The S&P500 had a stellar week last week as the index zoomed higher closing at 3901 which was a gain of just about 4% on the week–just a few points off the high for the week.

The 10 year treasury yield closed the week at 4.01%, which was lower by 20 basis points on the week. The yield ranged from 3.91% to 4.29% on the week—a wide range for a singular week as economic data finally weakens a bit and whispers of a ‘pause’ or slowing in the increases of the Fed Funds rate grip the market. It is a big week as the FOMC will meet Tuesday with an interest rate announcement on Wednesday at 1 pm (central)–then we have the employment report on Friday. So almost without doubt we will see some wild markets.

The Fed Reserve Balance Sheet assets fell by $21 billion last week–down $72 billion in the last 4 weeks.

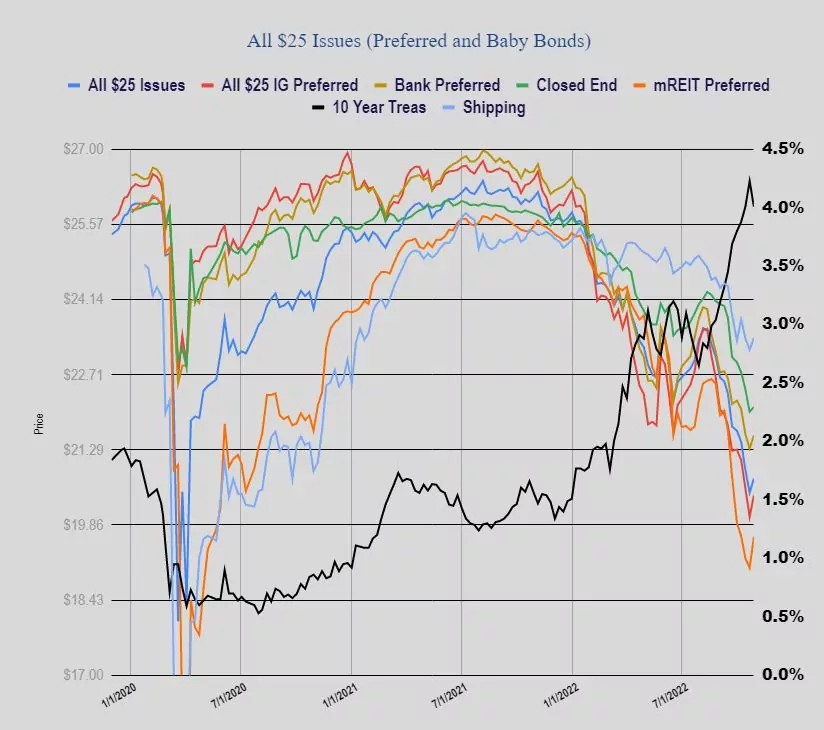

The average $25/share preferred stock and baby bond rose by 27 cents with strong gains on Friday (in particular Friday afternoon). Investment grade issues rose by 41 cents and banks by 25 cents. CEF preferreds rose a measly 9 cents while mREIT preferreds moved a strong 59 cents.

Last week we had no new income issues priced.

Good take from Almost Daily Grant’s last Friday on inflation readings here and across the world.

Night of the Living Fed

It’s alive! As the Federal Open Market Committee prepares to render its latest rate decision next Wednesday, data today on both sides of the Atlantic betray little sign that the inflationary monster is set to curtail its rampage. This morning’s reading of German CPI for October showed an 11.6% growth rate, topping the 10.9% consensus estimate and the hottest reading since West Germany “achieved” that distinction in the early 1950s. Italy and France meanwhile logged 12.8% and 7.1% respective rates of increase in October, well above the 9.9% and 6.5% economist guesstimate.

Stateside, the Bureau of Labor Statistics’ Employment Cost Index revealed a 1.2% sequential increase in wages during the third quarter, marking the fifth straight quarterly growth rate of at least 1%. Prior to the pandemic, that metric had not reached 1% on a single occasion going back to 2006. Meanwhile, the Personal Consumption Expenditures Price Index registered a 6.2% year-over-year advance in September, the 10th consecutive print of at least 6%. For context, that data series last showed 5% annual growth in 1990.

Price pressures are now increasingly codified. Earlier this month, the Social Security Administration announced that retirees will receive an 8.7% cost-of-living adjustment to their benefits in 2023. That figure dwarfs this year’s 5.9% uptick, which had stood as the largest retiree raise since 1983 and compares to a 1.65% average over the preceding decade.

Of course, the looming FOMC meeting isn’t the only major event coming down the pike, as mid-term elections are set for Nov. 8. Yesterday, Senator John Hickenlooper (D-CO) penned a letter to Fed chair Jerome Powell taking issue with the Fed’s ongoing tightening campaign: “Raising rates now when prices may come down [on their own] would be foolish and damaging to American consumers and small businesses.”