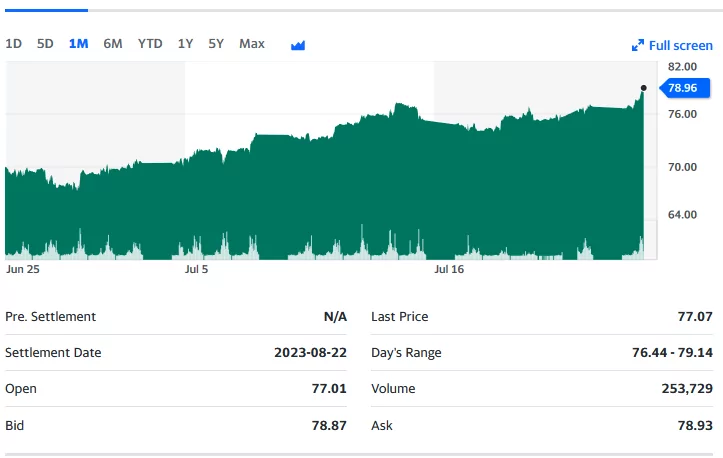

Crude oil prices continue to elevate with west Texas crude up more than 10% in the last month—up about $8 barrel. On a year over year basis prices of crude are still down almost 20%.

Personally I have noted gasoline prices at the pump are ticking higher by nickels and dimes – which of course is only 1 part of the story.

On an immediately basis the higher crude prices will translate into higher PPI (producer prices) which of course are not consumer prices–BUT they will translate into higher CPI prices eventually.

I am not too worried at this price level, but if we get continual moves higher it could well factor into future interest rate hikes by the Fed and I don’t want to see them getting more ‘ammo’ to help them drive the economy into the ditch.

Even with the leading economic indicators falling 6 straight months and forecast for a recession( soft-landing? ), oil prices are starting to go up? I guess with the recent production cuts in Saudi Arabia/ Russia oil prices are factoring supply/demand in the short run.

I suspect higher rates for longer until the Fed breaks something. Remember 10-13 Fed cycles have ended with a recession…only 3 with soft landings. Not a good batting average. With 3 month Treasury bill’s at 5.5% and higher, stay safe and close to the harbor.

I’ve been saying all along if the market keeps rising the feds will have to keep tightening.

The SP is up like 19% YTD.

The fed really only has one tool – raising or lowering rates. They have to be seen doing something, so they will, even if it won’t help.

“If all you have is a hammer, every problem looks like a nail. If you are a carpenter, you better be hammering nails.”

Well there is also the balance sheet which in many ways is a bigger hammer.

Plausible: Rates go flat at near current levels (which are near historical levels). Fed then levers the balance sheet to manage liquidity.

I don’t predict the future I react to the present. If you are psychic more power to you.

A cautionary tale underscoring that we have no idea where inflation or rates may be week by week, quarter by quarter or year by year; until it actually happens.

Alpha meanwhile, on same agreement we know nothing, I wish and want on both ends. Toeing a bit into roached out quality issues, while hoping interest rates rise more near term with stabilizing inflation so we can get a bigger fixed component offering by Treasury on next IBond cycle.

Grid, We’re pulling on the same oar through these choppy waters. No idea where rates are going and am investing accordingly. Mostly snoozing while waiting for the occasional seller that temporarily (even for 15 minutes) swamps the bid side like occurred last week with UBP-K. Small bites at a time have been adding 1000s of basis-lowering shares across holdings this way over the last few months.

Unpopular probably but absolutely staying in the mix with I-Bonds and still maxing with gifts. A fabulous hedge in my view against the unknown and the only investment of which I’m aware that provides all of the following:

1) AAA-rated

2) Guaranteed zero loss of principal

3) Auto-reinvest every six months

4) Tax-deferred gains (and associated compounding)

5) State tax-free in withdrawal

6) With #4 and a fixed rate component, ensures a yield that will exceed inflation.

7) Protects purchasing power, and modestly adds to it.

Important for us to remember real inflation-adjusted gains have been elusive the last few years. With a strong fixed component, seeing I-Bonds as a home-run hedge for a corner of holdings.

Alpha,

Just sitting tight right now. Sold all the MGR and purchased more DCP-C at 25.05 a parking spot for now. Have to remember my wife gets her withdrawal in a couple weeks so need to keep some change in the kitty to cover that.

Other than that, none of the stink bids have hit and not committing more cash I have sitting on the sidelines for now.

Charles,

But didn’t you get a nice hit recently on CKNQP? Been mining that with you for the occasional add.

Had a rare sell last week unloading RLJ-A. Been a terrific hold and payor though the alluvial plain of risks appear to be accumulating and wanted to let it go while it was still attractive.

Separately Charles wanted to share with you how much I’ve been enjoying your posts. Maybe partially because of your industry of employ, you’ve developed a unique and insightful view on much of the goings-on. Of course won’t always 100% agree but have valued what you have to share. Good stuff!

Thanks Alpha, Always like to hear what you and AB have to say ( wonder what he is up to?). I think we caught the low on the CKNQP about 3 weeks ago I was able to get a couple hundred for the ROTH.

We are going into the end of summer driving season and in a few months the refiners will switch to the winter blend. My play on this area has been KRP this is not a MLP and has been a good buy in the mid 14’s

My take on the economy from the building trades is business can run a lot longer chugging along than you think it could then something happens to derail it. Usually something similar to what’s happened before but never a exact repeat of what caused the last drop off. Is it going to be mortgages in commercial real estate this time?

Military spending is up so that is good business, but other sectors are down which is causing competition. With the late rains this year everything is behind from Ag to building and higher rates also slowed things. First 6 months of the year business is off but holding steady. Certainly not the growth that we projected last year that we hoped would have happened. Actually would say 10% off for the year but for next month and Sept. I booked a couple decent medical jobs this week so far.

Getting tired of the game and wishing I was out in the garden more, Enjoy the challenges and nailing the sale and helping everyone finish a project but those jobs in Vegas and Seattle will get finished without me being around.

I’ve been protecting investors from higher rates for 40 years………

I thought the Fed was only interested in inflation excluding food and energy. That will be their excuse for Wednesday’s bump with the CPI at 2.97%.

In addition to rising oil prices the state of Washington “Climate Commitment Act” has now taken affect. This measure has pushed gas prices in the state up another 50 cents per gallon. We are now over $5.00 per gallon and lead the nation with the highest pump prices even eclipsing California. (edited)

For my part, the price of gasoline would have zero influence over the person or party I voted for.

After the large raises at Deere and United Airlines, are the Teamsters going to settle for less than 9-10% for UPS? Labor settlements are also a driver for inflation especially with declining productivity?

Tim, also moving up short term are corn, wheat, natural gas, OJ and eggs. This could make for a bad couple of months for reflation. Hopefully won’t last. There is no rest in this game!

Thanks Fryman – I kind of watch corn and soybeans which have moved sharply higher in the last month. You are right – there is no rest – if it isn’t one thing it is another.

With Russia bombing Ukraine wheat storage expect futures to go up.

I will start to sell ADM shares again with the Russian attacks.

ADM has been a pretty good proxy for the grain part of the war. Bought in the $50s soon after the war started, sold in the high $90s last summer. Bought again when it fell back into the $70s (I didn’t think the Russians would let it keep going) – so I see it going back up into the $90s.

I was only brave enough to to a modest position, but the profits cover a lot of my dumber moves…..

Yes the commodity markets are kind of hot now – and speaking of hot Minnesota is burning up.

Too bad you can’t store some of it for January…

Well, for a person drawing SS, if you got to have an inflationary 3 months, the 3rd quarter is where you want it.