The S&P500 had another tough week last week losing 2.5% from the previous Fridays close. The index traded in a range of 4117 – 4255, the close on Friday was near the low of the week.

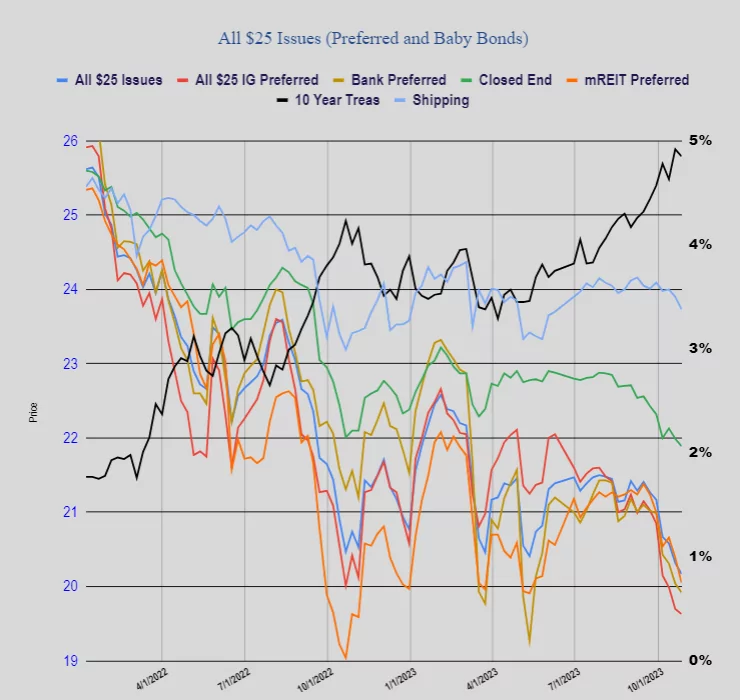

The 10 year treasury closed at 4.845% which was a couple basis points off the low of the week (which was 4.83%). A interesting trading week as rates touched a high of 4.98% on Thursday right after the super strong GDP release–the GDP figure was .2% above expectations, but almost immediately then started to fall and continued down to close the week at 4.845%. The personal consumption expenditures numbers on Friday came in generally as expected.

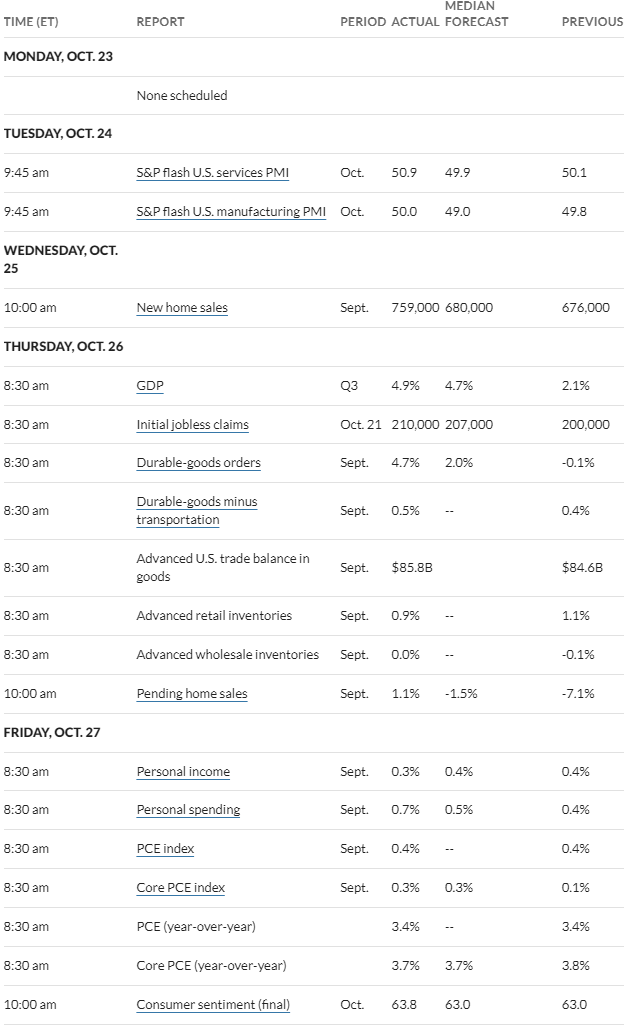

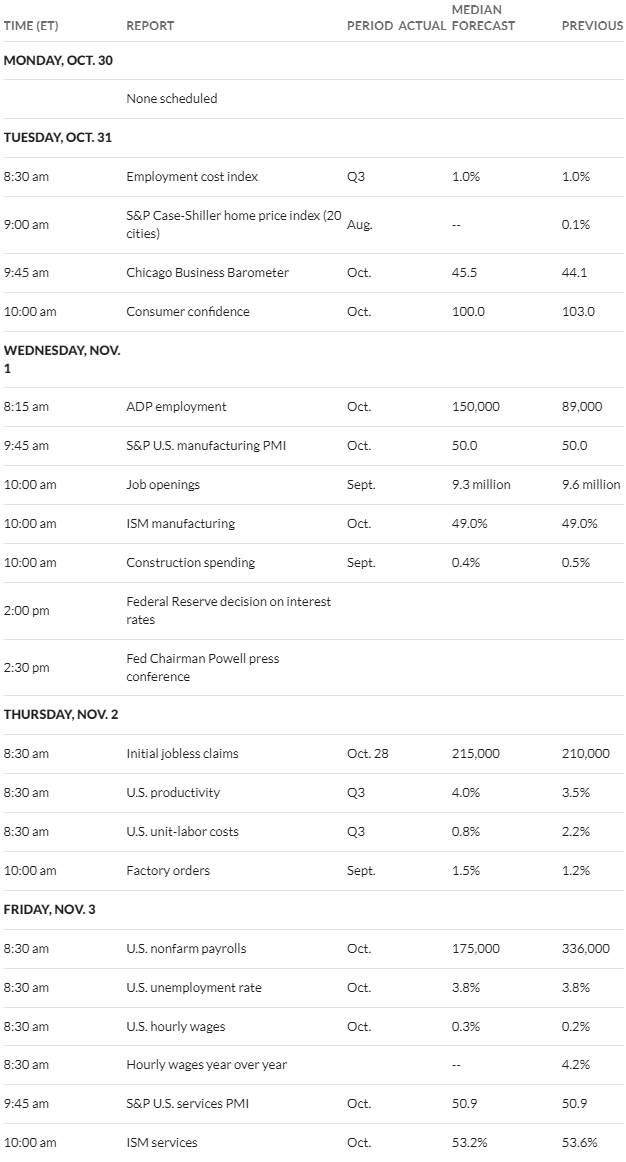

This week, of course, all eyes are on the FOMC which begins there meeting on Tuesday and concludes with an interest rate announcement on Wednesday at 1 p.m. (central). As usual there is plenty of economic news being released during the week, but while the interest rate decision is the most watched there will be the release on Friday of the October employment numbers. The forecast is for 175,000 new jobs being created, and I hope that is correct–but last month was 336,000 and we have seen actual’s come in stronger on on so many occasions I have little faith in a weak number forecast.

The Fed balance sheet fell by $26 billion last week with assets now at $7.907 trillion.

Last week was another losing week for $25/share preferreds and baby bonds with the average share off 16 cents. Investment grade issues fell 7 cents, banks fell 12 cents, mREITs fell a sharp 34 cents (which was in reaction to very poor quarterly financial results in that sector) and shippers fell 17 cents. This in a week in which interest rates fell–remember that while interest rates are a prime driver of share prices not each and every week marches in lock step with rates, but over time prices do march to interest rates.

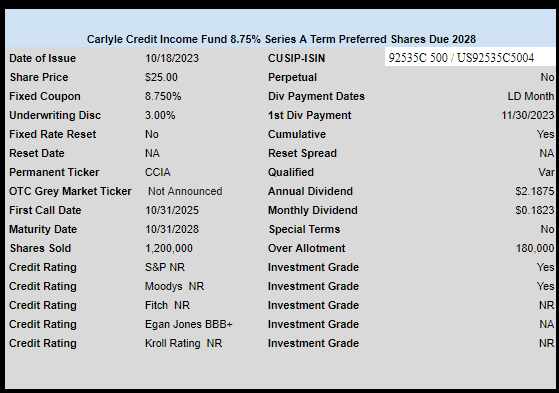

Last week we had no new income issues prices. The Carlyle Credit Income Fund term preferred (CCIA) did start trading on the NYSE and closed the week at $24.80. During the course of the day the shares hit a low of $24.10.

Just wanted to get some understanding of the Oakmark/ Brookfield preferreds. Both series A and B are at their lowest and yielding north of 8%. Does anyone have any idea whether these are considered a good investment to hold for the dividends?

They both issue K-1 documents for tax purposes, so you will want to know about the UTBI if you are buying them in an IRA.

Tim..still buying..A, B, rated, prefferred stock,,bargains ,,,this market is weak .wait and see after the Elections….Georges

O is buying out SRC and will keep trading SRC-A preferred stock.

Treasury Refunding Statement comes out on Wednesday,….

“Many bond dealers predict a refunding size of $114 billion” which will likely have an effect on markets.

https://finance.yahoo.com/news/big-bond-market-event-wednesday-200001324.html

Windy

The Treasury has to issue $4T by December 31st, and demand has been lukewarm.? You betsha the Bond Vigilantes have started to wake up and notice the risk at hand is greater than the reward!

$33,658,000,000,000 national debt with exponential debt acceleration since 2000 feels like a Ponzi scheme to many investors; higher rates will be needed to keep US investors playing now that the big buyers of our debt have left the game table.

I think the national debt doubled in george w’s precedency and then doubled again under obama. We will never know what trump could have done if he had a full eight years as president, but I am sure he would have made an effort do double it. And joe seems determined to add as much as possible and with the inflation that has occurred since he took over, I wouldn’t rule out doubling it as being possible.

And all those many years the fools mentioned above and their cronies in the house and senate stood around bragging about what “they” accomplished while the people they were bragging to were the ones that paid for whatever their “accomplishments” were.

Actually, we have not paid for it. If we did none of this would have happened. I have no idea when but eventually the entire world will pay for this.

True TNT , our economy is a major driving force behind other economies. I have to wonder with what is going on in China how their economy is affecting their trading partners. I bet they are not paying with expensive dollars and trying to be a world currency whoever is holding their money might be hurting just now.