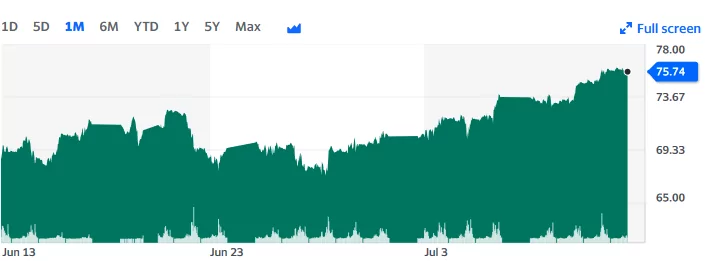

I have had my eye on the price of crude oil for a few weeks–many folks on the website believe that ‘as oil prices go inflation goes’. Certainly there is a correlation – oil flows through to such a huge number of finished goods of all sorts that large crude oil price movements eventually flow through to consumer goods prices. Energy and energy services are just 7.5% of the consumer price index so energy prices as a component of the index is kind of minor – when factoring in crude as a component of all items??? The nightmare scenario is crude oil moves sharply higher and spikes the month over month CPI numbers–then what? Month over month prices are sharply higher – year over year they remain sharply lower.

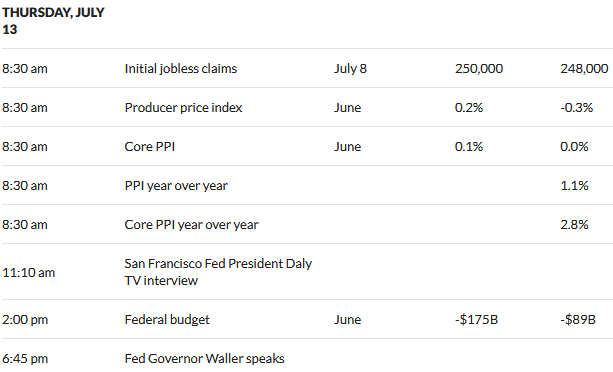

We are awaiting the producer price index numbers as well as the very important jobless claims numbers. The 10 year treasury is trading at 3.82% right now and it is almost shocking to see how fast rates have fallen from the 4.09% area just a few days ago.

I sit on my hands – not motivated to do anything (buy or sell), but I am looking as always – just not acting.

As an aside, we have visitors from Dubai. He owns a large distribution company for drilling. Apparently, the Saudis are having to drill more (deeper) as they are encountering water. I guess the old days of BP using a sand bucket to find oil is ending. Saudi is a welfare economy and will not allow discontent so one can expect them to manage as best possible to keep prices stable and high.

One of many reasons to unlearn recency bias re rates.

What I don’t understand (and I don’t follow this too closely, so my numbers are from memory) is how I am still paying over $4 for diesel with oil in the mid $70’s range when I was paying under $3 the last time it was in the $70’s range prior to the pop over $100/barrel last year. I guess fuel prices tend to come back down MUCH slower than they rise……

I’ve had over a doubling on my cost of goods (garage doors) since the beginning of the pandemic. None of my suppliers have lowered any of their prices. I have to believe the cost of fuel is contributing to these stickier, higher prices.

Check out refinery capacity and diesel exports. It is my understanding that until recently US refinery capacity declined during Covid. Also, Europe used to import diesel from Russia which is gradually being replaced by India?

I saw a blurb in the paper that one of the big refineries in northern California has stopped diesel refining completely and is switching to bio-diesel because of pressure to be “more green”, so Cal will be importing more diesel because demand hasn’t magically ended.

Heaven save us from the green do-gooders who keep trying to fix problems by constricting supply instead of fixing demand.

The Strategic Petroleum Reserve is pretty low so don’t expect any more help from that and the Saudi’s are acting pretty feisty. I am not betting against stable to higher prices.

I note the market seems to want to hear that inflation has been defeated. It still seems early days to project one month of data that provide a favorable comparison. Maybe it’s just a correction to the over reaction to the ADP report?

I had sell orders in on a couple oil related stocks which I cancelled as they are about 30 days out from x-div. date. Wanted to collect profits before Congress stirred things up. Still intend to sell, just be sailing closer to the edge of the storm. Once the run up equals the quarterly dividend I’m out.

Don’t forget end of summer and gas demand should decline. Oil could and may spike higher but I have profits and am not greedy so will take some of my chips off the table.