A wild week is on tap for the coming week. Futures markets are off around 2% this morning as there is more talk of a 75 basis point Fed Funds rate hike on Wednesday after the FOMC meeting. Also, notably, crypto is getting crushed with bitcoin in the $24.000 area.

Last week the S&P500 got clipped by 5% grinding lower all week as inflation numbers released showed no ‘peak inflation’. Friday was a particularly ugly day with losses of 2.7%.

The 10 year treasury was relatively tame for a week with ‘bad news’. Closing the week at 3.15% which was 20 basis points above the previous Friday close, but 1/2 of that increase occurred on Friday. This could have been much worse–but just maybe that has been reserved for this week? We’ll just have to wait and see–although at 5 a.m. (central time) we see the 10 year treasury up 10 basis points to 3.25%.

The Fed balance sheet showed a $3 billion increase.

The average $25/share preferred stock and baby bond fell by around 2% or 46 cents. Investment grade fell by 60 cents, banking issues by 57, mREIT issues fell by 37 cents with shipping issues falling just 17 cents.

The average $25 share remains 22 cents above the 52 week low of $22.72. We will see new lows in these issues today.

Last week we had 2 new income issues priced.

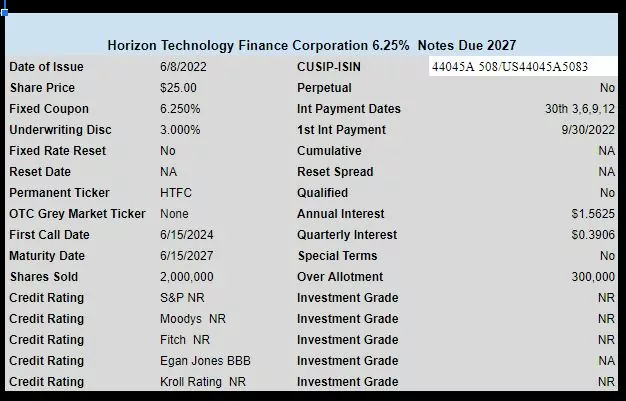

Horizon Technology Finance Corp (HRZN) priced a new issue of $25/share baby bonds with a coupon of 6.25%. Being debt there is no OTC trading and I am not aware that this issue is trading yet–but will in the next couple of days.

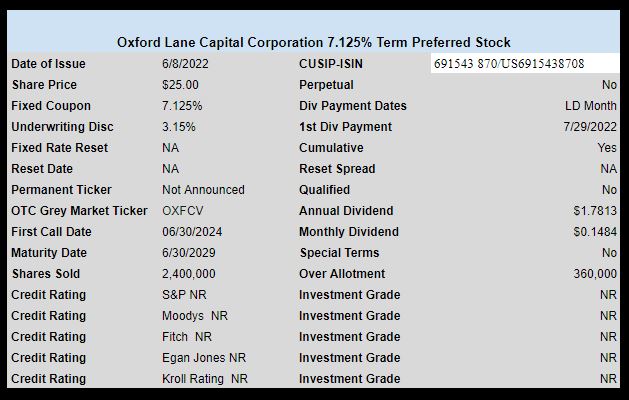

Oxford Lane Capital (OXLC) priced a new issue of term preferred shares with a coupon of 7.125%. This issue is now trading OTC and last traded at $24.24. This is a monthly payer. NOTE the ticker is now OXFCP.

Wanted to nibble on OXFCV, while there is blood on the street (24.10 )but not tradable at Schwab as this security has not supplied all the SEC requested info. Schwab uses OTCMarkets.com, it is on their Expert List as (2) diamond meaning not tradable. Well have to wait on this one. Not many blood days of 8% plunge to take advantage of.

“The SEC’s amendments to Rule 15c2-11 go into effect on September 28, 2021 and will effectively eliminate public broker-dealer quoting in securities of issuers that do not make current information publicly available. Giving effect to the SEC’s stated goals of encouraging public company disclosure, OTC Markets Group will use its Expert Market SM as a venue for broker-dealers to publish unsolicited quotes representing customer limit orders in “No Information” securities.”

Hmm… looks like I could buy it for $6.95 fee, but they don’t have a bid ask- just price range 24.10-24.54

TDA shows only 24.10, but has 33.02k shares traded

Schwab:

1.message not found

2.A quote on this security is currently unavailable. (DO9040)

3.An up to date quote is not available. Please use caution in placing this order. (DO724)

4.Please note: You are attempting to place an order for a security in the Over the Counter (OTC) market. Liquidity and volatility can vary widely which means prices may fluctuate greatly and appropriate share quantities might not always be available for these securities. Learn more about OTC Securities. (DO910)

5.Please Note: Special offers are not reflected in the Estimated Amount or Estimated Commission. (WB25041)

6.Quote at the time of order verification: N/A

Placed an order for oxfcv an hour ago. Not a single share has traded. Bid/ask is 0x0. Talk about a screwed up market. Aren’t market makers required to make a market?

Toed-in on OXLC-M at $25.10. Thought better than cash.

Also, there are now many CEFs that are touching my 10-15 year low mediums. CHW, FFC for example. Another really good crash and I’ll get more of these. Hoping for another Dec 2019 – I have ammo stashed.

It’s beginning to look like the last 2 weeks were nothing more than a suckers rally. Once there is a pull back on hiring, then the real pain for the market will start. Another 1000 point drop in the S&P is not out of the question.

Brought UZD at $20/share. Looking at more preferreds

It’s getting harder to justify putting money in fixed rate investments. Over the weekend I went to order Little Caesars pizza (I know, but my kids like it). They raised their prices again nationwide! The Classic is now $7.99 vs $5 in 2020 (60% more in 2 years) and the Extramost is $8.99 vs $6.00 (up 50%). For some reason it really ticked me off, even more than the $6.09 per gallon of gas. What happened to “transitory” inflation? The farmers are facing major increases to fertilizer, seed, fuel, etc. etc. and we haven’t seen the beginning of the shortages and price increases this will cause this Fall. It seems to look like putting money in Preferreds and Bonds is just going to be a losing game for at least the near term. Washington seems to have no plans but to spend more money.

Transitory inflation was just a myth.

The time may be fast approaching for last years 4.5% issued perps to say hello to Mr. $15 Handle.

Grid–agree. Maybe I will nibble some of them – or maybe not – will see.

Instead of nibbling at low coupon IG trading in $17-18s and yielding high 5%s, wouldn’t it be better to nibble on Fix to Float such as ATH-C or C-K that yield over 6.5% now and should continue to do ok when they float?

That is where I have largely been for a while. The live floaters and term dated. They are holding better. I’m looking down the road to sell these and buy into the roached out perps at a lower price well under par. I’m already seeing a call protected Baa2 7%er near par. So hopefully last year’s lots will fall through the floor with some help from a few funds hopefully.

Just bought some Grid…$25.10

Martin, I guess you are a member of the Old National club now?

Grid—any ideas of stocks to be followed?

Randy, I need to figure that out too, as two of my biggest holds should be getting redeemed in next month or so if regulators get off their bums. That money may eventually just go into 2 year TBills if it keeps rising.

I bought a small couple hundred shares of ONBPP at 25.05 today, just because of boredom and it is 7% Baa2. Not hand stand material. My terms are really not doing anything, but no compelling value to add either. The live floaters just bounce in the $24-$25 range and I just hold and plan on riding the yield increase wave and not get bothered by trying to trade them in their typical tighter ranges.

To be honest I was hoping to add to my recent sub $28 WCC-A purchase hoping for $27, but that turd is actually going higher today. So much for that idea.

I would be buying some RCA today, but I was too eager beaver buying last week, an have a full position and will have to let it go. As I dont trust them for an over limit position.

WCC-A ex-date is tomorrow 6/14.

What are some attractive live floaters, or soon to be floaters?

Thanks.

Ken, I keep it pretty tight.. CUBI has a couple, I own the E. NS has several I own NSS. As long as oil is good it can service its preferreds fine, but I dont like its credit quality. But it has been this way for 10 years so it enjoys be a sad sack outfit I guess. I have a lot of WTREP but its untradable. I also own TECTP which has held strong though its not floating yet, but has a bloated plus 6% adjustment. PNC_P just started floating with a 4.02% adjustment. But you have to be careful of these and assume Libor is going to say 3% or you really gain nothing owning it over say an ONBPP which is same credit profile and is already 7% and around par.

Various Mreits probably have some decent floaters but I dont follow that area.

Floaters can sink with market also. One just hopes they bob back up to the top of the water if their yields keep rising and market settles down.

Thanks Gridbird. I have WTREP, which is perfect because I can’t be tempted to sell.

mSquare

Picked up more NRZ-D, which is essentially a term (given f>var terms), and yields 7.85% at today’s $22.30 price. Likely will be called in 2026. I haven’t even calculated the YTC, which I’m guessing is around 11%.

There’s some risk to the NRZ model within the REITs, but confident it will survive.

IG, Qualified way under par ………

Sounds good to me.

$15 handle may be possible – seeing IG past call stuff making a break for lower prices

Keeping powder dry …………. I almost added to positions last week but flintched.

I’m just trying to figure out what will happen whent the next GDP numbers are released and what that will do to the issues we love here.

Even the Dollar store has bumped prices to $1.25 I don’t recall 25% inflation.

Also- read that the 2/10 yr treasuries briefly inverted this morning- not good, but to be an indicator it would have to last longer than a week.

The 5/30 is inverted.

FWIW, I’ve been adding to my position in ET-E.

Pipelines should be doing very well and ET has been focused on decreasing it’s debt.

The ET-E is a floater with very nice terms.

Greg, have you considered ET series F, G, and H? Decent yield now (7.1%-8.2%), higher spread when they float (5.1%-5.6%), and based off 5Y Treas rather than 3M Libor. They closed today at $909, $900, and $870 respectively.

Bur,

Thanks, I’ll give them a look.

Pipelines (MPLX, ENB, ET, WMB and CEQP) are ~17% of the income component of the nest egg today and it will likely be growing. I have positions in the common or units (for the MLP’s) and the preferreds (EBBNF, EBGEF and CEQP-).

I have also been recently adding to the shipping component. and I’ve been supplementing my positions in GSL and TGH-A.

Yep. Just last december I was happy to get gs-d and jpm-m in the $24.80 range. Looks like I’ll be stuck with them for a long long time 🙂