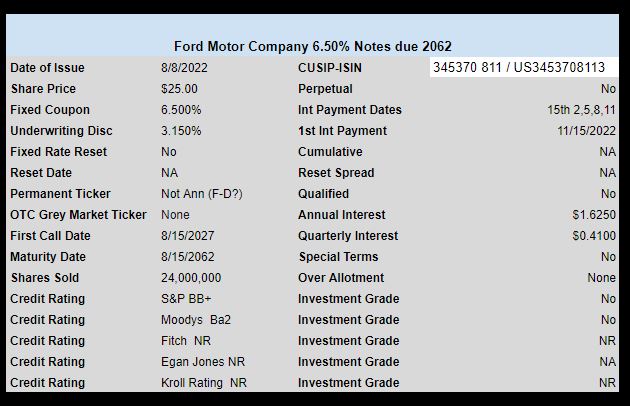

Ford Motor Company (F) has priced their previously announced new issue of $25 baby bonds.

The issue of 24 millions hares (bonds) prices at a rather tasty 6.50%–on the other hand the issue has a long dated maturity in 2062. The issue is a notch below investment grade at BB+ from S&P and Ba2 from Moodys.

This issue will not trade on the grey market, but will likely start trading in about a week on the NYSE.

The pricing term sheet can be read here.

I have 100 shares of this in my small account and it pays me $40.63/qtr. So I think this might pay $0.40625 quarterly.

Why would I buy this issue when I could buy the Ford bonds 7.75% of 6/15/ 2043 trading at 95 or so?

Seems a lot to pay for the liquidity of a baby bond.

The Ford Preferred D shares now offer a YTM of 7.77%. Easier to trade than the bonds. Picked up some today for ex dividend tomorrow in my IRA.

It opened under par today

Bonds, Preferred, Note– hey that’s not confusing… err, I guess it is if you look at Schwab — they list F-C & B as preferreds – have to find them with F/prB, etc.

I guess the new D, will be a preferred for them. I wonder how the record the coupon payment- interest or div?

Ford 6.500% Notes due August 15, 2062

Symbol F PRD

CUSIP 345370811

First day of Trading August 26, 2022

Thanks EB

Has anyone found a brokerage selling this?

call your brokers bond desk and ask for cusip 345370811. trading around 24.9

No. It’s not at TD or Fidelity. Called Fidelity bond desk….hours later they called back and said the issue is so small that they couldn’t get any. hmmm

If you’re on Fidelity and call the bond desk (or research it yourelf) you might as well look at the other Ford Ba2/BB+ issues of bonds they can show you in the 1k par field… A quick look shows that 6.50% + YTM is not all that hard to get on the name with even shorter maturities in the 2040’s

2WR, thanks. I did exactly that using FINRA and found something I liked almost as much with a higher yield. Appreciated.

F-C is a 6.00 coupon. Both B and C have current yields way below new issue 6.50% coupon. I expected deal to print at 6.25 ish. 6.50 higher then I thought. Possibly will open over par

B really tanked. It had been one of the stronger pfds in the sell off of 2022. Almost hit 27…..was around 25.50…. Now last I saw 25.50 off like a buck in two days. C is firm?? Figure that!!

Not sure how much related to this new issue but F-C the 5% coupon preferred now trading below $25 and goes ex-divd 8/16 so perhaps a decent dividend extraction play?

Hi m, QOL lists F-C as a 6% Coupon baby bond? Are you talking about the same security?

Yes, a typo saying 5%.

F-C is indeed a 6% coupon. Here is the data from this site showing big red volume candles as this continues to sell below $25 past few days

https://innovativeincomeinvestor.com/security/ford-motor-company-6-00-notes-due-2059/