Small Texas Banker Triumph Bancorp (TBK) is selling a new fixed rate non cumulative preferred

The issue will be non-cumulative, qualified and optionally redeemable starting 6/30/2025.

The company also released a presentation which can be read here.

Our site runs on donations to keep it running for free. Please consider donating if you enjoy your experience here!

Small Texas Banker Triumph Bancorp (TBK) is selling a new fixed rate non cumulative preferred

The issue will be non-cumulative, qualified and optionally redeemable starting 6/30/2025.

The company also released a presentation which can be read here.

Office REIT Office Properties Income Trust will be offering some baby bonds with a maturity in 2050.

The ticker will be OPINL and the baby bonds will trade on NASDAQ. The issue will not trade on the OTC grey market, but you might be able to secure notes before exchange trading by calling your broker.

I did a quick look at the offering and don’t find anything unusual–quarterly interest payments, optionally redeemable starting in 2025 and a maturity date in 2050.

The preliminary prospectus can be read here.

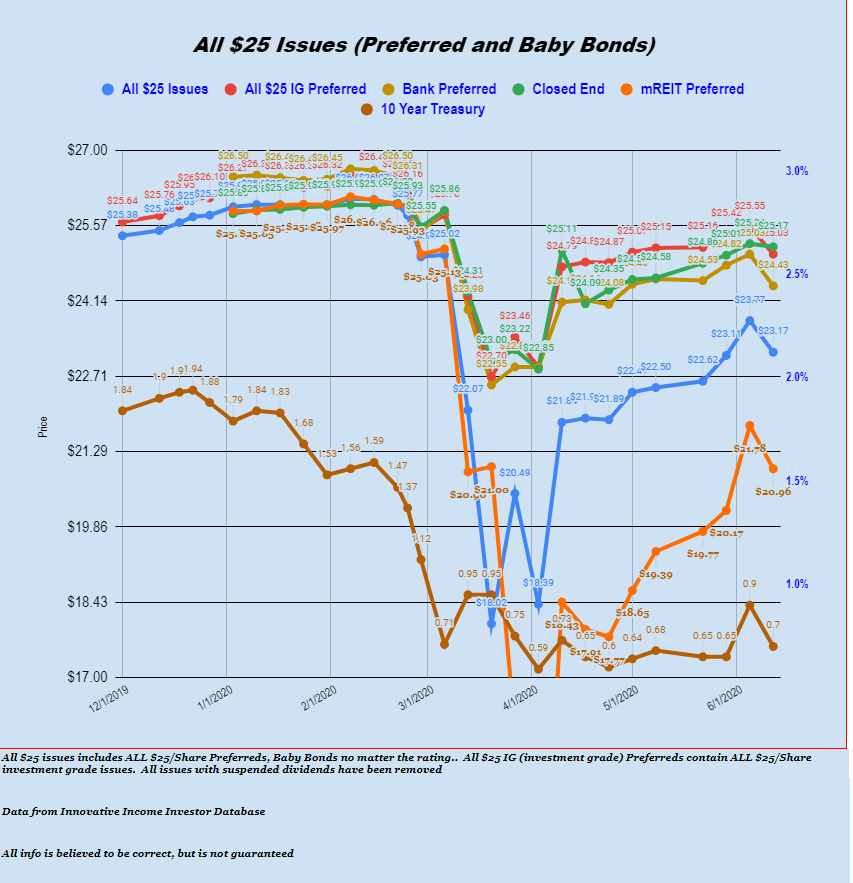

The S&P500 traded in a range of 2984 to 3233 last week before closing at 3041 which is a loss of about 5% on the week.

The 10 year treasury traded in a range of .65% to .92% before closing the week at .70%

The Fed balance sheet grew by only $4 billion last week–certainly the smallest rise in months.

The average $25/share baby bond and preferred stock fell by over 2% last week. Bank issues fell by 3%, utility issues by just over 2%, lodging REIT preferreds by 6%. This was the 1st losing week since back in early April.

Last week we had 3 new income issues announced.

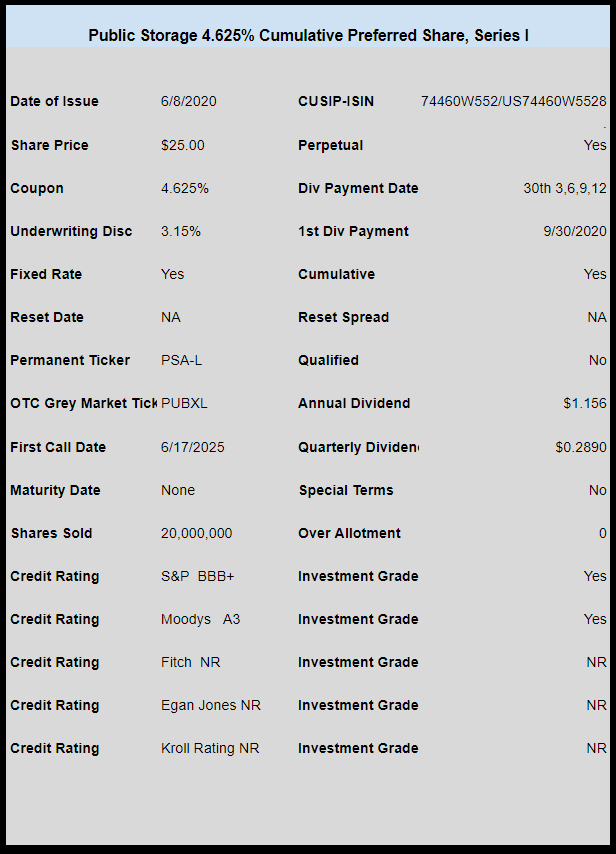

We started off the week with self storage giant Public Storage (PSA) announcing a new perpetual. The new 4.625% coupon issue is trading under temporary ticker PUBXL now last traded at $24.50. They have called the 5.375% PSA-V issue with the proceeds of the new offering.

Associated Banc-corp (ASB) announced a new non-cumulative preferred issue with a 5.625% coupon. The issue is trading under OTC grey market ticker ABBCL and last traded at $24.67.

Lastly annuity provider American Equity Investment (AEL) announced a new non cumulative perpetual preferred that is a fixed-rate reset issue (reset every 5 years). The issue is trading under temporary ticker AEIHL and last traded at $24.56.

Not a surprise to most of us here to see the DJIA off about 2,000 points this week–easy come, easy go.

We are back to a realization that the economy pretty much sucks–of course it does. The question is always what it will do in a few quarters?

Companies stepping forward and talking about the future–in a realistic way, are bringing share prices back to earth.

The airlines as well as the cruise lines have traded at silly prices–no matter the bounce back in traffic–a doubling from near nothing is still pretty much nothing. Delta (DAL) today said they were looking to renegotiate credit terms with dire implications if they were unable to do so.

Royal Caribbean Cruises (RCL) traded to $75 just a few days ago–up from $22 a month ago!! RCL has no business–today, next month and maybe a few months from now. RCL is carrying a $12 billion market cap–with no business—WTH.

These companies are again need to go to the debt market and their credit ratings are being lowered–i.e. they are screwed if this recovery doesn’t come off perfect.

In the markets we care about–preferreds and baby bonds we are seeing more red than we have for months. The air is being let out of many of the junkier issues. You can see the losers here.

All the crap issues such as the Ashford Hospitality preferred are off significantly. The AHT preferreds are off 25% TODAY. Almost all the lodging REIT preferreds are getting the wood put to them. This is true of the mREIT preferreds as well.

I am not buying–just watching the ride down. Believe it or not there are only about 20 gainers out of near 500 preferred shares today. Even the utility preferreds and baby bonds are off 1-3%.

Will there be even better bargains ahead for income investors? Everyone has an opinion–none of us know for sure.

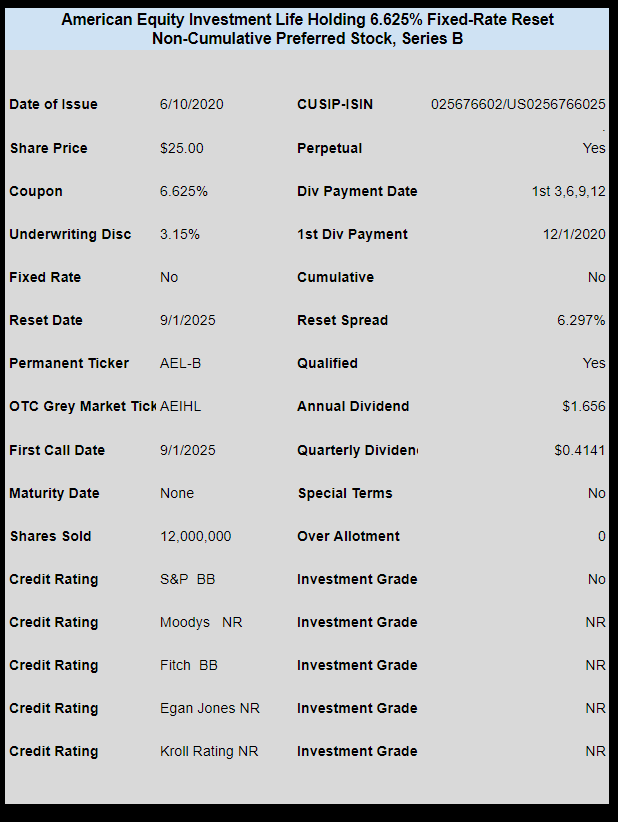

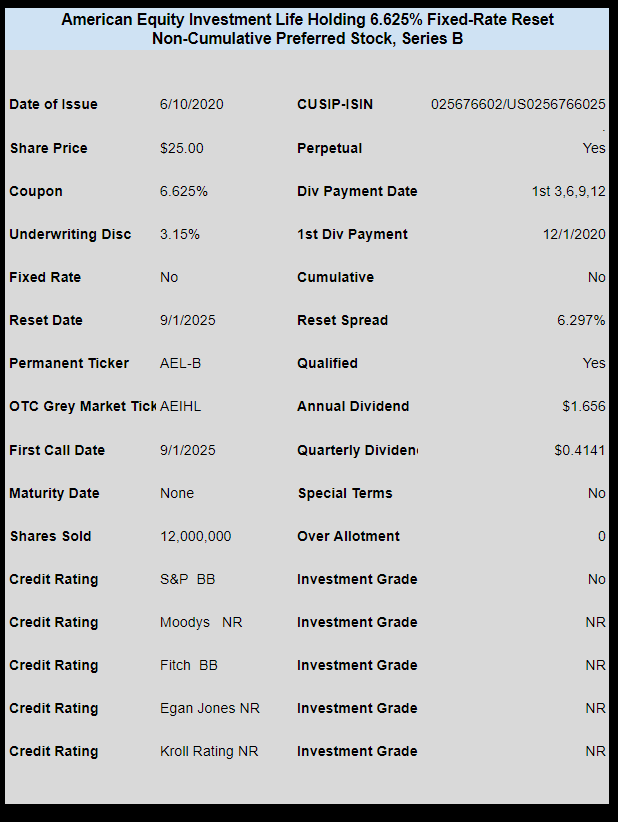

Annuity provider American Equity Investment Life (AEL) has priced their new fixed-rate reset perpetual preferred with a fairly tasty initial coupon of 6.625%.

More importantly the issue, which will have the 1st coupon reset on 9/1/2025 has a ‘spread’ of the reset at 6.297%. The spread will be added to the 5 year treasury every 5 years to ‘reset’ the coupon.

This issue is non-cumulative, qualified, and NOT investment grade.

The issue will trade immediately on the OTC grey market under ticker AEIHL