All in all a decent week for the Standard and Poor’s 500 with a gain of 1.6% over the previous Friday close. The range for the weeks was over 4% as we had a couple high importance economic news items – the FOMC rate hike decision and the release of a very strong employment report on Friday. This morning we have the S&P500 futures off about 1%–for what that is worth.

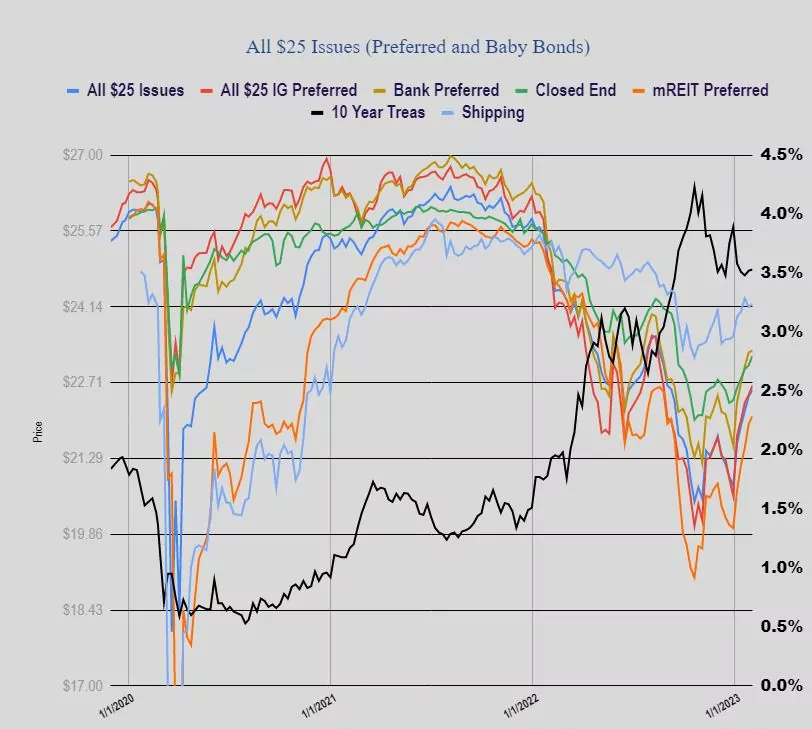

The 10 year treasury yield closed almost where it had closed the previous Friday at 3.53% (versus 3.51% the previous Friday). The strong employment report on Friday kicked yields up by 13 basis points we gave us a rare loss in income issues on Friday. We are starting off the new week with higher rates as the 10 year treasury is up 7 basis points this morning to 3.60%

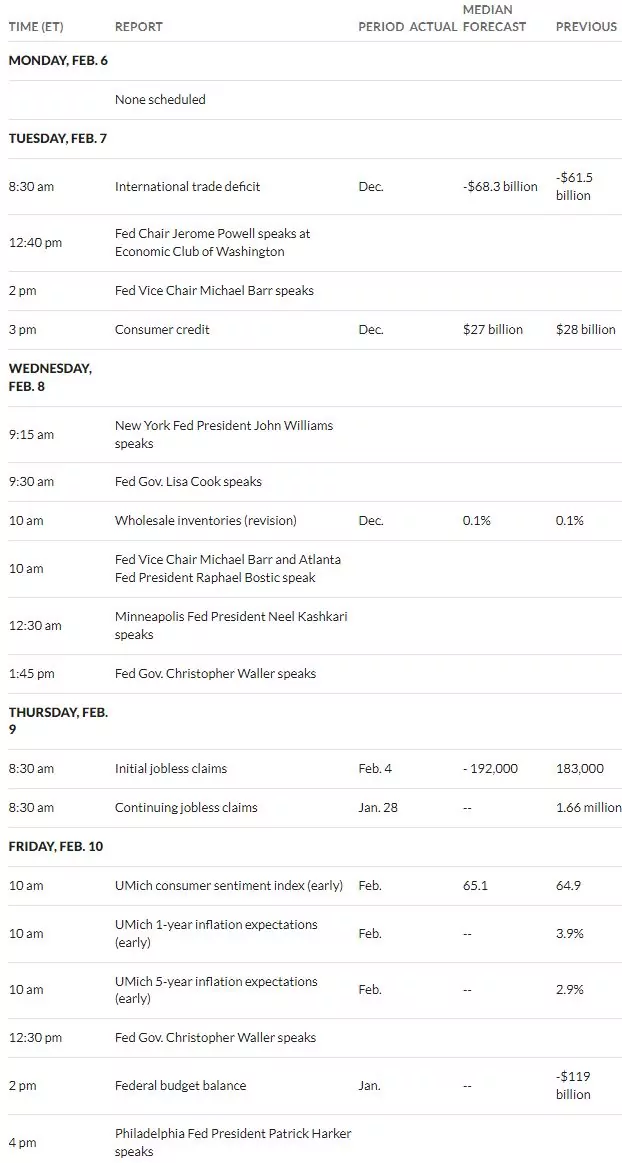

For the coming week we have few economic reports coming out–one can never tell what will move markets though. Of course we have Fed yakkers–and any one of them can move markets.

The Federal Reserves balance sheet fell by 37 billion from the previous week–now at $8.433 trillion. So since April when the balance sheet peaked out at $8.965 trillion we are down about 1/2 trillion–another 10-15 years we will have a zero balance sheet–ain’t going to ever, ever, ever happen, but if we can get down a trillion or 2 we might have a shot of re-inflating the economy out of the next deep recession.

Last week was a decent week for income issues with the average issue up 13 cents. On Friday we saw a drop of maybe 1% though on the employment report and subsequent levitating of interest rates. Investment grade issues rose 18 cents, banking issues rose 4 cents and mREIT issues were up 14 cents on the week.

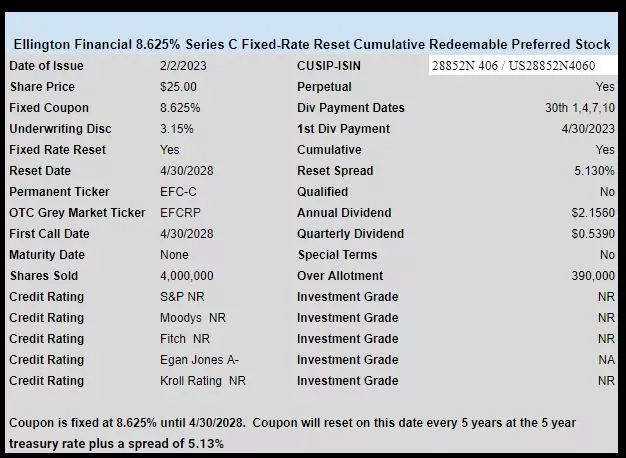

Last week we had one new income issue priced–a fixed-rate reset issue from mREIT Ellington Financial (EFC). The issue is trading on the OTC right now and last priced at $24.58.

LOL where’s early bird??

New issue today

Still no news? I see cusip and gray market ticker. Heard a 2/10 settlement. 6 5/8”s coupon on 300mm and info is on news wire. But neither quantum nor SA nor anybody else has picked it up…, and their other two aren’t even trading off. It’s super weird

Are you talking about ASB notes?

Details here: https://www.bamsec.com/filing/110465923011260?cik=7789

Yeah.

2yr barely moving compared to the 2 & 5yr treas- about 14 points today!

Financial Times article ….. This is such a mess

Read the headline and after you are done scratching your head just read the last five paragraphs.

The fed is just putting on a show and keeping themselves stuck in a loop without a counter to kick them to a different subroutine.

http://www.ft.com/content/64b3d0b6-e0be-4e8c-9b20-c595428267d5

(heavy sigh…………..shakes head)

Pickle,

Thanks for the article. Cant say that I fully comprehened all the details, however, it appears that the Modern Monetary Theory (MMT) experiement is a Frankenstien. A tenant of MMT is inflation is to be managed by fiscal policies – I guess they did not get the memo.

Cheers! WIndy

Somewhat true but at best the items they mention to backup their Stealth QE claim are shaky. At best these will keep the balance sheet more or less steady rather than the advertised shrinking by $95 billion a month. The Treasury General account is limited in time and size. That’ll be either be exhausted by June or be resolved earlier as soon as congress passes a new budget and bond issuance resumes.

Counting on a continuation of the weakness in the dollar is another weak argument. Expect the opposite as the fed will increase its terminal rate when inflation surges again by summer. And cheaper oil? We may have reached a lower bound if not a bottom. Economy is still strong and wouldn’t count on a recession till late 2023 or in 2024 so the odds of further significant price drops that can make a difference in inflation seem low IMO.

The 4th cup of coffee kicked in….

From another angle to debate.

I’ve been hearing about the tragic economic fallout of a deficit since the Reagan era, but I haven’t seen these bad results. Maybe we are kicking the ever-increasing can down the road, and sooner or later our toe will get broken, but…

IMHO, the key to a growing economy is a growing population and productivity – that’s the economic shell game. This matters more than where the gov’t puts beans in a diff bucket (does it matter if the fed has a balance sheet?). Gov’ts will run deficits, and they need to be reasonable (Hamiltonian here – a good ratio of productivity to deficit), but as long as productivity + head-count keeps growing, then the deficit-can continues down the road no problem.

We need larger immigration than we have now, ever-increasing tech & energy productivity, excellent education (at least at the collendge level – our K-12 is a joke), and good infrastructure, which ours is 2-3rd world in lots of areas. Lot’s of issues here, and I’d like clean energy sooner rather than later – I don’t want bad air or water.

Japan, Italy, Spain (and soon China) are the prime examples of this not happening. China might have more room to expand productivity, so I won’t care in my lifetime, but they are up the population chop-stick in the long run. Russia is a joke unless they get their feelings hurt (again) and nuke everyone. Japan shows they can increase productivity, so they hang on a bit longer. Is there a productive Italian? I think not – that’s why we vaca there. Actually, I think QE helps the fed manage the economy better – and might be the only way interest rates stay down – I don’t think Tic-Toc Washington will ever work together, and there aren’t many other independent levers for an adult to pull.

Immigration: needs to be legal, and keep all the smart ones (bachelor’s degree in STEM, or masters+ get auto citizenship – same with serving in the MIL). We need a large number of low-end folks, too, but get this legal (I’m not sure how to do this well – Washington can’t get their act together for 30 years – both parties suck at this).

Final rant – keep Silicon Vally and TX creating companies – this is a key economic driver. I love seeing tech and energy conflict+innovation. These are key to moving forward and will leave many road-kill luddites.

I apologize to our Canadian friends for my myopic US view.

Whew…The 4th cup of coffee is wearing out.