I study, study, study and find no clear investment direction to take other than the one I have chosen. Lots of CDs and treasury notes with maturity dates ranging from 3 months all the way out to 5 years (minimal at 5 years maturity). Then some preferred shares in the mix to help to goose the portfolio current yield. There are really only so many ‘tricks’ one can play to try to maximize yield (within one’s risk tolerance). Up until a year ago one of my younger brothers and I would speak fairly frequently and we would always express the desire to ‘just earn a safe 5%’–well we are there, albeit with inflation. I see lots of what I consider ‘bargains’ out there–i.e. the regional and community banks preferreds, but so much danger lurking and I need more time to pass to consider adding much to the current modest positions. I just reviewed current CD and money market rates and find them pretty attractive and continuing to creep higher–very nice.

I do have good until canceled orders in on 6 issues–only to buy if someone wants to give me a ‘fire sale’ price.

Well earnings continue to roll out and Microsoft and Alphabet reported and while growth rates are modest earnings are decent and Microsoft is ‘flying’ this morning–with the banking companies they are setting the tone for equity trading today–and that tone is pretty flat–we’ll see if that holds. Also last night California regional banker Pacwest (PACW) reported earnings and they were pretty dreary.

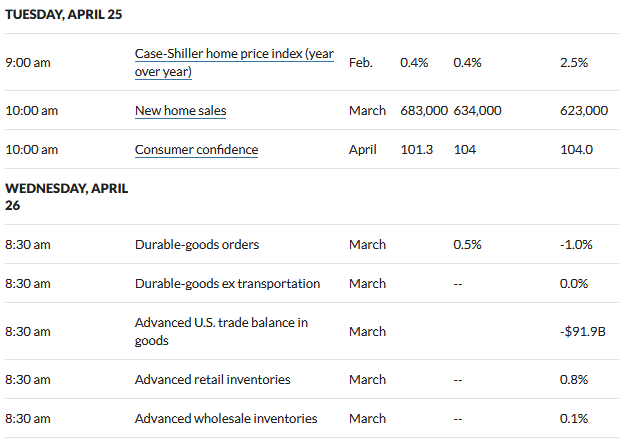

Yesterday we had new home sales reported at a much higher level than forecast–683,000 versus 634,000 forecast. Case-Shiller showed that prices of homes continue higher on a year over year basis. Consumer confidence came in weaker than expected. So the mixed signals continue with economic data. Today we have durable goods and wholesale and retail inventories being reported in 30 minutes so we will see what kind of numbers we get.

Well let’s get this day going!

ZION looks pretty cheap at 26.50 ;I bot some today; 6% dividend too

hasn’t been this low since 2020!

I grabbed some First Bancorp (FBP) yesterday after they beat earnings estimates and it had a nice pop this morning…also pays an ~5% dividend. Not a long term position, just playing the oversold bounce.

FIBK is another one to consider – paying 7% dividend on the common and reported after the close today.

Hmm, I guess people didn’t like that report – FIBK common down 4%, yielding 7.5% 🙂

Not unsurprisingly I got a notice of call @ Fidelity on 3133ENX21 FEDERAL FARM CR BKS BOND 6.44000% 11/01/2032 To be called 5/1, the first available call date… Issue dated 10/25/22… So my exciting trade for the day is to replace this with 3133EPHA6 FEDERAL FARM CR BKS BOND 5.80% 4/28/31 CA 7/28/23 with expectation I’m buying a 3 month piece of paper. Settlement date = 4/28/23

2whiteroses;

I expect that may be the case this coming November for these two I own, but hey, when I bought them I just looked it at like a great rate for a couple of 1 year CD’s 🙂

3133EN3C2 FFCB 6.1%32 DUE 11/29/32

3133EN2D1 FFCB 6.375%32 DUE 11/15/32

Yep I’ve got 3133EPCP8 FEDERAL FARM CR BKS BOND6.54% 3/8/2034 which is callable June 8… no questioning its fate. My ladder assumed it would be called.

Does vanguard give notice of call anywhere? Mine just get called away but I would love to know in advance.

Irish, all call alerts should be in your Vanguard mailbox/message center

AZ – Did you get your ENBA interest as you anticipated? I didn’t @ TDA but have been taking the Grid be patient approach – at least for now………

2WR – I received my ENBA interest/dividend payout at Fidelity on 4-25

2WR, yes I received my distributor for ENBA at Vanguard yesterday. You have not?

I received mine at Etrade on Tue as well.

Still no interest on ENBA applied to my account at TDA. And of course they say in email the following [in other words it’s not our fault despite the fact that other brokerages have paid out what’s due and we haven’t]

” The full call only affected cusip 29250N477 (ticker symbol ENBA). Again we have yet to receive any information from Enbridge about interest being due at the time of the full call. If we do receive interest from Enbridge we will issue the interest in your account. Please contact Enbridge if you have any questions or concerns:

Media

Investment Community

Jesse Semko

Rebecca Morley

Toll Free: (888) 992-0997

Toll Free: (800) 481-2804

Email: media@enbridge.com

Email: investor.relations@enbridge.com

If you have any questions, please reply to this email or call the Reorganization Department at 888-723-8504, option 1″

Just to close the door on this matter, TDA applied the interest on ENBA to my account very late in the day yesterday.

Well at least the farmers are doing well.