Let’s get this short week rolling. Monday and Tuesday could be a bit wild in equities with some subdued action as the week wears on and we near the Christmas holiday.

The S&P500 traded in a range of 4600 to a high of 4712 closing the week at 4621. This is a total range of just over 2% with a loss from the previous Friday of almost exactly 2%—not really much–leaving us just 3% off a 52 week high.

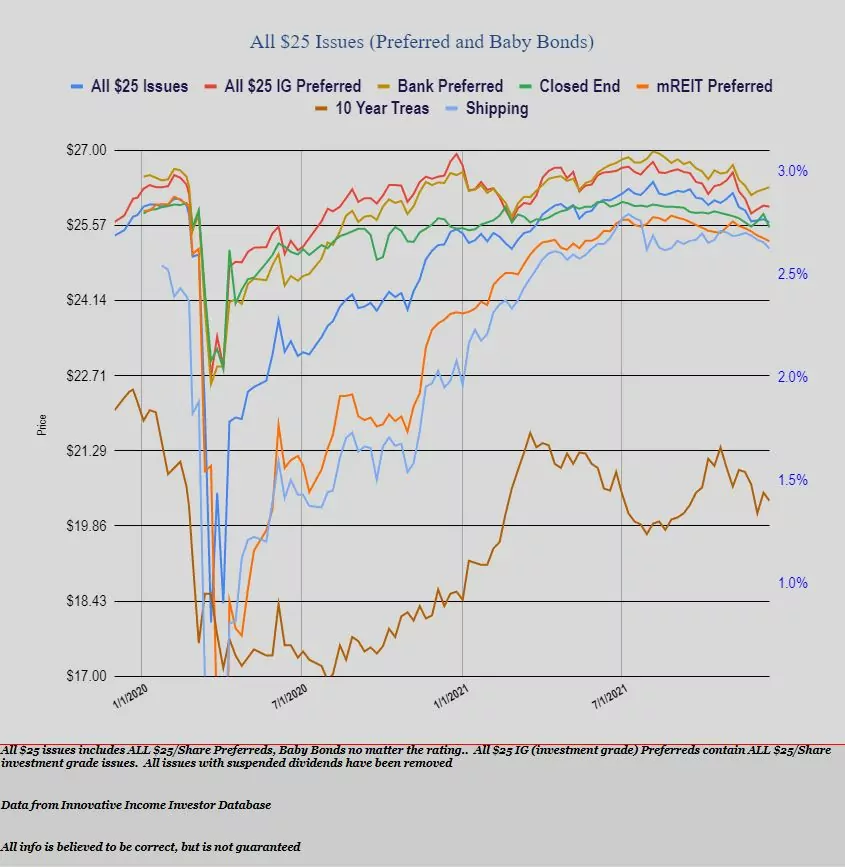

The 10 year treasury traded relatively tamely with a range of 1.37% to a high yield of 1.48% closing the week at 1.40%. Of course we had the Fed drama — now yields are dropping as investors latch onto the ‘recession’ tag line for now.

The Federal Reserve balance sheet shot higher by $92 billion last week–kind of a large jump for a time period when we are tapering. Just like all numbers/statistics 1 number is meaningless–we are looking at these number in series of 3-4 weeks at a time.

The average $25/shares preferred stock and baby bond fell by 6 cents. Investment grade issues fell by the same 6 cents. Only CEF preferreds showed much movement falling by 26 cents – this was no doubt reflective of ex-dividend dates with a small sample size and Priority Income and others going ex.

We only had only 2 new income issues prices last week.

Sachem Capital (SACH), a real estate finance REIT, sold a new baby bond with a 6.00% coupon. This issue is not yet trading, but should be later this coming week.

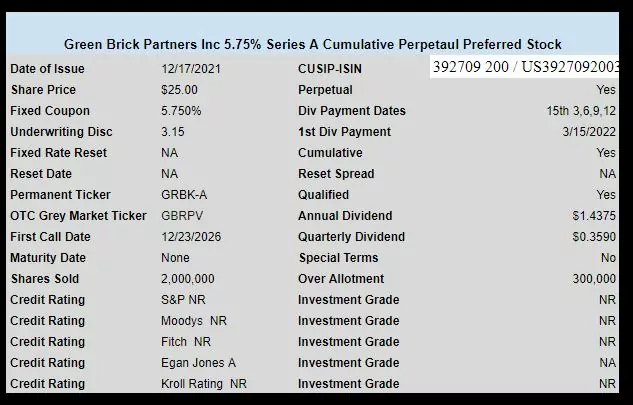

Homebuilder, land developer Green Brick Partners Inc. (GRBK) sold a new issue of perpetual preferred stock with a coupon of 5.75%. The issue will be trading on the OTC today with ticker GBRPV. Note that in spite of the name this is a C corp.

Question for ALL; In this incredibly low interest rate environment for fixed income investors and not a whole lot of relief in sight. Yes, Iam fully aware that J. Powell will be raising rates 3 times next year. Have any of you done any business with “FIRST NATIONAL REALTY PARTNERS”??? Iam on their mailing list and just spent about 20 minutes with one of their folks. He was telling me how they do these shopping Centers with a big well known anchor like Krogers triple net lease. He was giving me a 7%+ return rate and also the fact that you get fantastic “depreciation” on it as well. It sounded quite good on a “Personal Basis”. But as we all know its easy to get burned in the real estate arena so just wondering if you have done any business with them.