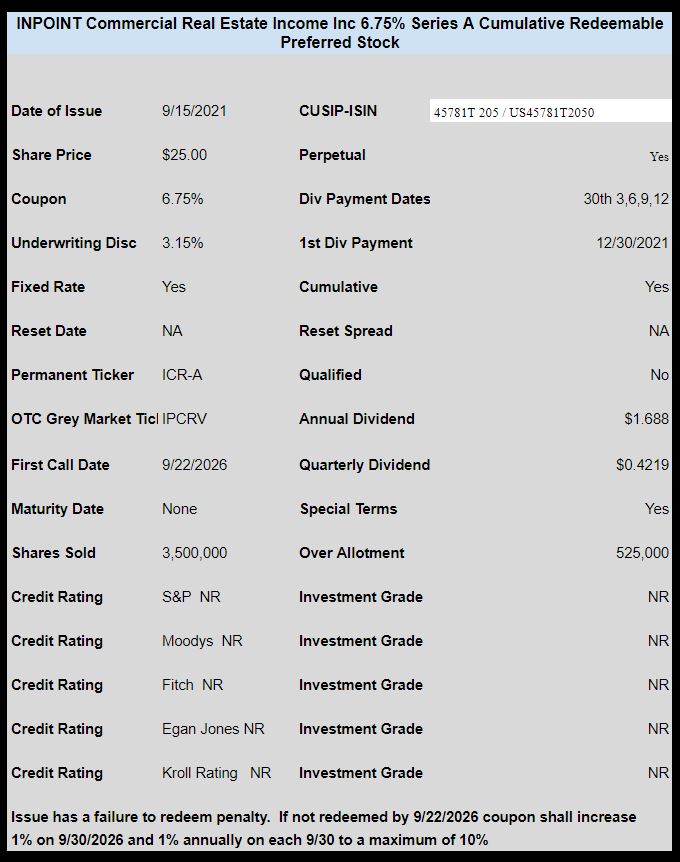

INPOINT Commercial Real Estate Income (not publicly traded) has priced the previously announced preferred stock.

The issue prices at 6.75%, is cumulative and non qualified.

The issue does have a 1% failure to redeem clause which kicks in on 9/30/2026 and 1% more each 9/30 to a maximum of 10%. So 9/30/2027 rate is 7.75%, 9/30/2028 8.75% etc.

The issue trades immediately under OTC grey market ticker of IPCRV.

The pricing term sheet can be read here.

I’m driving myself nuts on this one – https://www.sec.gov/Archives/edgar/data/0001690012/000119312521275129/d234241d424b1.htm is the 9/16 425b1 prospectus…. It has language talking about a “Downgrade Event” but I sure can’t find a definition of what that is OR WHO RATES THIS ISSUE??? I don’t see it here, but the language is,

If either (i) the Applicable Ratings Agency (as defined herein) downgrades the credit rating assigned to the Series A Preferred Stock to below Investment Grade (as defined herein), or (ii) in the case where there is only one Ratings Agency (as defined herein) rating the Series A Preferred Stock, such Ratings Agency ceases to rate the Series A Preferred Stock or fails to make a rating of the Series A Preferred Stock publicly available (each of the events described in clauses (i) and (ii) being a “Downgrade Event”), we will thereafter accrue cumulative cash dividends on each then-outstanding share of Series A Preferred Stock at a rate equal to (a) the dividend rate in effect immediately prior to the Downgrade Event, plus (b) 0.25% of the liquidation preference per annum, subject to a maximum annual dividend rate of 10.00% while the Series A Preferred Stock remains outstanding (the “Maximum Rate”). If, subsequent to the occurrence of a Downgrade Event that results in an increase in the dividend rate in effect immediately prior to such Downgrade Event, the Applicable Rating Agency subsequently increases its rating of the Series A Preferred Stock to Investment Grade or an Applicable Rating Agency subsequently issues an initial rating of the Series A Preferred Stock at Investment Grade (each such event, an “Upgrade Event”), we will thereafter accrue cumulative cash dividends on each then-outstanding share of Series A Preferred Stock at a rate equal to (a) the dividend rate in effect immediately prior to the Upgrade Event, minus (b) 0.25% of the liquidation preference per annum; provided, however, that in no event will we accrue cash dividends at a rate lower than the Initial Rate.

Am I once again being sloppy??? Has anyone found the definitions or ratings?

“Ratings Agency” means a “nationally recognized statistical ratings organization” (as defined in Section 3(a)(62) of the Exchange Act).

“Applicable Ratings Agency” means one of the following Rating Agencies at any given time: (i) in the case that there is only one Rating Agency rating the Series A Preferred Stock, such Rating Agency, (ii) in the case that there are two Rating Agencies rating the Series A Preferred Stock, such Rating Agency providing the lower rating, or (iii) in the case that there are three or more Rating Agencies rating the Series A Preferred Stock, such Rating Agency providing the second lowest rating.

So you go to the Exchange Act and then find section 62, I’m guessing:

(62) Nationally recognized statistical rating organization.—The term “nationally recognized statistical rating organization” means a credit rating agency that—

(A) issues credit ratings certified by qualified institutional buyers, in accordance with section 78o–7(a)(1)(B)(ix) of this title, with respect to—

(i) financial institutions, brokers, or dealers;

(ii) insurance companies;

(iii) corporate issuers;

(iv) issuers of asset-backed securities (as that term is defined in section 1101(c) of part 229 of title 17, Code of Federal Regulations, as in effect on September 29, 2006);

(v) issuers of government securities, municipal securities, or securities issued by a foreign government; or

(vi) a combination of one or more categories of obligors described in any of clauses (i) through (v); and

Thanks, A4I – that’s the boilerplate definitions, but how do you apply it to the provision in the prospectus that adjusts the coupon rate if a “Downgrade Event” occurs if there’s no indication of which agency rates it? There’s even talk of and definitions of “Investment Grade” but who’s rating this IG or anything else to start with? Downgraded from what by whom?

I haven’t been able to find any mention on their website or materials of any ratings agency involvement. No AMBEST, No EJones, etc. Maybe you should try emailing their IR folks?

It is a mystery… I of course emailed IR… It took a while to find a contact since they are not publicly traded but I think I found her…. will post if I receive an answer.

“The issue does have a 1% failure to redeem clause which kicks in on 9/30/2026 and 1% more each 9/30 to a maximum of 10%. So 9/30/2027 rate is 7.75%, 9/30/2028 8.75% etc.”

Under normal conditions, shouldn’t this make it trade somewhat like a preferred which is to be redeemed on 9/30/26?

Thanks a lot.

D.

David – Most of the failure to redeem clauses I’ve seen seem to be more draconian than this one so that adds a little iffiness to your idea, but I’d agree, it certainly makes it more likely, assuming a stable environment for both interest rates and this company. At the very least I suppose you could say this will act as a cushion to any potential changes to the upside on interest rates in the next 5 years.

Grey market symbols do not show public quotations. same as rule 15c2-11

Fidelity and TDAmeritrade show 165,000 shares traded but still no bid, ask, or last?

Same on eTrade C. Malcolm.