BDC Great Elm Capital Corporation (GECC) has priced their new issue of baby bonds with a coupon of 8.75%.

The pricing term sheet is here.

Further detail to come.

Our site runs on donations to keep it running for free. Please consider donating if you enjoy your experience here!

BDC Great Elm Capital Corporation (GECC) has priced their new issue of baby bonds with a coupon of 8.75%.

The pricing term sheet is here.

Further detail to come.

Early yesterday I sold 2 of my small bank positions.

I sold the Heartland Financial 7% Fixed Rate Reset preferred (HTLF-P) at $24.30. Including dividends I had a total return around 8%.

I sold the CNB Financial 7.125% fixed rate preferred (CCNEP). I held this for a very short time and realized a 4% gain–no dividends received.

My logic here is simply to raise a little cash by selling a few issues which I believe will present another buying opportunity in the months ahead. Moodys is pounding on the banks and there are predictions everywhere of issues with the banks. While this may all be BS in the short term there could be (is) some pain.

I was fortunate in my timing on Tuesday because my GTC orders executed early in the day as banking issues got beaten later in the day. Numerous issues which I hold have given up 50% of my gains, although 100% of them remain in the green–although some only 1-2% (plus dividends).

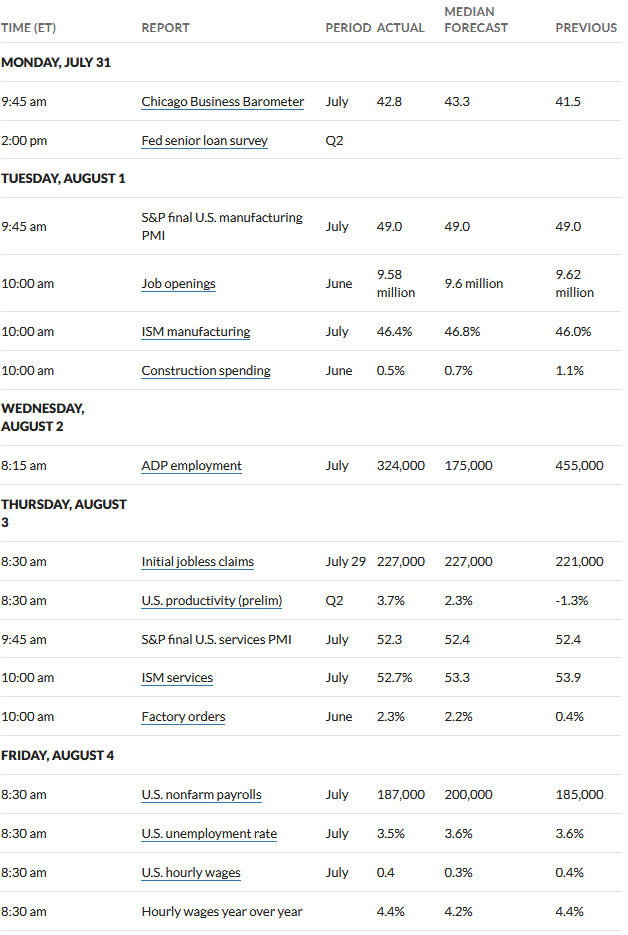

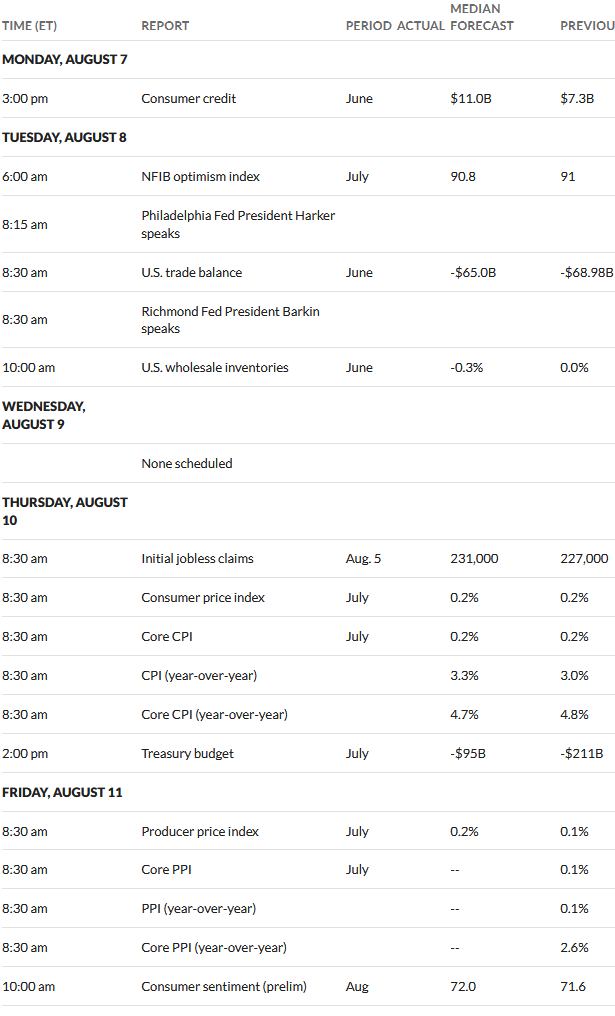

Equities are quiet this morning as we await the next piece of economic news which is the consumer price index which is released tomorrow. Forecasts are for a CPI up .2%. Year over year forecast is 3.3% which would be up from last month—core is forecast for up 4.7% year over year. Certainly we could see a number that is a few 1/10ths higher or lower–and either one would likely drive markets substantially. We are now in the ‘data’ gathering period in the run-up to the next FOMC meeting which 5 weeks or so out (September 19-20).

Interest rates seem to be awaiting the CPI as well as the 10 year yield is trading at 4.03% which is virtually unchanged from yesterday–we’ll see what the end of the week brings as we get these inflation gauges.

Earnings season is coming to an end and there weren’t many massive downside surprises that I saw – in particular in the banking sector. Most banks reported softer quarterly numbers but generally I didn’t see massive provisions for losses related to commercial real estate. I think that folks have been looking for these provisions BUT these things take years to play out–not months. The worrys as I understand it is for refinancings that will occur between 2023-2028. I have no idea whatsoever why 2027-2028 matters–I have not seen 1 single ‘forecaster’ who can reliably forecast interest rates for next month let alone 4-5 years out. Most certainly we will see some issues in the next year or two, but to forecast beyond the short term is simply foolhardy.

Almost nightly (Monday through Thursday) I post some interesting ‘news’ for investors in preferreds and baby bonds in the ‘Headlines of Interest’. This is a summary laundry list from a quick scan of the news release services–I try to catch most everything related to companys which have exchange traded income securities outstanding. If you aren’t taking a minute to scan these headlines you may be missing some important news items that could lead to great ideas for investing.

Early yesterday I sold 2 of my bank holdings–locking down respectable capital gains (although only 50% of what they would have been last week). I will write a little blurb this morning yet on my logic.

Below are press releases from companys with preferred stock or baby bonds outstanding – or just of general interest.

I have added in some earnings reports from some smaller banks to get a ‘flavor’ of where they stand relative to commercial real estate loans.

Oaktree Specialty Lending Corporation Prices Public Offering of $300,000,000 7.100% Notes due 2029

UMH PROPERTIES, INC. REPORTS RESULTS FOR THE SECOND QUARTER ENDED JUNE 30, 2023

GAMCO Investors, Inc. Reports Results for the Second Quarter 2023

Runway Growth Finance Corp. Reports Second Quarter 2023 Financial Results

Synchronoss Technologies Reports Second Quarter 2023 Results

Franchise Group, Inc. Announces Second Quarter Fiscal Year 2023 Financial Results

Conifer Holdings, Inc. Announces Closing of Exchange Offer

Assured Guaranty Ltd. Reports Results for Second Quarter 2023

Babcock & Wilcox Enterprises Reports Second Quarter 2023 Results

Jackson Announces Second Quarter 2023 Results

Maiden Holdings, Ltd. Releases Second Quarter 2023 Financial Results

Moody’s has downgraded a number of banks–once again on the worries about commercial real estate. Obviously this is not a new worry, but it continues to help put a lid on banking preferred stock price increases. I had very healthy capital gains in most all of my banking issues, but some of that gain has melted away–it it probably a good time to cut back some of these issues preserving decent, although reduced, gains. If you want to see the huge number of downgrades by Moody’s you can scroll through them here.

Equity futures are showing losses this morning with the S&P500 off about 3/4%–at the same time interest rates (the 10 year treasury) are back down to the 4% area – are they headed back to under 4%? We have big treasury auctions yet this week which may pressure rates-but honestly no one knows for sure so we just play the hand we are dealt.

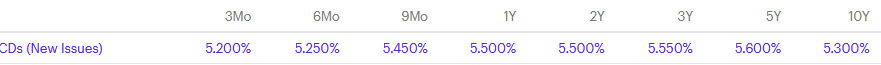

I continue to watch CD rates and we have seen no ‘bump’ higher in rates since the last Fed Funds rate hike last week. I was hoping, based on history, that we would get up to 5.6 or 5.7% which would have made decisions easier as my CDs and Treasuries mature–I would take plenty at 5.7% for sure.

It looks like we have seen a short term peak in oil prices (west texas) around $80–I sure hope so since the last few trips to the gas station have been getting progressively more painful. I am paying $3.89 for unleaded in Minnesota –that high enough.

Well let’s get this show rolling and see if stocks can bounce up from a lower opening–there is a lot of FOMO out there and each time we have a small setback in prices buyers come in and drive prices higher.

Business development company Great Elm Capital (GECC) has announced a new issue of baby bonds.

The company intends to use the proceeds to redeem their 6.50% baby bonds (GECCN) which has a maturity in 2024.

The registration statement for the new issue is here. The new issue, which has not priced, will trade under the ticker GECCZ and will have a maturity date in 2028.

Below are press releases from companys with preferred stock or baby bonds outstanding – or just of general interest.

I have added in some earnings reports from some smaller banks to get a ‘flavor’ of where they stand relative to commercial real estate loans.

Ready Capital Corporation Reports Second Quarter 2023 Results

Johnny Rockets Announces Twenty New Texas Locations

Tellurian Reports Second Quarter 2023 Results

Diversified Healthcare Trust Sends Letter to Shareholders Outlining Robust Process to Maximize Value

AG Mortgage Investment Trust, Inc. Reports Second Quarter 2023 Results

KKR & Co. Inc. Reports Second Quarter 2023 Results

Spirit Realty Capital, Inc. Announces Second Quarter of 2023 Financial and Operating Results

Kemper Reports Second Quarter 2023 Operating Results

Kemper Announces Exit from Preferred Home and Auto Business

National Storage Affiliates Trust Reports Second Quarter 2023 Results

Great Elm Capital Corp. Announces Public Offering of Unsecured Notes

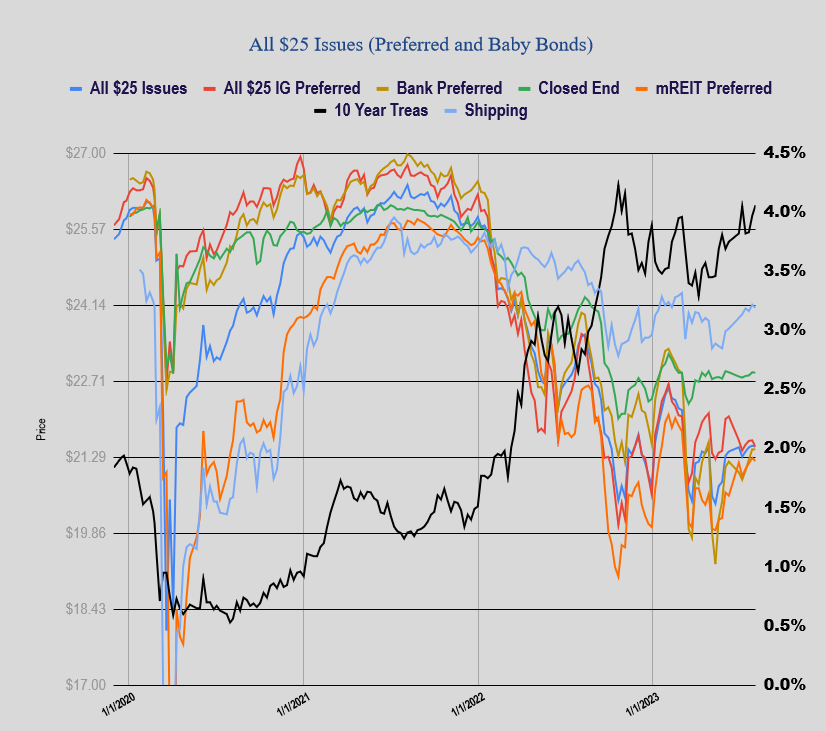

It has been rare in the last few months, but last week the S&P500 fell. The Friday close was 4478 which was 104 points lower (-2.3%) than the previous Friday. The Fitch downgrade of U.S. debt gets the blame for the tumble as investors needed to find a reason to lock down some gains.

The 10 year treasury yield rose sharply to close the week at 4.06%, but had been as high as 4.20% earlier Friday. Rates moved off the high as the number of jobs created for July came in lower than the forecast – wages continue to grow at a high rate at +4.4% year over year.

This week we have plenty of economic news with the consumer price index (CPI) and producer prices (PPI) being announced on Thursday and Friday. These have been relatively tame as of late–can it continue?

The Federal Reserve balance sheet assets fell by $37 billion – still at $8.2 trillion. I guess falling is better than rising, but the best thing one can say is that we are building potential balance sheet powder for the next black swan event–whatever and whenever that occurs.

Talk about flat markets—the average $25/share preferred and baby bond was off 3 cents last week—so in the last month the average share has moved in a 10 cent range. Investment grade issues were off 12 cents–banks were dead flat, mREIT preferreds were off 6 cents and CEF preferreds were off 1 cent. Pretty tight trading considering the movements in interest rates.

Last week we had no new income issues price.

Below are press releases from companys with preferred stock or baby bonds outstanding – or just of general interest.

I have added in some earnings reports from some smaller banks to get a ‘flavor’ of where they stand relative to commercial real estate loans.

FAT BRANDS INC. REPORTS SECOND QUARTER 2023 FINANCIAL RESULTS

Global Ship Lease Reports Results for the Second Quarter of 2023

Brookfield Infrastructure Reports Second Quarter 2023 Results

Apollo Reports Second Quarter 2023 Results

Great Elm Capital Corp. Announces Second Quarter 2023 Financial Results

Armada Hoffler Reports Second Quarter 2023 Results

RLJ Lodging Trust Reports Second Quarter 2023 Results

OFS Capital Corporation Announces Second Quarter 2023 Financial Results

Cherry Hill Mortgage Investment Corporation Announces Second Quarter 2023 Results

Hercules Capital Reports Second Quarter 2023 Financial Results

Great Ajax Corp. Announces Results for the Quarter Ended June 30, 2023

Air Lease Corporation Announces Second Quarter 2023 Results

MFA Financial, Inc. Announces Second Quarter 2023 Financial Results

CHIMERA INVESTMENT CORPORATION REPORTS 2ND QUARTER 2023 EARNINGS

Chimera Declares Third Quarter 2023 Common and Preferred Stock Dividends

NuStar Energy L.P. Reports Solid Second Quarter 2023 Earnings Results

The 10 year treasury yield is trading at 4.19% right now and close to the highest level in about 15 years–up 11 basis points today.

Income securities are taking a bit of a knock, although not severe–nickels and dimes. Unfortunately those nickels and dimes turn into real money after a few days – of course I am talking my book – I don’t like ‘red’ which is what I am seeing all week.

As mentioned on Monday (I think) I had 2 GTC sell orders in on a couple of my banking preferreds – but with a greedy sell price they have not executed and don’t think they will anytime soon given interest rates, but with these thinly traded issues one never knows when they will sell – maybe someone puts a market order in and takes them off your hands.

I did enter a GTC BUY order for the SiriusPoint 8% Resettable preferred (SPNT-A). It is trading firmly at $24.92 so of course my buy order is below that price – once again I am waiting for someone to dump a few shares and fill my order 15-20 cents below current levels–probably penny wise and pound foolish, but this one isn’t going anywhere soon–if ever.

I see that JPMorgan is hanging a 5.60% 5 year CD out there – unfortunately it is callable in 1 year – but just the same not a bad coupon.

Here is what I am showing on eTrade right now.