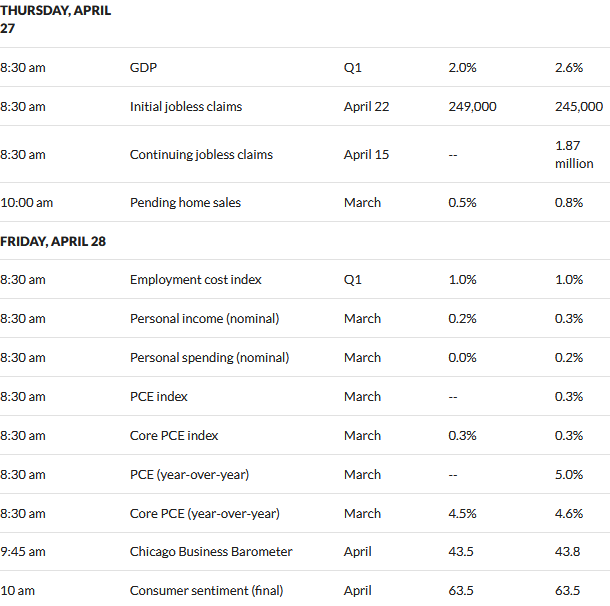

We have the 1st read on GDP in about an hour–the forecast is for a 2% growth rate–the growth rate last quarter was 2.6%. This number could move interest rates a bit–but with the 10 year treasury now at 3.43% can a slowing economy move this much lower? Or maybe we get a super surprise on the strong side we could launch rates higher. Regardless after these numbers we will have the personal consumption expenditures (PCE) being released tomorrow and I expect the 25 basis point rate hike for next Wednesday will be confirmed barring a major surprise.

Since it is Thursday we have 1st time unemployment claims being released at 7:30 a.m. (central). It’s funny how what used to be somewhat of a throwaway number has become very closely watched–I guess that’s what happens when your Fed chair, and really all the Fed officials, continually hint that they want employment to slow. Today we have a forecast number of 249,000 claims which is heading in the upward direction, but far from being super soft.

Earnings continued to be released yesterday and the driver of higher equity prices this morning are earnings from META (Facebook)–I guess they were pretty good (at least markets think so) as shares are zooming higher–up $23/share at 5:30 a.m. Tonight we have Amazon and Intel reporting so we will see equity reaction to those numbers.

I continue to be somewhat fixated on the regional/community banks. The earnings reported by the smaller banks have been ‘ok’ and on the surface (and in normal times) one would jump on more of the 8% current yields from their preferred issues. BUT you still need to ponder ‘bank runs’. I can’t quite figure out how a bank can avoid a run – folks will react before they know facts which seems silly, but it is what it is. Maybe the answer is simply to buy a basket of these preferreds keeping the total exposure equal to a normal full position. No rush on this decision since this problem will be with us for some time to come.

So I expect to do nothing investment wise today (buying/selling), but I will nail down a decision on a lodging REIT preferred to buy. Hersha Hospitality (HT) and Pebblebrook (PEB) reported earnings last night–not that pretty. Right now I have either Pebblebrook (PEB) or RLJ Lodging (RLJ) preferreds in my sights – maybe both. Remember if you wait for the company’s to be firing on all cylinders their preferreds will no longer be ‘bargains’.

So we can get 7% on several good preferreds, versus 4.9 on a treasury. Risk a lot to get 2% more? Besides interest rate risk, there are questions about how each issuer will deal with libor floats. I’m even concerned the biggest, best issues may claim stress and rates forced them to pay hard ball.

And…. If the markets keep rising the fed will increase rates.

True if your plan is to hold forever. If you retain the option of selling at an approppriate time then the odds are better.

I remember buying a Hersha preferred during 2020 lockdown. Got it for $2.67 I believe. Didn’t have enough change in the brokerage account to make much of a dent to bring down my $24.00 avg tho…

Definition of Stagflation…1.1% first qtr GDP g and a PCE of 4.2% vs 3.7% est.

Slowing growth and stubborn inflation = tough environment for risk assets.

Well, its that sometimes rather thin range between survivability and death that gives the greatest bargains. I’m thinking hotels are in for a rude awakening.

RLJ preferred I consider almost a buy and hold forever due to its noncallable nature . RLJ, I’ve seen in the past run their business decently during recessions.

Sotherly has done well with the accrued dividend they have to pay out.

Others seem to have better opportunities as hotel revenue should get worse over the next few quarters, at least. If summer data looks weak…..