Well we know this week will be an exciting week as we have a 75 basis point Fed Funds rate increase starring us in the face–oh well this has been known and considered for weeks so likely no surprise here (well really I have no idea) Of course it really isn’t about the rate hike, but is about the Fed statement and the Powell presser afterwards on Wednesday afternoon. Will Powell indicate a softening in his hawkish view during the press conference? Or will he simply reiterate that they are ‘data dependant’?

On top of the Fed Funds increase we get the 1st read on the 2nd quarter GDP on Thursday. The 1st quarter was a minus 1.6% so any minus reading technically means a recession is at hand–but of course this will be the 1st estimate of GDP with the 2nd release in late August with the 3rd and final reading on September 29, 2022. The forecast is a positive .3%–so we will have to see what Thursday brings us.

Last week the S&P500 moved sharply higher -part because of some corporate earnings being ‘less bad’ than expected and partially based on lower interest rates because of recession fears–not certain it all makes any sense, but it is what it is. The index was up 2.55% closing at 3962.

The 10 year treasury closed on Friday at 2.78% which is 15 basis points lower than the previous Friday and 30 basis points below the high yield for the week. With the 2 year treasury at 3.02% obviously the yield curve is inverted–recession? We will see as the recession call is actually more detailed than 2 quarters of negative growth.

The Fed balance sheet rose by about $3 billion last week

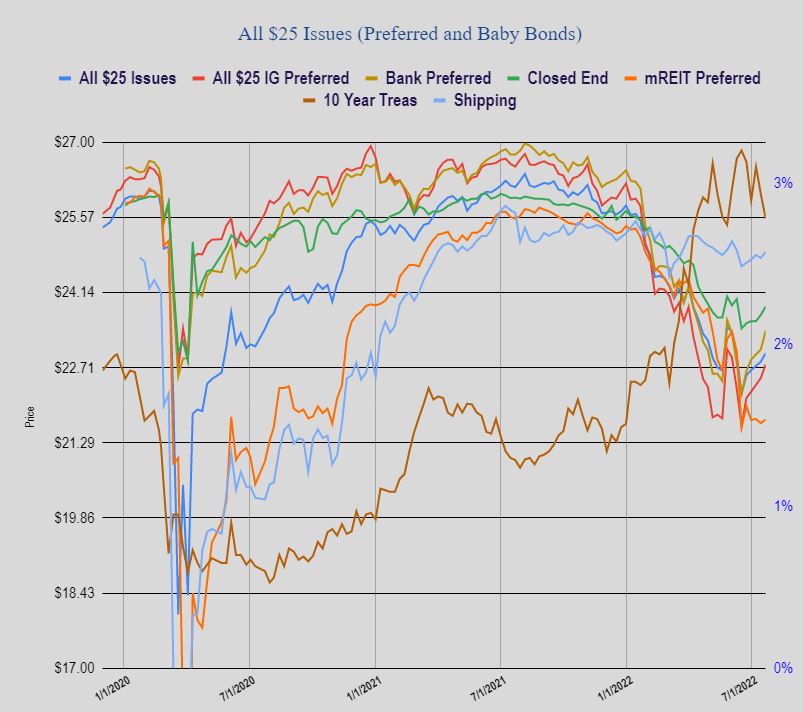

$25/share preferred stock and baby bonds had a good week with the average share up 17 cents. Investment grade issues were stronger gaining 26 cents. mREITS gained 7 cents with CEF preferred up 18 cents.

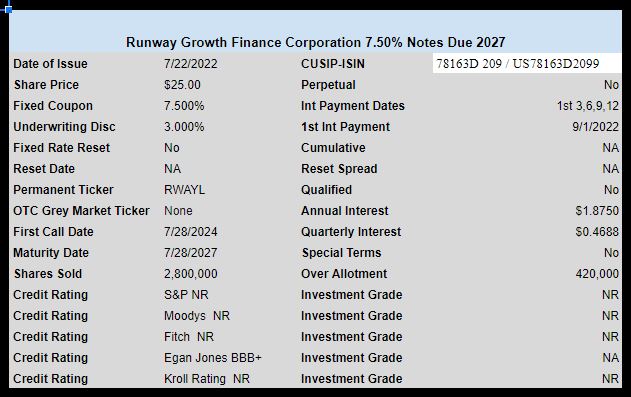

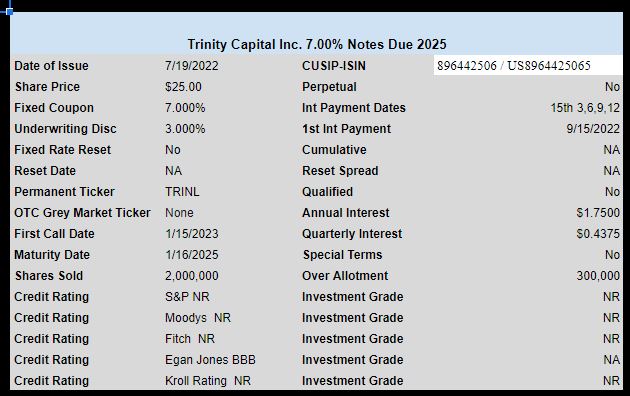

Last week there were 2 new baby bond issues priced by business development companies (BDC’s). Neither issue is trading as of yet (as far as I can find).

For those of you that may not hit the lottery tonight and own Oxford Lane securities…

Oxford Lane Capital Corp. – Oxford Lane Capital Corp. Schedules First Fiscal Quarter Earnings Release and Conference Call for August 2, 2022

https://ir.oxfordlanecapital.com/news-market-data/press-releases/news-details/2022/Oxford-Lane-Capital-Corp.-Schedules-First-Fiscal-Quarter-Earnings-Release-and-Conference-Call-for-August-2-2022/default.aspx

Tim.. Very hard to Trade, 60/40 % portfolio, not safe and now 40/ 60 % not working.. what”s next …? 0.75% increase ..? something good, buying A-B rated preferred below Par..

Everything just seems too quiet. Everyone awaiting Fed speak Wednesday at 2 PM 🤐 This administration wouldn’t know how to run a quality economy if it bit them in the lip 🫤

Here’s an ITM trade I just placed on an IG-rated small insurer.

Note: Ex-div date is tomorrow, Wednesday (see ^footnote below).

UNM Unum Group Insurance

Moody’s Baa3

Fitch BBB-

Fitch Insur A-

Dividend “Contender” Raised 14 yrs in a row

Price: $32.83

Div: $1.32/4.02% (just raised to $0.33; 14 yrs of raising div)^

Exp: Jan_24

Strike: $32.50

Premium: $532 (off $490 bid)

2-yr return: 12.12% annualized*

4-yr return floor: 8.07% annualized** (can write post-Jan_’24 CC to increase 4-yr return)

ROI if called at exp: 21.23%***; or 14.15% annualized over 1.5 years

56% chance of being called^^

Div Dates: 28th; 1,4,7,10

*($132div+[$532prem/2yrs]/$3283cost)

**($132div+[$532prem/4yrs]/$3283cost)

***[(1.5yrs*$132div)+($532 premium)] – $33 cap loss/$3283cost

^https://seekingalpha.com/article/4525353-dividend-champion-contender-challenger-highlights-week-of-july-24?source=all_articles_title

^^https://www.stockoptionschannel.com/symbol/?symbol=UNM&month=20240119&type=call

Fredson, thanks for all that detail. Are you describing a covered call you sold on 100 shares of the underlying you bought the same day?

Bur – yes.

($32.50+(7*33))/($3,283-$532)

Assuming: Q1 24 ex-date is prior to call date

Assuming: UNUM is quoted at >/= $32.50 at Jan 19, 2024

Ignoring: Early distributions of divs

18 month ROI: 15.79% CAGR

Best wishes Fred

TIM ********

Could you please remove my message of 8:07pm 7/25

Thanks

Anyone here able to buy these debt term certain preferred IPO’s: TRINL and/or RWAYL? I have tried multiple times speaking with bond/preferred specialists at Merrill Edge and Vanguard with zero success. Any thoughts would be appreciated. TRINL should be trading for us retail neophytes because it has settled.

Azure,

No luck with TRINL at Fidelity nor TD Ameritrade.

My stock charts.com is showing the 10 yr. treasury (EOD) yield at 2.77 and the 2 yr (EOD) 2.29. Where is the inversion?

Payday–not sure what you are looking at – it is 3.03% right at this minute.

U.S. 2 Year Treasury

US2Y:Tradeweb

EXPORTdownload chart

WATCHLIST

+

LIVEWatch live logo

POWER LUNCH

RT Quote | Exchange

Yield | 2:47 PM EDT

3.035%

Price Day High

100.0352

Price Day Low

99.9219

Accidently put the 2 MONTH yield in place of the 2 year yield. Sorry about that, we do have a inversion

Today (EOD) treasury yield at 2.81 and the 2 YEAR (EOD) 3.09.

This spells trouble on the horizon.

There will be a lot of talk of 9% inflation in the media this week. It’s worthwhile to note that the Fed does not use the CPI headline number in setting their targets. They focus on the Core PCE and it’s ~5% today.

There is a nice picture on this link.

https://fred.stlouisfed.org/series/DPCCRV1Q225SBEA

Seems like a long time since I’ve seen a preferred called. What’s the next one I wonder.

I’m voting for GMLPF since I have some, but not holding my breath over it. It may join my other dark one that I mention in my last will and testament. It can be called in October.

I cant find the data, but my assumption is that preferreds with current and near term call dates will not be called until they can be refinances a rate much lower than today. Also I noticed that a few 2 year preferreds were issued, I suspect for the same reason, a bridge to lower rates. Thoughts?

Porky, they were deep in the weeds issues but I have had two called this month CNIGP and WTREP. And Im betting that BKEPP will be yanked fairly soon after their vote occurs in a couple weeks. I think UMH has one being redeemed soon. I would suggest the large majority are not in a position to be redeemed from recent rate hikes. But there are always a few at different times that will surprise with a notice. Some live floaters may get out of hand at some point and get redeemed also.

GSLD also got called last week. Dropping like flies….

That vote affecting BKEPP has now occurred:

https://www.marketscreener.com/quote/stock/BLUEKNIGHT-ENERGY-PARTNER-5789022/news/BLUEKNIGHT-ENERGY-PARTNERS-L-P-Termination-of-a-Material-Definitive-Agreement-Completion-of-Acq-41345543/

I used to think it would be PSA-F (5.15% with 1st call June 2, 2022).

I think it is pretty telling that they haven’t called it, because past history has shown that if PSA thought they could issue a replacement with a lower coupon, they would. It wasn’t that long ago they brought PSA-N to market at 3.875% and 4 other issues at 4% or less. Now you can get a 10 year, FDIC insured CD paying 4%.

I thought PSA was going to call some preferred but they paid out all that cash as a special dividend. Oh well. So much for that plan it seems. It appears I can sell for a small gain or just keep this quality preferred paying 5.5% or so.

I mentioned EBBNF on Canadian page [it’s a USD issue though] on Sat…… We will know for sure if it will be called before August 3. ENB called another reset issue, Ser. J, with identical terms in May when 5 yr Treas was at 2.90% so I suppose it’s dependent on whether they have changed thoughts on long term interest rates. And don’t they only have ability to call every 5 years??? not sure of that but I think that’s right.

I looked it up – that’s correct – they either call it now or it remains outstanding for another 5 years