XAI Octagon Floating Rate & Alternative Income Term Trust (XFLT) has announced the pricing of a new term preferred stock issue.

XFLT is organized as a closed end asset management company and as such is required to maintain an asset coverage ratio of at least 200%.

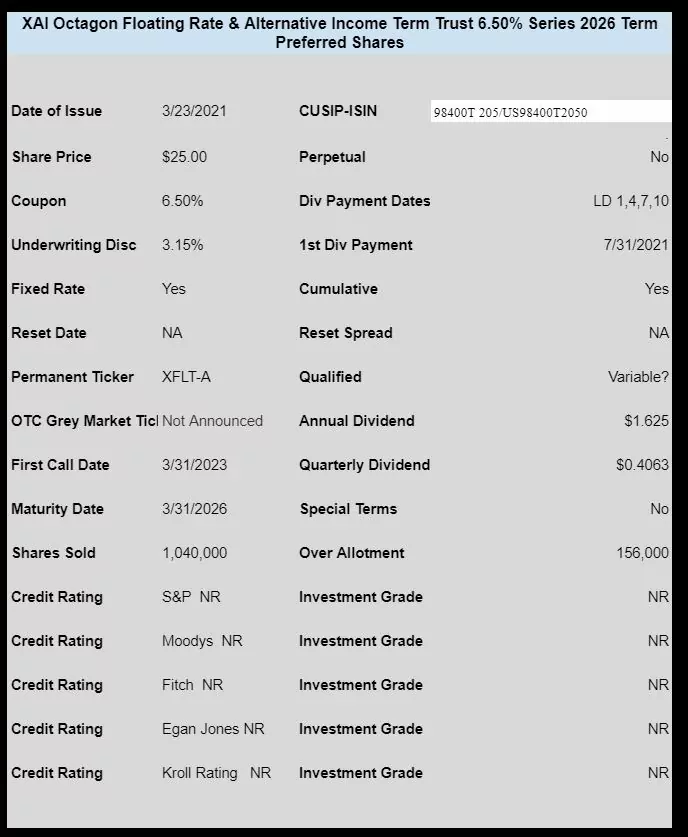

The issue, with a maturity date in 2026, prices with a coupon of 6.50%.

They are selling just 1.04 million shares with another 156,000 for over allotments.

No OTC grey market ticker has been announced and I see no trading in the issue. The shares may skip OTC trading and go straight to the permanent exchange (NYSE).

The pricing term sheet can be found here.

This issue may have been mentioned by readers on this website–I just noticed today when Landlord Investor and Gary mentioned it.

Now trading. I only got a partial fill of 100 shares @ 25.20 before it went up. Now at 25.40 with a 25.50 ask.

Has this one got listed?

XFLT PRA (XAI Octagon Floating Rate & Alternative Income Term Trust) is scheduled to begin trading on Monday April 5, 2021

Jay and Scott, The initial price of $25 par is a target for thios upcoming initial sale and a redemption price upon call or maturity. THe price today (? or next week) will be set by the market asks offered by buyers.

The underlying CEF is a pool of assets that guarantees the preferred issue at a mandatory 200% coverage. The preferred is an entirely seperate issue.

This site has helped me learn alot and it really goes on as long as you invest. So I can echo back to you. Tim, here at III, has managed to help alot of people learn about this thin sliver of the investing world so stay plugged in. Really, you have to do alot of homework; you will learn HOW to fish over time. Good Luck, Study and Skill. Keep Going.

It was very kind of you to explain all of that, Joel.

But I took it as Jay telling a little joke about being issued at over 25 par because even if it were it would not change the coupon and the payments would just be proportionally larger. I can’t speak for Jay, but I already knew the rest.

I do appreciate your looking out for us though. That is the sign of a healthy community.

Thank you Joel and Scott. Yes, having being on Tim’s site for sometime and thanks to well wishers like you I have learnt a bit and also humbly learnt how much I don’t know (Tim, thank you to you too ).

).

I was curious on what a CEF which was apparently doing well issued preferreds at such a rich coupon

A 6.5% for a CEF where the common unit is priced at a premium over NAV? Will it list over 25?

Yeah, I am just waiting for someone to come along and tell us what the catch is.

Scott–a quick peek at their holdings and I see they are similar to Eagle Point or Oxford Lane–a holder of CLO’s so from that perspective the pricing is about right.

I was going to say I bet they hold a lot of CMOs or other riskier investments.

And when I went and looked later it turns out they do.

True. 6.5% is high for an average CEF. It’s not high for one that owns risky assets.