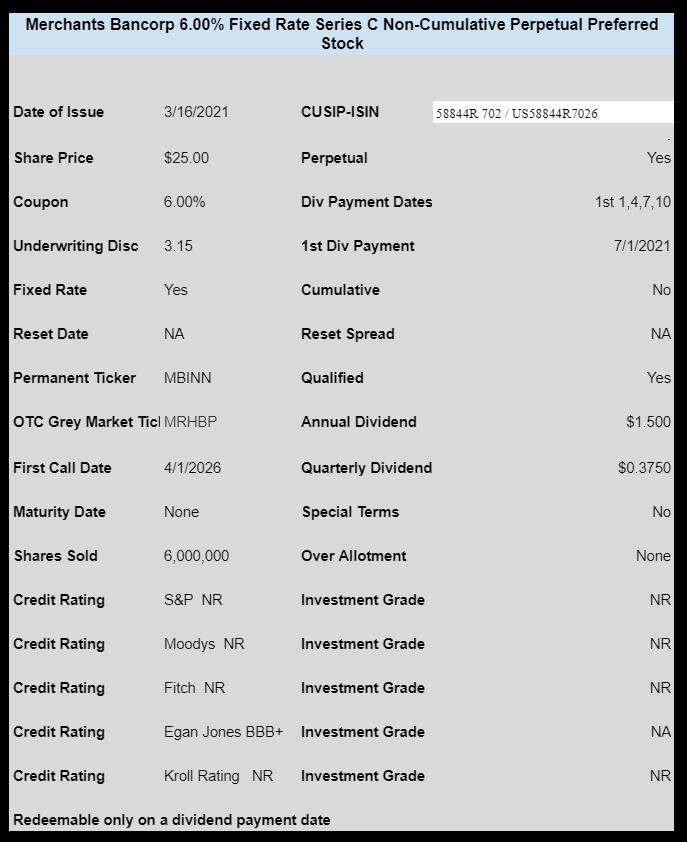

Merchants Bancorp (MBIN) has priced their new issue of non-cumulative preferred stock.

The issue priced at 6.00%. The company sold 6 million shares.

The issue is unrated by major rating agencies, but BBB+ by Egan jones.

The shares will trade immediately under OTC temporary ticker MRHBP.

The pricing term sheet can be seen here.

Sold half of my MBINN. May have a little more room to run. My game is to gradually cash out on the way up.

I did a lot of their previous issue, this one I only nibbled at. It may trade well for now. Am a little surprised at it’s strength!

The parent, MBIN, is a bit different than a “traditional” community bank.

MBIN derives a vast majority of net income, roughly 55%, from mortgage warehousing operations, which is essentially funding a mortgage from the time of origination by a broker to the ultimate sale to federal agencies. Another 15% of net income is derived from the sale of multifamily loans to federal agencies while the remaining 35% is through more “normal” banking activities (%s exclude inter-company eliminations & per 10-K).

In comparison to peers, MBIN currently shows superior ROAA and ROATCE profitability returns, which is largely attributable to a lower cost structure (e.g. fewer employees & branches), fees earned on loan sales to agencies and more leverage (e.g. lower capital ratios, notably common equity).

Given the nature of the warehouse business model, MBIN recognizes a lower net interest margin (e.g. short-term agency approved lending) and will largely make up the difference through volume and turn.

Given the current level of residential mortgage activity, profitability is strong, but like all residential mortgage focused banks, cyclicality associated with future profits is of concern (which is why MBIN trades at less than 8x forward earnings).

Bank common equity is low for MBIN, 6% TCE/TA ratio, and has declined over the past few quarters given the strong mortgage activity and associated growth in assets. Currently, and on a historical basis, MBIN has reported superior credit quality to that of peers and appears to show strong reserve coverage ratios. Such would be expected given the short duration lending model and ability to sell said loans to federal agencies.

Other banks participate in the mortgage warehousing space, but few have MBIN’s level of concentration and exposure.

Thank you Josh. Your post about MBIN is helpful deciding to buy or not at what price.

I guess they have to pay 6% i.e. a bit more than other regular small banks, as markets think they are a higher risk ?

IMO, rate reflective of:

One of the smaller preferred issuers at under $10 billion in total assets.

Also, TCE/TA at 6% is on the low end.

Cyclical mortgage concentration / exposure.

Mitigated by strong current profitability and lack of credit quality issues.

Josh; THANK YOU. That is great info.

I was extremely close to pulling the trigger on this one. I read their last quarterly and also their last annual which is very time consuming. Iam wrestling with this one. Just can’t seem to pull the trigger. By my standards its a very small bank. For you Bank Experts out there please feel free to chime in as to WHY you like it alot for a long term investment.

Good morning Tim; Can we get your opinion on this as a Long Term Hold??? I really don’t do any flipping so I tend to look at these things differently than most of your folks on this site. I just don’t have the time to flip in and out of everything these days. I did buy a pretty big dose of the TDS+U and it seems to be moving higher which always gives one some comfort.

In at 25.25

Hey Martin,

Appreciate all your info and insight in the Flip/Divy capture category. In for the same 25.25… Relatively new the preferred game in general, using this one as my first flip. just curious what your goal and expectations would be here? A quick run up to 26 and out? Thanks!

No price target, just whatever I can get. After doing it for awhile you get a sense of price movement.

One thing I look for is comparison to their other preferreds. MBINO in particular since they are similar. I bought the new one because it was priced lower and I’ll think about selling when the prices are close. Unless it’s worth keeping, or even swapping for the other one.

I bought a double position.

Half to flip and half to keep. Got a little at 25.24 and some more at 25.25