The 10 year treasury yield is trading at 4.19% right now and close to the highest level in about 15 years–up 11 basis points today.

Income securities are taking a bit of a knock, although not severe–nickels and dimes. Unfortunately those nickels and dimes turn into real money after a few days – of course I am talking my book – I don’t like ‘red’ which is what I am seeing all week.

As mentioned on Monday (I think) I had 2 GTC sell orders in on a couple of my banking preferreds – but with a greedy sell price they have not executed and don’t think they will anytime soon given interest rates, but with these thinly traded issues one never knows when they will sell – maybe someone puts a market order in and takes them off your hands.

I did enter a GTC BUY order for the SiriusPoint 8% Resettable preferred (SPNT-A). It is trading firmly at $24.92 so of course my buy order is below that price – once again I am waiting for someone to dump a few shares and fill my order 15-20 cents below current levels–probably penny wise and pound foolish, but this one isn’t going anywhere soon–if ever.

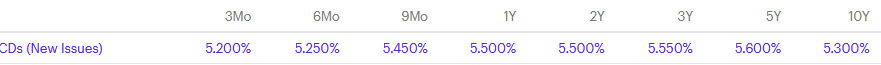

I see that JPMorgan is hanging a 5.60% 5 year CD out there – unfortunately it is callable in 1 year – but just the same not a bad coupon.

Here is what I am showing on eTrade right now.

Federal Farm Cr Banks 6.29% due 8/9/38 = a new issue out now with a 1 year continuous call…. CUSIP 3133EPSU0. Pays semi-annually.. AAA/AA+ A 1 year call seems longer than usual for their most recent similar maturity/coupon issues

SPNT-B going ex-div on the 14th. Dividend capture has been spotty lately but may still be a factor for something you want to buy anyway.

Just took a Treasury with 2% coupon and maturity out to 4/30/24 for a YTM/YTW yield of 5.33%. Unlike the CDs spread out there at ~5.5%, the treasuries are not callable. The fact that the CDs are callable (many of them) just irks me to no end – you have to take lower interest if you want non-callable.

Isn’t that SPNT-B?

I really find it bordering “dishonest” for JPM to put out there 5 year CD rates which are callable in one year (many of their other term CD’s are also callable). These are free (or inexpensive) options which can only work against buyers.

Yesterday through Fidelity I picked up some of the JPMorgan 13 month CD’s at 5.55%. I am very pleased with that. Would not surprise me to see 5.75% on some offerings pretty soon.

It looks like these CDs have a call option beginning 2/8/24.

Yes they do. I view it as a 6 month CD at 5.55%.