Self storage giant Public Storage (PSA) has priced their new preferred issue.

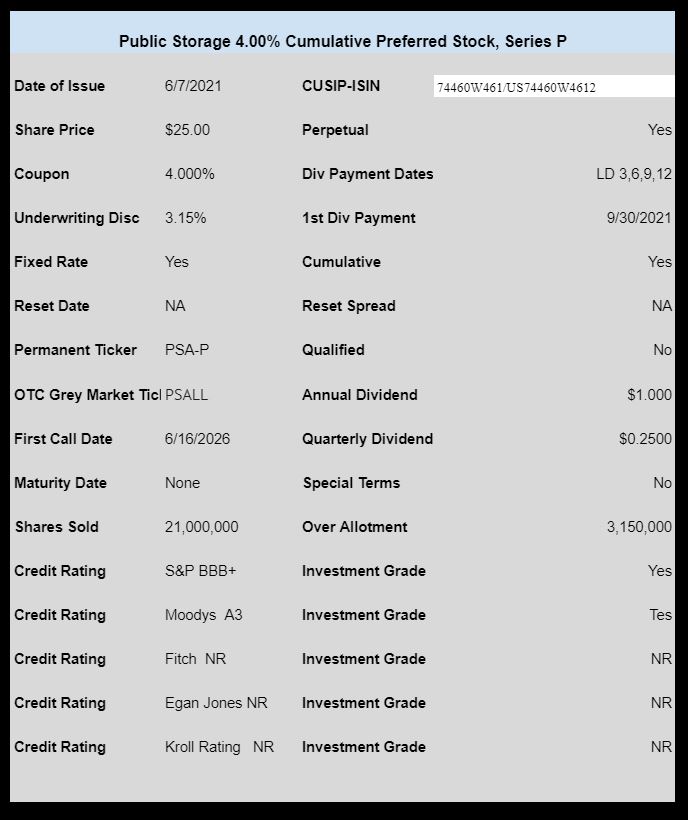

The pricing is 4.00%–the issue is cumulative and non qualified. The issue is strongly investment grade from both Standard and Poor’s and Moody’s as shown in the chart below.

The company has many outstanding preferred issues which should be reviewed prior to investment decisions being made on whether the new issue meets your needs. Their issues can be seen here.

The pricing term sheet can be read here.

I saw them at 25.10 yesterday and look like a straight path to 26 IMO. If I was allowed I’d have flipped al my sub 4’s PSa’s into this

I despise this preferred stock assassin outfit. As I told Bob a week or so ago, there is no way this outfit would ever issue a reset. They get rock bottom yields issuing fixed ones. And they would love to hang buyers out to dry on a 4% or under any chance they get!

But, I like easy trades and the O and N issues with lower yields are holding strong, so I had to man up today and buy a bunch of the new 4% one. Only intend to hold long enough for IPO shares to dry up and new ticker assigned, then I am out the door shortly there after.

PSA-P has been slow to increase in price, not sure why, but it is going up, slowly. Since the coupon is exactly halfway between recently-issued PSA-M and PSA-N, my simple math says the price should level out midway between those two issues. Right now, that would mean that PSA-P should trade at about $25.75, and it is still 50 cents below that level. I’d normally shy away from this one as well, but the easy math told me to buy a bunch, and will flip most when the price reaches the correct level.

At 21 million shares this might be PSA’s largest preferred issue ever. Shows the unquenchable thirst for yield right now. A little surprising they had to pay 4% with both PSA+N and PSA+O both yielding a paltry 3.75% today.

I’m confident that we will be able to buy this PSA+P issue well below $25 sometime over the next 5 years.

Bought a large slug of PSALL for a flip

Bot a full position as a relative value trade vs PSA-O.

Well someone will buy it but a non-qualified 4% not for me.

Curious, when I enter PSALL in the normal TDA web page, it says

“The symbol you entered, PSALL, changed to PSA-H.”

Maybe they’re re-using temp symbols…

Well, the PSALL symbol is working now at TDA, nabbed a good chuck, some to keep, some to flip.