8:30 p.m. Central Sunday Evening

It is too early to know how markets will trade tomorrow, except we all know that this is one of those times we could see huge swings–up and down. Easily we could move in a 1000 point range on the DJIA.

We can be certain that regulators will close more banking company’s – who that will be is unknown of course. In my opinion every bank is at risk–because of old fashioned bank runs–actually not old fashioned because all I need to move money is a computer. Money moves fast.

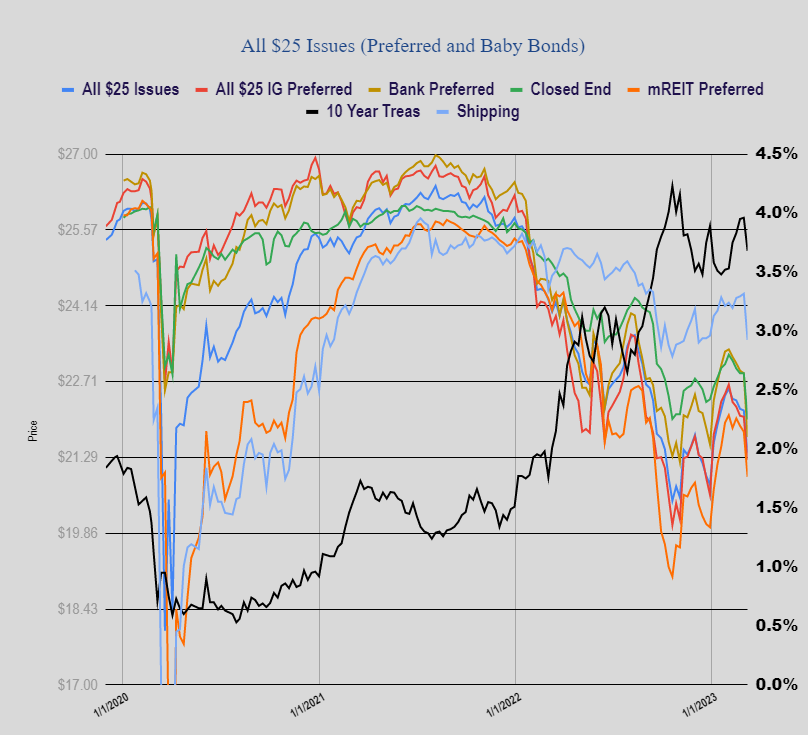

As I understand it the U.S. Treasury will be backstopping deposits that are beyond the typical $250,000 account limit thus reducing reasons depositors would want to flee an institution–but depositors will do what they want to do. Banks, much like insurance company’s, are holding lots and lots of bonds and other fixed income securities many have very large losses on their portfolios. Now this is a manageable situation–if you look at Silicon Valley Banks financials on 12/31/2022 they were rock solid. Their capital position was stellar and way, way above required levels, but none of this means anything if capital starts to ‘flee’. Sales of securities are necessary to meet customer demand–thus requiring the bank to book a loss–and then it snowballs when folks like Billionaire Peter Thiel begin withdrawing funds and recommending to others they do the same.

From what I can see this all unraveled very quickly, BUT certainly bank officials and their regulators knew days in advance there was potential for the unraveling. During the weekend I found numerous ‘lists’ of banks with large portfolio losses published on line by various sources–these lists are NOT helpful at this time. I did note that Customer Bancorp (CUBI) made the lists–I hold 2 of their preferred issues at this time and don’t plan to sell them as they are modest positions and I believe they are money good–as are most banking issues.

So from what I can see NOW S&P500 futures are UP 1.3%, but there are 11.5 hours until markets open and so much can change. We know the markets will be wild–with news hitting the wire continually. ‘Rumors’ will be hitting the newswires – whispers of this bank or that bank being in trouble.

I am unlikely to be a buyer. I think there are likely deals out there NOW–but I am a low risk person and by and large leave the ‘hero’ role to others–but you never know, because I don’t know where the reward warrants the risk.

So folks always have to do what they have to do – some will panic, some will exit the market with large losses only to see shares bounce back sharply in a week or two. Some will reinstate their ‘mayonnaise jar’and bury their stash in the backyard. There will be the brave who step in front of the falling knife and buy, buy buy. Others like me will mainly ‘watch’ and see if this thing gets sorted out quickly.

Buckle up!!