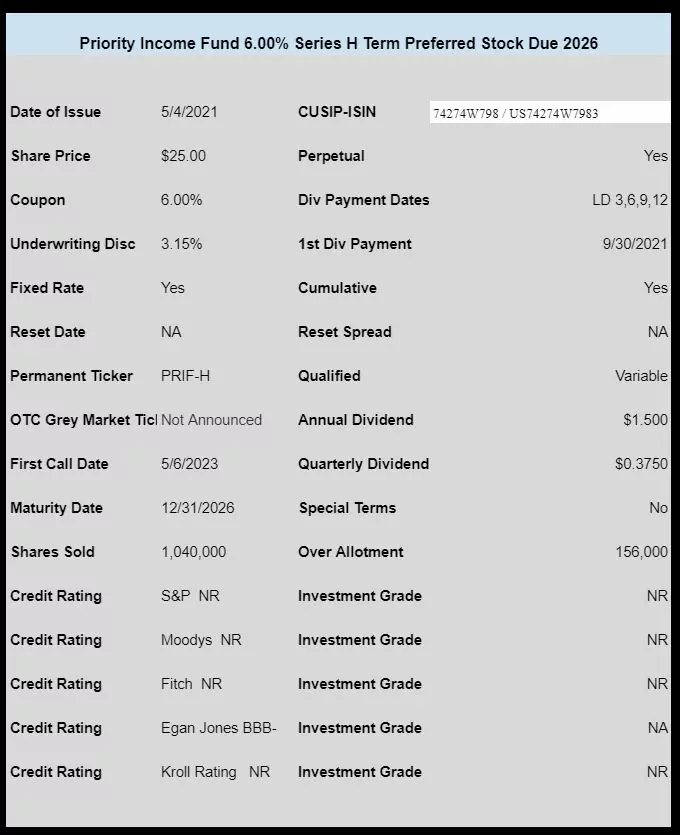

Closed end fund Priority Income Fund (not publicly traded) has priced their new issue of term preferred stock.

The issue prices at 6% with a mandatory redemption in 2026.

The issue is cumulative and potentially qualified (depending on whether the fund has income).

The issue is just 1.04 million shares with another 156,000 available for over allotments.

The fund plans to call the 6.25% (PRIF-B) term preferred with the proceeds of this offering. It appears the company is calling based upon maturity date versus coupon as they have other higher coupons available now to be called. All of their outstanding issues can be seen here.

The OTC grey market ticker has not yet been announced, but should be assigned today.

The pricing term sheet can be read here.

PRIFH otc ticker.

Tim,

Curious about being potentially qualified income depending on their profitability. If PRIF is unprofitable, will the dividend be treated as Return of Capital?

Yes Greg. Here is the info for 2020 on the common shares.

https://assets.website-files.com/5dd730c4b9c85c11ca7a9558/602bf3e1c8d369430e479b43_Form%208937%20-%202020%20-%20Priority%20Income%20Fund%2C%20Inc.%20-%20signed.pdf

Someone had told me the preferred will not necessarily follow this same percentage–so not certain on that, but I personally don’t care as all my holdings are in IRA’s etc.

Tim

Thanks!