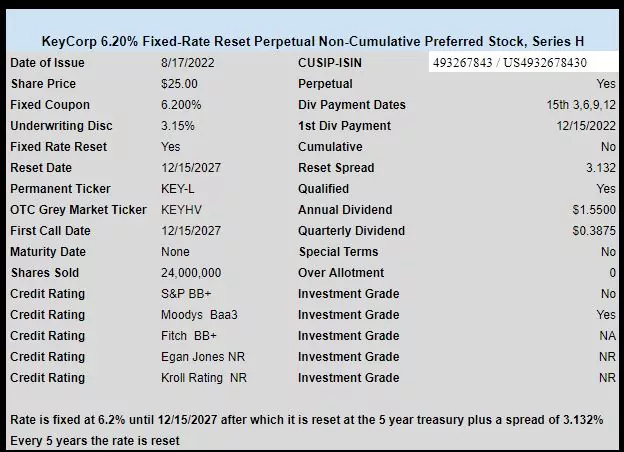

Banker KeyCorp (KEY) has priced their newly announced fixed-rate reset preferred.

The issue is split investment grade (Moodys is IG, S&P and Fitch are not) and carries a nice initial fixed rate of 6.2%. The reset spread is 3.132% which is added to the 5 year treasury yield starting on 12/15/2027 and then every 5 years there after.

The pricing term sheet can be found here.

This is now trading as KEY/PRL. $25.16

KEYHV trading $25.10-$25.30 and can be bought at Fidelity and TOS. Surprised it is not trading higher…

Vanguard says cannot place trade for it electronically and Schwab cannot ‘find it to buy’ but does give quote for it!

Thanks. Was able to buy at 1:40pm via Schwab. Etrade will not accept the order. Agree with you. Also surprised at the pricing.

Was able to buy KEYHV at Fidelity

To me it’s pricing is not surprising. Recent issue MS-P is currently yielding 6.14%

So to yield the same KEYHV should be priced at $25.25 – about where it is trading

Yeah,,,very surprised at the opening price. Picked ups shares at $25.20 on Fidelity. It was interesting that early on it had traded 71,400 shares but there was no bid/ask. I think volume now is just over 2 million.

Would anyone know if the ticker has changed? Couldn’t find it at Fido, tried the expected variations but no go. Thanks.

See Tim’s Monday kickoff post. KEYHV is now KEYHL and will be KEY-L when off the OTC.

If you had already bought some at Fidelity it appears with a long # instead of symbol and likely ‘no number’ at Schwab!

Thanks mSq, found it after open, trading as KEYHL.

I prefer buying below liquidation pref (par) as well, but I always look at the YTC as a sanity check.

For me, unless its past call, YTC is indeed the “sanity check”. For me today I did buy a ~ 3 year duration ute bond at $97.50, below par. But for me the 4.62% YTM was all that mattered since I will hold until 2025 maturity.

I just calculated the actual YTM assuming 5 years and no reset….. at a purchase price of $26.25 and I get 5.06%. When I compare that to current non-callable CDs at 3.5% and zero risk I’m not really sure this KeyCorp Preferred is that compelling.

I hate paying more than par for anything. Based on the previous Morgan Stanley Preferred which is trading at around $26.30 I’m assuming this KeyCorp Preferred will immediately shoot to $26+.

Even at $26.50 I think I’m still yielding 5.8%.

I was wondering how the more experienced traders deal with this.