FLASH–large mall owner CBL Properties (CBL) has finally officially filed for Chapter 11–they have 2 preferred issues outstanding, both selling around 65 cents/share–they will now be worthless.

Also Pennsylvania Real Estate Investment (PEI) has filed a prepackaged Chapter 11, but the common and preferred will continue to trade. Dividends were already suspended and we will see where shares go from here.

It was a pretty rough week last week in common stocks as the S&P500 traded down as low as 3224 after opening the week at 3441, which was the high for the week. The index ended at 3270 on Friday–a loss of 5.6% for the week.

In spite of the tumble in equities the 10 year treasury closed the week at .86% which was 2 basis points higher than the week before. The bond had traded as low as .75%. With equity futures up 400 Dow points this morning are we going to see rates pushed above .90%?

The Fed Reserve balance sheet fell last week by $31 billion last week which is consistence with the sawtooth upward pattern–no reason for this to change.

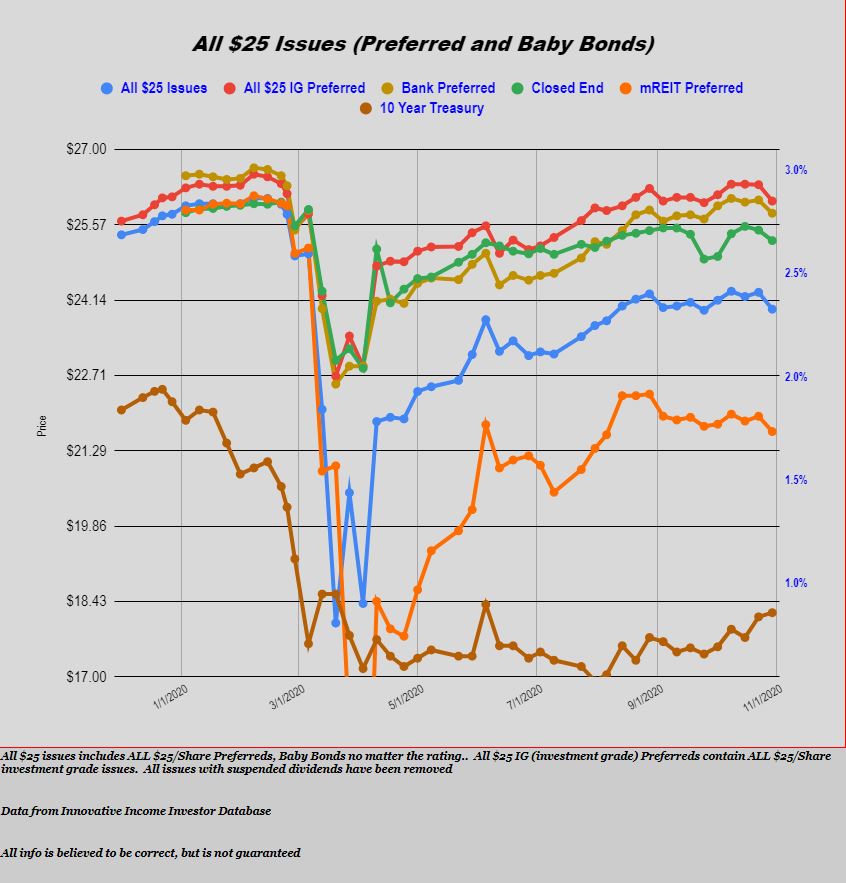

The average $25 preferred and baby bonds fell last week by 32 cent last week. Investment grade fell by 31 cents, banks by 25 cents, CEF preferreds by 20 cents and mREIT preferreds by 29 cents.

Over the last 10-12 weeks movement in preferreds and baby bonds are consistent with interest rates creeping higher while preferred and baby bond prices are flat to down.

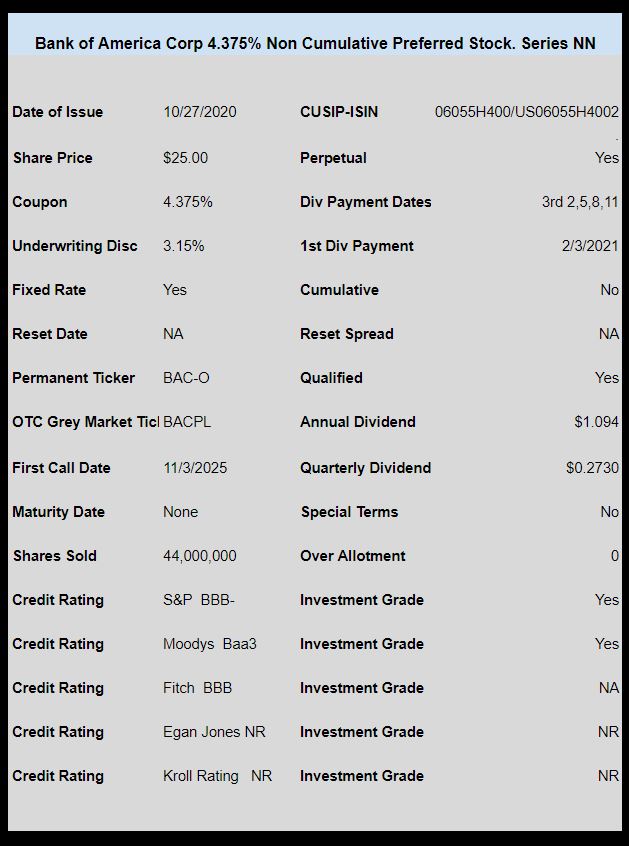

With the volatile nature of the equity markets the new income issuance arena was slow last week with just 1 $25/share issue coming to market.

Bank of America (BAC) sold a new non cumulative preferred with a coupon of 4.375%. The issue is trading now on the OTC grey market under temporary ticker BACPL. Shares closed at $25 on Friday.

I saw the owners of PEI make a presentation circa 1994 ish in my office. It just lacked pizzaz. I’m sorry to hear they failed but that shipped sailed long ago. It was destined to fail prior to covid. I believe they had too much mall exposure. Was hoping they could plow enough under and build multi family mc boxes to turn a corner…..but I guess not.

Why do people buy the barely IG and non-cum BACPL at par when the A1 rated OPP-A is available below par at the same coupon? Is it just that people like to buy a brand name they know?

Landlord–Gridbird says it best–names matter. A1 rated CEF preferreds from Highland Income Fund and RiverNorth/DoubleLine trade cheap while more recognizable names like Gabelli trade at full potential. Plus there is a general lack of understanding of CEF preferreds by investors (at least in my opinion).

I can understand Highland trading cheap based on the fund manager (I highly question that A1 rating and I highly question reported NAV) but it appears OPP-A is trading more on the Rivernorth name than the DoubleLine name. They should have reversed the order of the names on the fund!

I think you’re right though that investors don’t understand CEF preferreds or are not even aware of them.

I think the underlying assets in Gabelli funds are generally a lot safer than what Highland and RiverNorth are in.

Hello “35spline”; No multiple state tax returns but they do send you a K-1 to file. I own my shares in my pension plan and my CPA does any paperwork for me. I have never had a problem with owning it this way.

fyi. B of A says they have a billion $ in deferrals. I own some common.

guess no big macs this week. Friendly’s in bankruptcy again so no fribble either. I am very happy the election season commercials/talking heads are

over. Need some cowboy movies!

I messed up. Sorry. B of A said 10 billion $ in consumer loans is in deferral.

(Whats 9 billion among friends).

Good morning Tim & All; While I rarely make a comment anymore I decided this morning to make one. While many of you (me too) continue to struggle to find anything that you feel is “worthy” of buying I will just bring up a company that I own and feel very comfortable with. I own a large amount of shares of EPD which has a yield of around 10% at todays price. FIRST thing I want to say is I just got off the phone with their I R Mgr. and he was kind enough to spend well over 25 minutes with me. I truly feel this company is very “misunderstood” in oh so many ways. SECOND, he said the distribution of $1.78 (annual and paid quarterly) is very SAFE. I have literally read everything on their website and feel pretty educated about the company in general. THIRD, he explained there is no way they (meaning the Left) can just come in and completely replace the Oil/Nat Gas/NGL’S/PETRO anytime soon. He explained the world population is growing immensely and all those people are going to NEED ENERGY. He also explained that the “wind” doesn’t always blow and that SOLAR cannot possible replace all the energy that is needed. I truly think a person needs to take 2 Giant Steps Back and look at the BIG PICTURE here. Iam going to add more to my position. For those of you that don’t even own it I would just tell you to do your own homework and if you don’t feel comfortable with it thats fine. For me, even if the stock price didn’t move up an inch over the next 3 years you still make 32% on your investment. Pretty good by my measures. Hope everyone has a great week. Thank You again to Tim for having such a good site.

ChuckP, Since you are a large shareholder of EPD can you please tell me if you are required to file multiple state tax returns as a result of EPD being a partnership?

Thanks for commenting Chuck P

Also an EPD shareholder. Solid company, 5 Star Morningstar rating at the current price. Enjoy the distribution every quarter.

I don’t do my own taxes but I for sure don’t file in multiple states and I own a fair amount of it.