Last week the S&P500 moved in a range of 3887 to 4077 – a range of 190 points, almost a 5% spread. The index closed at 4067 which was a gain of 3.6% on the week.

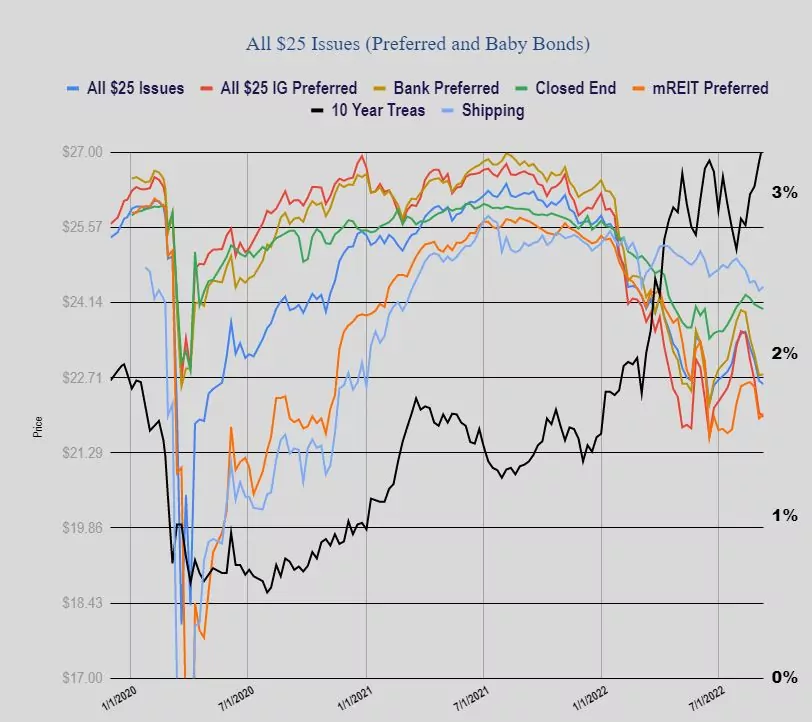

The 10 year treasury moved in a range of 3.21% to 3.35% and closed the week at 3.32% which was 13 basis points higher than the prior week. A little continued stability this week would go a long way.

The Federal Reserve Balance sheet fell by $4 billion. We now have full blown QT (quantitative tightening) in effect at the rate of $95 billion per month so we will watch this ‘experiment’ closely.

The average $25/share preferred stock and baby bond fell by 7 cents last. Investment grade issues fell by 8 cents, bankers rose 2 cents, CEF issues fell 4 cents and mREIT issues moved 9 cents higher. All in all a relatively stable week as interest rates moved 13 basis points higher.

Some other sectors (not charted) moved as follows. Insurance moved 4 cents lower, BDC baby bonds moved 1 penny lower and eREITs moved 12 cents lower.

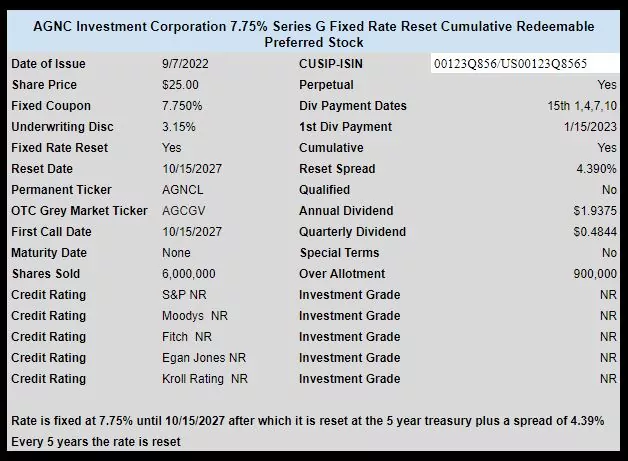

Last week mREIT AGNC Investment (AGNC) sold a new fixed rate reset preferred issue with an initial coupon of 7.75%. This issue is trading on the OTC grey market and investors thus far have strongly disagreed with the pricing as the shares are now trading at $23.50.

AGNCL temp ticker changed from AGCGV to AGCGL. Now trading $23.50-ish and yields 8.24%.

Not sure if it next pay divd 10/1 as per sheet above or it being a partial quarter skips that and pays the next one in 1/15/2023 (above sheet says 1/15/2022)

I did buy some in $23s last week

Thanks mSquare–corrected that date.

Tim, the graph looks great!

Thanks Sailor–yes the 10 year line sticks out.