Once again interest rates are very quiet – in the last 7 days rates (the 10 year treasury) have traded between 3.42% and 3.55% with closing yields of 3.46% and 3.55%. This morning the 10 yield is at 3.52% right now. I think we are due to break this range soon–what will shove rates higher or lower is anyone’s guess.

Well finally after many days in the green (I lost count–maybe 13-14 days in a row) my accounts were all red yesterday, although just by a tiny amount. Today I hope to be green–if for no other reason than the number of dividends and interest payments hitting the accounts. I did do some more trimming yesterday–no buying just more trimming around the edges. I trimmed back the Oxford Lane Capital (OXLC) term preferreds – the specialty finance company’s make me nervous. While technically their coverage ratios (must maintain 200% asset coverage ratios) remain flattish because of the number of new shares they issue their portfolio markdowns are large and if their is a recession coming where are their markdowns going then? I remain a holder but at a reduced rate.

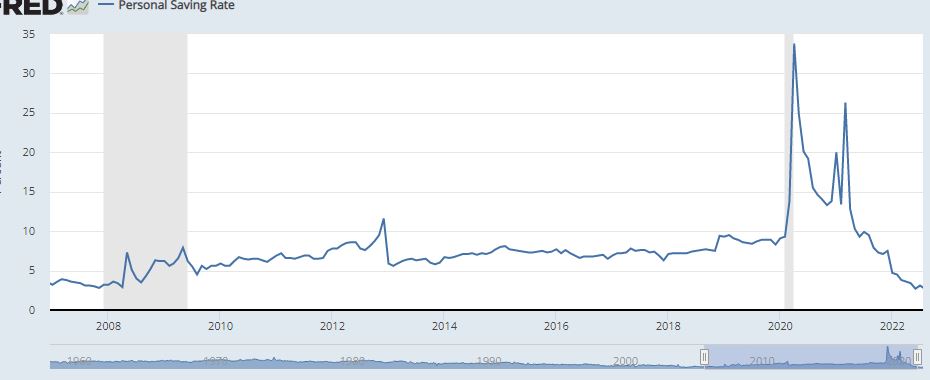

I noticed yesterday that the personal savings rate continues at a very low level–in fact as I read the chart the rate is the lowest since 2008. Consumers are using credit cards at an increasing rate while saving less–all in all not a great indicator for the economy ahead. I know my personal savings rate is WAY down – earned income down 30% in 2022 and for January, 2023 down a whopping 64%–that’s January in Minnesota for a property appraiser–no worries though as my social security and General Mills pension cover expenses easily.

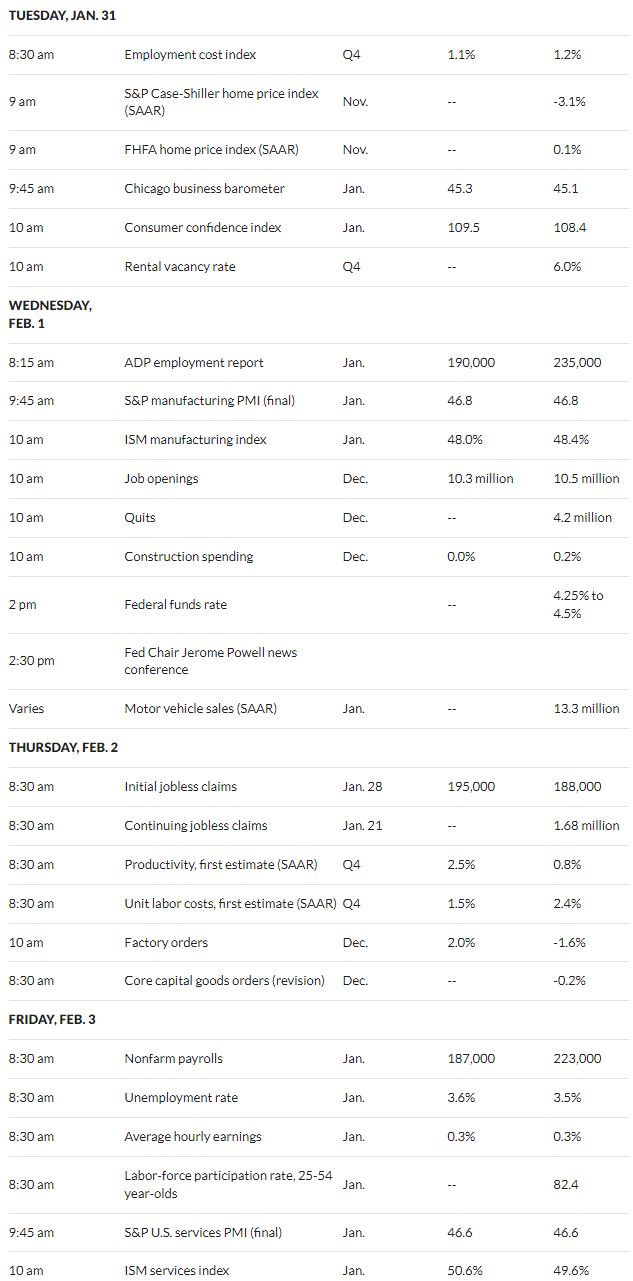

So today we have the start of the FOMC meeting–ending tomorrow with an interest rate increase announcement at 1 p.m. (central ), but there will be additional important news –in particular ADP employment tomorrow and the ‘official’ government employment report on Friday. I think before the week is out we will need to have our seat belts firmly fastened.

I’m holding my OXLCM, maturing 6/2024.

How refreshing that as a site owner or let’s say a ‘service owner’ to use SA parlance, you disclose all the time what is going on in your portfolio and personal financial situation. It adds to the stellar reputation you bring to your work. While your income is down from r/e appraising, we benefit from more time spent here by you, Tim- selfish though that may be on our part!! lol. How interesting at SA 3 big ‘services’ now offer chat and pfd/bb/bond recommendations.. we’ve benefited here in the back corners of the web for years..playing ‘catch up much’ over there!! Or the reality maybe of what returns will look like for the years to come and getting 6-8% is not going to look bad.

Well old Bea is not trimming she is whacking.. and is back up to 45% cash and has moved 50% of her Discover Savings to brokerage, most went into 6mo T’s. Sweep a/c is up to 3.95% too, so that even is .65% higher than Discover’s rate. Will pause on moving more but I have other money that functions as ‘cash’ earning 3.5% guaranteed so I could be moving more to FIDO. I may need or want to finally replace the old Subaru this year (rust.)

Some of the sales of pfds/stocks in IRA’s went into T’s as well. I sold out of several issues because the spread over 6m 4.75-4.80 rates available had dropped to 2-2.5%. I’ll leave those pennies to others for now as I position through the year. I think I will be able to get back in if I want..we’ll see that is the question I guess.

Sold out of CIO-A, SLG-pf, trimmed SLG bot at 32 for 39, HPP bot a little under 10 for around 11, sold UBP-H, BFS-E, 60% of ATLC-P (the ones I got at 16, not the old ones I bot at 23! lol) to lower that cost basis a lot

50% of TFSL common bot at 12 for 15, the NXDT common sold, sold OZKAP, CADE-A. I guess some others too. Other sales were right-sizing gold miner positions in conviction names that ran massively since summer- and tightening up risk in that area w weaker names dumped.

I think it was Tex who mentioned booking the nice gains early plus collecting 4-5% on top of it in cash is a great return and I am in that camp. Even if 2024 is a 4-5% year, avg’g the two years would now be over 10% /yr from gains booked. Every couple years it seems the market gives us these ‘pounce’ opportunities to grow capital or for those who need it to improve their income.

On the ‘expense’ side in last 6mo, our NG bill doubled (budget from 92 to 197/mo) our phone up 10%, electric up, water, sewage up, homeowners/auto ins up a little , cable up a little (for mom, I’d dump it but she doesnt want to,) food is up of course. We use mom’s income as much as possible for expenses (SS and dad’s pension she gets) so her SS went up but it is gone w all the ‘inflation’ noted here. Still able to give to our charities monthly which is important to us. What she has comes to me so using her income and modest assets for as much as we can lets me grow my capital should I live to 89 like her!

The SS decision is up in the air, 65 later this year, the calc indicates wait to 67.6 to maximize, should I have the longevity of mom’s gene pool, I might need it though I doubt it. Should she pass of course or have to go to skilled care, things change for me somewhat from the income/expense side.

Most of my investing is intuition from doing it so long (plus hard 10k reading, macro and technical analysis.) Preserving and increasing capital is most important overall.

Sorry for the long post, just sharing I guess ala Tim and others here who contribute so much as we self-manage our money in these volatile times. Caregiving ‘gives’ me a lot of time to do so and knowledge is power (and profit) so I appreciate the thoughtful posts of all! Bea

Bea – Nice post! Out of curiosity, when you say you’re “up to 45% cash” are you considering your 6 mo Treas and similar short termers as cash or is that cash above and beyond those kinds of parked money situations?

thank you -and thanx for all your great posts here and ‘elsewhere’… I love when you and Grid ‘school them!’..

and yes I count them as ‘cash’. 45% of my ‘investable’ funds in FIDO, IRA, RothIRA are in cash or T’s. the ‘other’ cash I ignore although I take that into consideration I am the antithesis of Ray Dalio for sure!

When I go on Medicare later in 2022 I will be more active w ALL cash sources watching the limits of course, for now being a little more cautious for ACA reasons.

Tim;

I am a bit froggy when it comes to OXLC as well. I trimmed it back some in December and just kept a couple hundred shares of OXLCM which matures in June 2024. Been thinking of selling those shares as well as I have a small capital gain on them. Getting close to retirement date later this year, main goal is income and de-stress the portfolio as much as possible.

Nice that you have a General Mills pension. I have a small pension from Sears where I worked as a TV repairman the first 20 years of my working career before getting my engineering degree and working in aerospace for the last 30 years. Sears turned the fixed pensions into annuities many years back and I actually get my monthly check from MetLife.

Same here Bill. I worked for 17yrs Georgia Pacific until they sold their Distribution division to a hedge fund along with the liabilities and renamed it Bluelinx. Been collecting the pension for a year, but now they are moving it over to an annuity which they said takes place later this year. Good time to move with the insurance companies able to lock in higher rates of return.

Speaking of this, I want to mention to younger readers if they are thinking about getting life insurance to cover their partner and children in case of a life ending event to pay things like the mortgage.

Before 40 I bought a whole life policy for a year then dropped it. Why? to meet their target date and amount of money promised I would get in 20 to 30 yrs they had to raise my rates. Imagine the era of zero interest rates we had the past few years how much my payment would of been. Also don’t forget you have to pay into a whole life a set number of years before you get something back if you drop it.

I went with 20yr term life to help my wife pay the mortgage if something should happen. Now with rates going back up it may be a good time for younger people to lock in a term life insurance contract.

Note- I do not and never have sold insurance. DYODD