Let’s go–let’s get this week underway–I have no idea why I am all fired up to get this week underway. Maybe because the weather here is terribly cold (-12) and I have been very bored–I think I will be looking into a gym membership this week.

Anyway the S&P500 rose a nice 2.5% last week to close at 4071–the highest close in the last 2 months.

The 10 year treasury yield closed at 3.52% on Friday. The yield was in a range of 3.42% to 3.56% for the week–a week with a number of important economic news items. The leading economic indicators came in soft on Monday at -1.0% against a -.7% forecast. On Tuesday the PMI manufacturing index and the PMI services index both came in hotter anticipated. On Thursday the very important jobless claims number came in lower than anticipated, which has been the case week in and week out. The 4th quarter GDP came in slightly above expectations and durable goods orders came in very hot BUT the durable goods number was driven by tranportation–mainly new aircraft, trucks and SUV orders–taking these out durable orders were down. On Friday we had the personal consumer expenditures price index number which came in right on forecast at 4.4%. All in all the economic releases are not showing much distress at all in the economy. Fortunately inflation is seemingly under control for now.

So for the coming week we have the FOMC meeting starting on Tuesday and then at 1 p.m. (central) on Wednesday we have the announcement of the Fed Funds rate hike–1/4% if the consensus is right. Fed chair Powell has his news conference at 1:30 p.m.–probably more important to markets than the rate hike. Powell will likely warn they stand ready for larger rate hikes if inflation flares again.

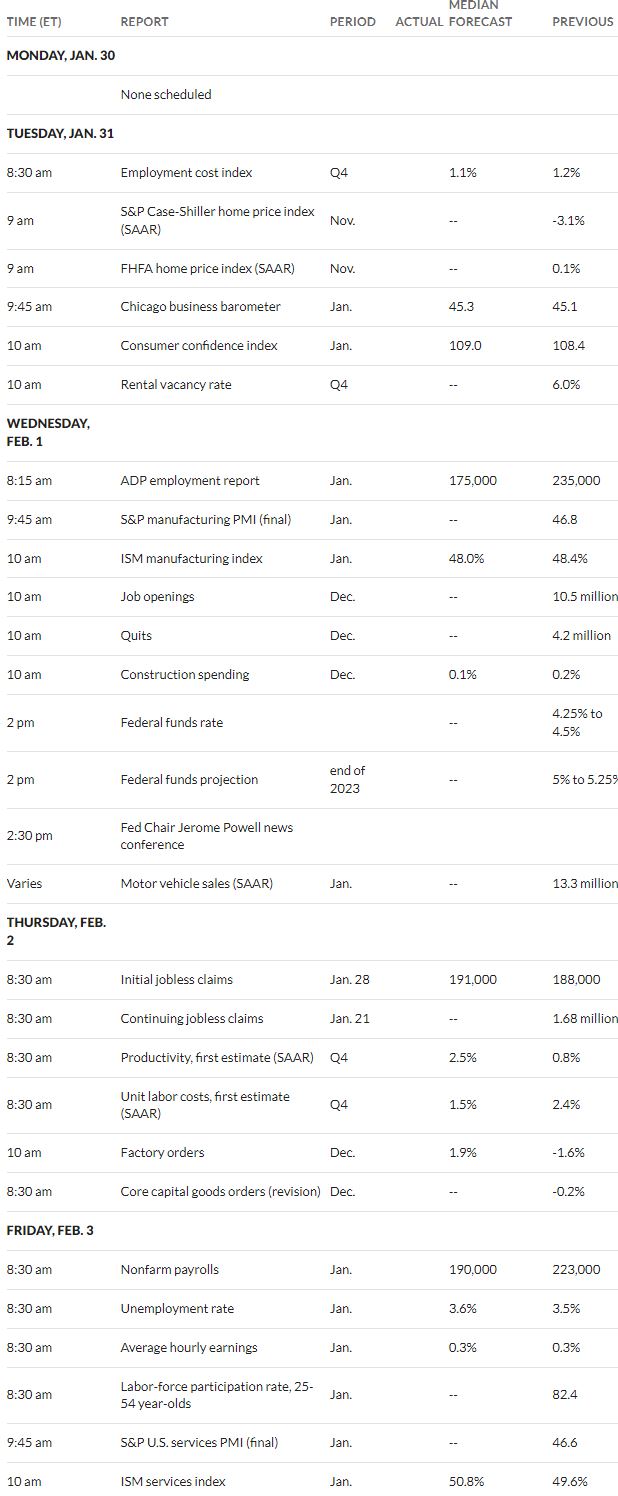

Of course there will be plenty of news beyond the FOMC meeting–the long list is below.

The Fed balance sheet fell by $17 billion last week–now at $8.47 trillion.

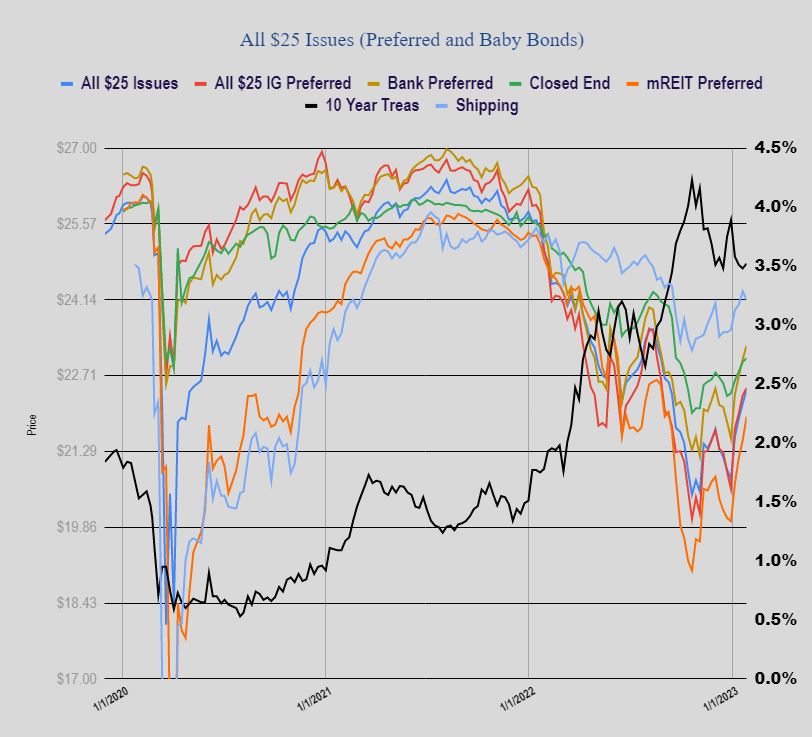

Last week was another great week for $25/share preferreds and baby bonds as the average share rose by 27 cents. Banking issue rose by 26 cents, while investment grade rose just 14 cents and CEF issues rose only 7 cents. mREIT preferreds rose 45 cents.

Last week we had no new income issues priced.

We did have a preferred stock dividend suspension on Friday by crypto banker Silvergate Capital (SI) on their 5.375% perpetual (SI-A). Shares are trading between $8 and $9/share now.

On like Friday Silvergate suspended a divd on SI A. I’m sure it must have been notated here, just saying….

Silvergate Preferred (SI PR A) is NON Cumulative (Bank) which means they don’t have to pay the suspended dividend at any time in the future. Will they re activate the dividend in 90 or 180 days? As the blind man said, “We shall see.”

I would be interest in any opinions. Im holding 300 shares.

I have some shares. I sold a small amount today above 9. It is just a thought process I went through to start minimizing the holding but still thinking it has a shot to start paying again … but … at the same time taking some off the table to minimize a worst case scenario. I did not think I would act so soon but the small recovery of it allowed me to give it some more thought.

SI may very well end up being the only serious game in town for crypto banking. The crypto group who applied for a banking license got rejected. JPM is still not “live” with their offering. While I can read a basic earnings report it takes a special person to fully wrap their head around SI’s last report. What I mean is… did the money they borrow cost more in interest then what they have invested from deposits and holdings? I think they call that a negative spread? Can they hold on to so much cash/liquidity to give their clients confidence while actually making enough money to cover costs allowing them to dig themselves out of the hole?

I have read the last transcript. I went over the quarterly report. I could probably spend hours studying it only to be incorrect due to flawed assumptions and misunderstandings. I like that they are slimming everything down. They can be profitable with current deposits based on numbers from the past but the money they borrowed obviously costs serious money to maintain.

Even the questions by analysts, experienced people in this stuff, which got vague answers caused them to make assumptions which just resulted in them down grading the bank. Do they need to raise cash for example?

I am rambling but the end result is if the price of this preferred keeps slowly going up, for whatever reason, I will slowly take advantage and sell some off. Each small sale might help me avoid a worst case scenario leaving some to ride for a while.

I don’t think anyone should be buying this preferred right now without more information. Not much of a difference between buying at 9 with no news and buying at 12 with positive news they will survive. If you are looking for a distressed future yield situation. That 3 buck difference is just gambling on too much negative issues.

What might be interesting is JPM, for example, buying them out cheaply and just taking the clients to their system they are developing. That would be good for the preferred but who knows. Maybe JPM knows they will blow up already since they have smart people who can wrap their head around the full situation with the information in the last report.

Thanks for your post fc. I thought of selling some SI PR A but held off until they made a decision on the dividend. I think its worth waiting another 90 days to see how things play out.

Business has picked up past two weeks. Large portion from projects reaching final stage and interior work being done. Shielding projects booked 2 to almost 3 weeks out. Transportation still being affected by the weather with freight backlog being held up and carriers running partial trucks but charging for full truck load. Not sure, but maybe a combination of weather and driver shortages. We have to split shipments to keep weight under 10,000# to avoid full van charge. Freight charges up 10% since Oct. and fuel cost is climbing compared to past month. Showing more demand or supply constraints? Raw materials costs still down which is where you need to look if economy is actually slowing.

Definitely seeing fuel prices spike again–locally there are no bargains on auto fuel any longer (a nice months long gas war ended) and prices are up 50 cents to a buck in the last few weeks.

based on what happened last week I decided this of “thing” might have turned the corner. locked in a big chunk of 1yr. cd’s an 1yr treasuries with a 5% taste of PFXF at the other end of the barbell last Thursday.

Isn’t it about 6.14% at 18.17? (latest annualized)