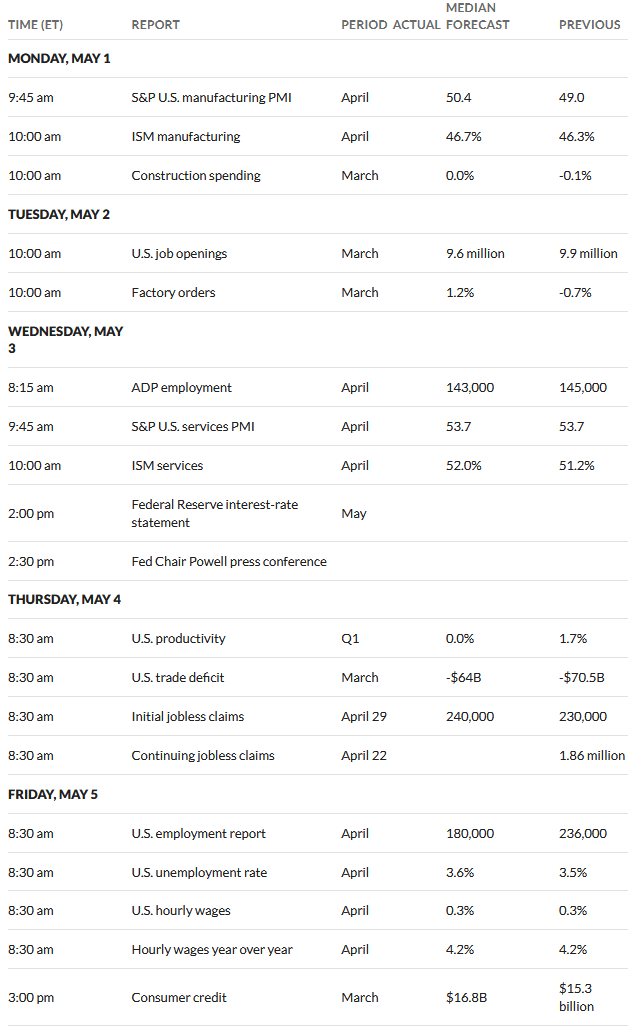

This week there is plenty of economic news activity this week–of course the biggest being the FOMC rate hike decision at 1 p.m. (central) on Wednesday, but we also have the April employment report prior to market open on Friday.

The Federal Reserve balance sheet fell by $32 billion last week. The repayment of loans made for the banking crisis and the ongoing quantitative tightening runoff of maturing assets has brought the balance sheet down $170 billion in the last 7 weeks.

Last week we saw a small jump in the average price of a $25/share preferred stock and baby bond. The average share was up a dime to $21.46. Investment grade issues were up 9 cents, banking preferreds up 18 cents, mREIT preferreds up 20 cents with shippers off 5 cents.

Last week we had no new income issues priced–but we did finally get trading started on the Saratoga Investment 8.50% baby bond (SAZ) which ended last week at $25.13

Bonds holders get zero. Same with common and preferred shareholders.

And the reason the fdic is involved with the loans is because…. The deposits get deposit insurance. The fed gets back whatever they can sell the assets for.

Bank net worth…. . Assets minus lianities equals net worth…..Most don’t understand. The banks assets are…. Securities owned and loans. The loans need to be cashed out. The fed does this by selling the loans. It happens behind closed doors. Nobody knows what they sell them for. They are notoriously BAD at getting value.

That jpm bought most is probably a positive. Compared to straight fire sale by closed lottery.

Janet “We’re monitoring the situation closely” Yellen deserves to be fired immediately IMO

> Bank net worth…. . Assets minus lianities equals net worth…..Most don’t understand. The banks assets are…. Securities owned and loans. The loans need to be cashed out. The fed does this by selling the loans. It happens behind closed doors. Nobody knows what they sell them for. They are notoriously BAD at getting value.

You’re confused here. The “fed” doesn’t sell bank loans; it’s the FDIC’s job to dispose of them in a way that minimizes the hit to the fund.

And we DO know the terms of how the portfolio was resolved: it’s in JPM’s investor presentation.

I’ve only dealt with like four hundred liquidations

Oh they ‘dispose of them’. Please explain the difference in between dispose and sell. Here’s the headline…………….

What JPMorgan’s First Republic Buy Means for the Stock

PS I’ve dealt directly with loan holders, here a common story. “We were called 2 days ago. We were told that we had 24 hours to decided. Pay back 40% of the loan value tomorrow. And you’ll be clear”…..The loan had been sold for 20 cents on the dollar. The purchaser made 100% in 3 days.

If you Prefer, I don’t know if Yellen is doing a bad job or doing the best she and everyone else can do with the resources they have and having to fight the internet with news and rumors influencing what is happening.

But personally I feel having you post about Yellen several times today almost feels like a political statement.

Please leave her out of the comments is all I am asking.

In a purchase like this by JP Morgan of First Republic, will holders of First Republic corporate bonds get any of their investment back?

From what I read, it sounds like JP Morgan is taking on the bonds, so those should be fine.

https://www.sec.gov/Archives/edgar/data/19617/000001961723000304/jpmc2023exhibit99.htm

JPM not assuming bonds and preferreds

Thanks for the link!

Can someone interpret this sentence for me?

▪FDIC will provide loss share agreements covering acquired single-family residential mortgage loans and commercial loans, as well as $50 billion of five-year, fixed-rate term financing

Why is the FDIC involved in loans? I thought they were the federal DEPOSIT insurance company?

> Why is the FDIC involved in loans? I thought they were the federal DEPOSIT insurance company?

When a bank fails, the FDIC takes over the bank’s assets (loans, securities, etc.). The general idea is that we want to get those assets back into the private sector as soon as practical, so the FDIC aims to sell them.

Sometimes that might require a sweetener. If you’re thinking about buying a bank over a weekend, that might not be enough time to do as much due diligence as you’d like. So the FDIC says, for a certain illiquid portfolio, we think the assets are good but we’ll split losses with you if not.

It’s not a perfect process but resolving failed banks rarely is.

OC, The role of the Fed has vacillated between a pawn for corporate purposes, presidential control, a tool of war, part of the Treasury, been expected to have independent authority to having none, etc. In other words a total chameleon for Power.

There is a great current book 2019 called Goliath worth reading. It factually explains all the stuff our grandparents knew intimately , but we have conveniently forgotten. A good read for people in this III crowd. Our ‘sensibilities’ are NOT shaped by the things we think we know, but carefully positioned and marketed as New Dogma.

PS: Bonus points: Who first used the phrase, “too big to fail.” Don’t google it, just go back and think where you think it first came up.

Continental Illinois failure?

My interpretation is that JPM was able to negotiate a great deal for JPM.

1)FRC common zeroed out.

2)FRC preferred zeroed out.

3)FRC unsecured debt zeroed out.

4)Impairments on assets on FRCs books made whole by FDIC.

This situation is a notably different settlement from the 2008 time frame in all regards. My guess is that this is different because we now have much higher levels of concentration in the banking industry which is now dominated by a small number of TBTF banks. JPM is in position to extract economic rent that simply did not exist in 2008.

I don’t know what the term “not assuming” the bonds really means.

However, I did find a price on their 4.625% bonds maturing on 2/16/2047:

Bid: 2.016 . . . . Ask 3.0.

That tells me bondholders are screwed, with only a faint chance or no chance to challenge the takeover in court, claiming some bondholder right to assets.