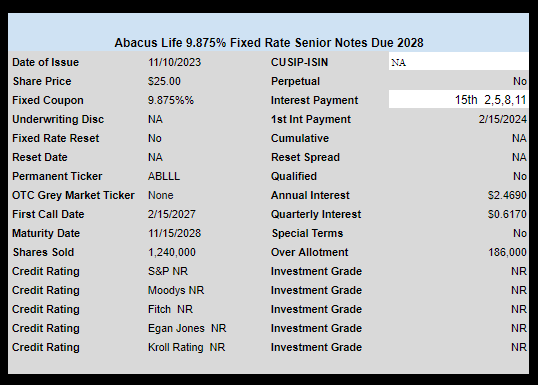

Specialty asset manager Abacus Life (ABL) has sold a new issue of high yield baby bonds. This issue was overlooked by me, but 2whiteroses pointed it out. Officially these shares were sold on 11/10/2023, but only registered a few days ago.

The issue has a coupon of 9.875%. It is unrated.

The issue is currently trading under ticker ABLLL and the last price was $24.26.

This is not your typical insurance company – actually they ‘provide liquidity to life insurance policy owners’ – i.e. they buy life insurance policies from folks at a discount (as I understand it from a quick skim) Very interesting.

Here is more data from their website.

My 3 favorite metrics, from the balance sheet:

– Shareholder equity: $166MM

– Goodwill: $140MM

– Intangible Assets: $31MM

no trading in abill for past hour ? any reason for that ; had an order in at 24.90 since then

ok now ; finally got a trade

I know very little about this company besides a quick read online about it which barely registered in my head. There has to be a reason the market wants almost 10% to borrow them money. I just cannot get excited about this situation because I am worried a year or two down the road they will mess up. The company seems overly complicated.

https://seekingalpha.com/filing/8028965 (search for “owl rock” and then keep reading.. definitely a mess for a normal person to understand easily).

Who will actually end up smiling at the end of this venture? SPV? CEO? Investors who borrowed money which has restrictions and guarantees to get paid?

I will pass on this. I just do not need a position I have to worry about. I have nothing concrete to say why except a feeling.

fc,

The proceeds of ABLLL are to used to pay off a term loan from Blue Owl, formerly Owl Rock, that was costing Abacus S+7.5%, which would be around 5.37%+7.5% or 12.8% currently. What I’d like to know is why I should lend Abacus money at <10%, if Blue Owl, with their underwriting expertise, were able to exact nearly 12% a year ago. Looking at the current ABL stock price around $7 doesn’t give me confidence that they are a better credit now than they were then at $10.

I think the proceeds of this BB was enough to pay off more then just Blue Owl (I think, could be wrong). So they are obviously trying to lower their interest costs on multiple fronts. There won’t be much left over when said and done. A nickel here and there for general purposes.

My issue is that this company is valued at 400 Million or something based on market cap and they do not really have a plan to just pay back these loans in a more natural fashion? We are not talking big money here. Also revenue of 22 million last quarter I think it was THUS just keep borrowing endlessly. It would be different if they were borrowing at 9% with a plan to make 12% and keep the difference.

Either way I am way over my head with this company. I just see that the CEO will suck out 40 plus million if he can keep the carnival show going just long enough before this stuff matures and able to sell his shares. That is what his stock compensation plan seems to be.

“As of September 30, 2023, unamortized stock-based compensation expense for unvested Restricted Stock relative to the CEO was $41,252,686 with a remaining contractual life of 2.3 years.”

blk you can’t compare the interest rate a BDC is going to charge a Company for money with the rate the Company can get by issuing their own Debt to the public. In the land of the BDC lenders, 12% is probably “cheap” money reserved for those with the safest credit profile .

ted, I think he was trying to say this but in a more polite way. The people who borrowed 12% probably were fully secured, had covenants in place to protect them, yada yada. They are quite careful to protect themselves and GOT 12%.

Now along comes the public who accepts less, unsecured, and in market parlance are the possible chumps?

With that said I have no idea if this company will successfully make all payments and mature on time. Is 9%ish worth that risk? For me personally.. no thanks.

A good example of a company taking the public to the cleaners will probably be TELL and their TELZ BB. Smart money basically told them no or wanted way too much protection. The CEO though seems happy with his salary the whole time.

FC, thanks for the hard work and sharing. I did a quick look and that was enough for me to decide to pass. I saw the comment on SA it was a SPAC company and debuted at 10.00 and has moved down to 7.00

Preferred stock investor had a quick review of this.

He also noted high quality preferred had moved up in Nov and now had an ave discount from par of 6% compared to a 12% discount to par in October. And yield had dropped off to 6.39%

The deals in quality preferred have dried up at least for now and retail investors are left with the junkier issues.

Looks like it’s a $25K minimum to purchase.

Where are you seeing that? Definitely not true at Schwab.

Trading normally at TD. Bid 24.91 / ask 25.05.

Huh. On Fidelity, but only if using the CUSIP provided by Justin (below). Not true if using the ABLLL symbol. (???)

My (2) favorite metrics.

Interest coverage (most recent qtr.)

+16.8x. as of Jun-30-2023….👍

Debt/assets (TTM)

21.07%. as of Jun-30-2023…..👍

Thank-you 2WhiteRoses and Tim

WOW, love that rate. They purchase Life Insurance Policies. Very similar to Coventry’s model.

I know absolutely nothing about this company or it’s ability to pay its baby bonds back. However, I do like this business model. Life insurance done properly is a great asset – unfortunately, many people don’t buy life insurance smartly and are left with policies that may be bad for them but good for an investment firm with a different level of capital or investment time horizon than an individual. Coventry shows some good examples of how they achieve a win/win by creating a secondary market in life insurance. I suspect that with the economic disruption already manifesting itself and likely to get worse, that many people who have life insurance will be needing to restructure and creating awesome opportunities for Coventry and Abacus to buy policies while the seller is under duress. Of course, caveat all that with the fact that I know absolutely nothing about Abacus, so it still may be a bad bet for this opportunity.

CUSIP 00258Y203

ISIN US00258Y2037

Thanks Justin