As most of you know already the stronger company’s are starting to eat the weak–I guess with interest rate where are where they are this shouldn’t be much of a surprise–it is hard to make money if you have to refinance your debt at super higher interest rates.

Lodging REIT Hersha Hospitality (HT) is being acquired by KSL Capital, a private equity firm targeting leisure and hospitality. The acquisition price is $10/share – a nice premium over the closing price last week of $6.28. HT has 3 preferred issues outstanding and all 3 are to be redeemed–a nice gain for holders as issues were trading around $20/share prior to the announcement.

Also Kimco Realty (KIM) , a REIT owning open air malls, announced the pending acquisition of RPT Realty (RPT) which also owns open air malls. Again KIM is much larger and stronger than RPT which should keep the cost of capital favorable – at least relative to many smaller weaker company’s. RPT has a $50/share convertible preferred outstanding which is sounds like will remain outstanding.

I would expect we will see quite a few more acquisitions in the coming year–some will be forced of course, because of poor financials. Look to see quite a few deals in the banking space.

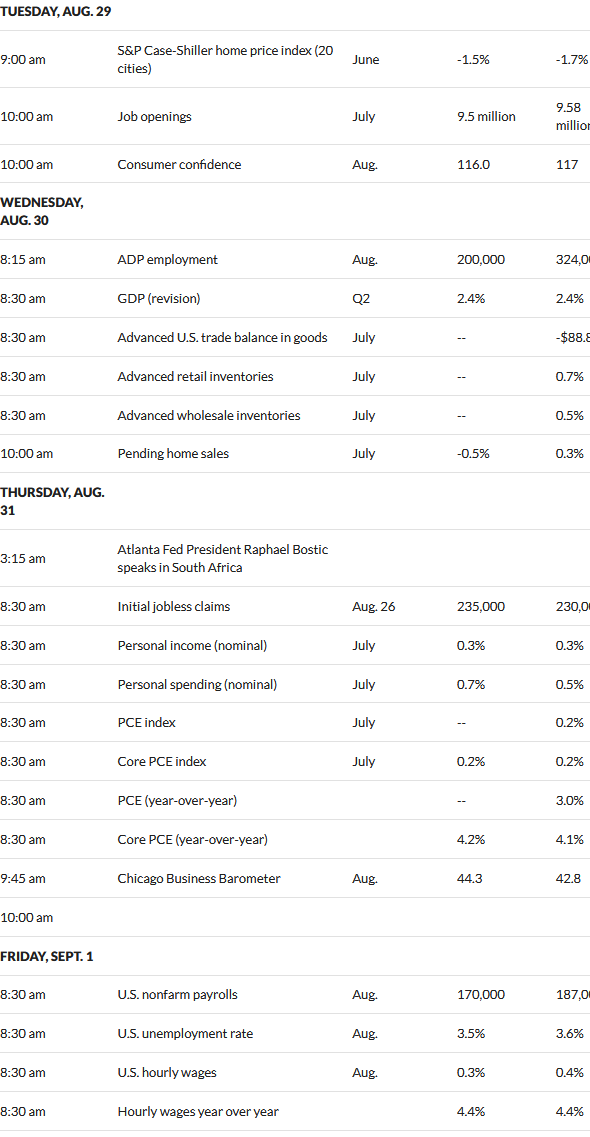

Yesterday equities moved relatively strongly higher–while today the indexes are essentially treading water—off less than 1/10%. Interest rates are up 1 basis points from the close yesterday–really just treading water awaiting the inflation number on Thursday (PCE) and employment report on Friday. We could see quiet markets for a couple of days, which I always welcome.

RPT D is my favorite “safer” investment currently..

It looks like a UBA/REG situation but the relative value is even larger.

RPT still yields close to 7%, and has upside potential with its convertibility feature.

KIMCO prefs appear to be IG.

The opportunity makes sense as holders shuffle shares post merger. There also seems to be some confusion on whether it will remain outstanding and the conversion features.

https://investors.kimcorealty.com/financial-reporting/credit-ratings/default.aspx

Maine:

So with the new conversion rate of 2.2963 on this $50 preferred (which will now be 7.25% KIM+N), the only thing that could hurt us is if the $20 Billion KIM (total enterprise value after deal closes for RPT) is somehow taken private below $21.77/share?

Or is there a make-whole provision that might even protect us in that far-fetched scenario?

There should not be any more confusion on whether this security will remain outstanding after the deal. KIM clearly said it would and provided the new ticker and the new conversion ratio in the merger docs published yesterday.

KIM+N is a great way to play the potential upside in KIM (once traded over $50/share before the global financial crisis – although this price is unlikely to ever be reached again) and get paid nearly 7% while you wait. KIM currently trades near $19/share.

I would argue that KIM might be the finest shopping center REIT in all of REITland…definitely Top 3 (KIM, REG, FRT).

Yes, I guess a take private is a possibility. But I would guess any take private would entail a large premium buyout, and you could convert your shares to common if you had any concerns.

That is the beauty of this issue and why I had a large slug going into this. I have more now 🤓.

DHC and OPI have been doing the merger dance….but we’ll see on this particular one.

“WILSON, Wyo.–(BUSINESS WIRE)– Flat Footed LLC (together with its affiliates, “FFL” or “we”), a top shareholder of Diversified Healthcare Trust(DHC) and the owner of approximately 9.8% of the Company’s outstanding common shares, today announced that all three independent proxy advisory firms – Institutional Shareholder Services Inc. (“ISS”), Glass, Lewis & Co. (“Glass Lewis”), and Egan-Jones Ratings Company (“Egan-Jones”) – have now recommended that DHC shareholders vote AGAINST the proposed merger with Office Properties Income Trust(OPI) at the Company’s upcoming Special Meeting of Shareholders (the “Special Meeting”) on August 30, 2023. “

Not really a strong vs weak, but there’s been some conjecture that Realty Income (O) will buy out the much smaller Spirit Realty (SRC). Brad Thomas wrote an article about that possibility recently.

https://seekingalpha.com/article/4631215-pounce-on-spirit-realty-before-realty-income-does

Wow, I had a nice memory on RPT PRD. Glad to see it went up some much