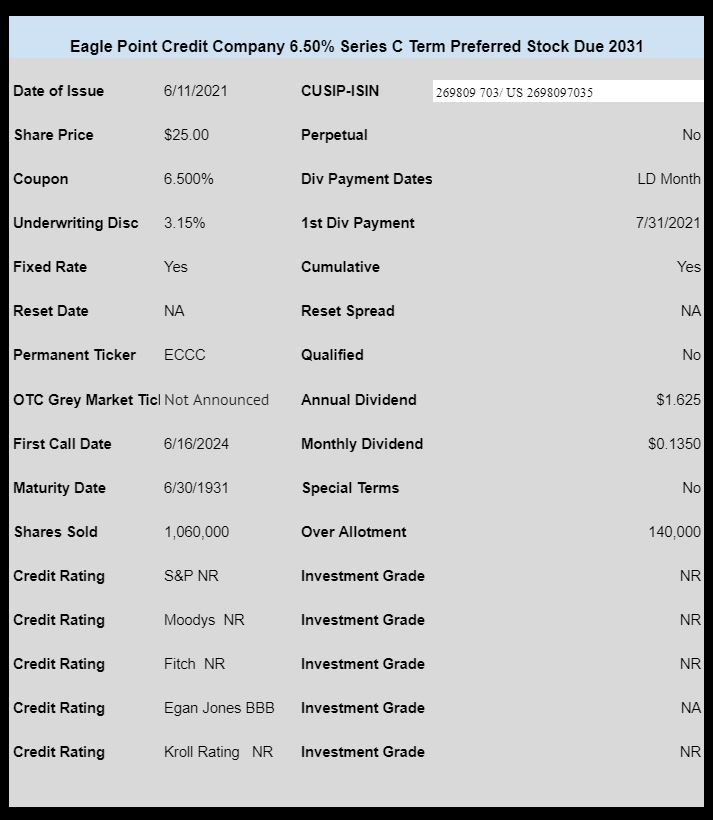

Eagle Point Credit Company (ECC) has priced their new term preferred stock issue with a coupon of 6.50% (note the actual trade will occur today).

The issue is a monthly pay preferred and is cumulative and non qualified.

There is an optional early redemption period starting in 2024 with mandatory redemption in 2031.

The issue is likely to trade on the OTC grey market, but the temporary ticker has not yet been announced. It should be out today.

The pricing term sheet can be read here.

Big boys are doing the buying 1600, 20,000, 35000. 24.55 low, now > 25.

TDA & Schwab showing last as 24.93, but not current. no B/A vol >250k

Guess they’ll be selling to us Mon.

Well Gary, I can’t resist. Don’t be a sexist…..what about big girls? Oh OH I don’t think big girls works either. How bout big ah ah. Being politically correct does have some drawbacks I guess.

Schwab recognizes the temp ticker (ECCPP) however; no trades / no values shown. I have always wondered if I should place a limit order (i.e. $24.90) at this time (assuming the system would allow it)? Even though the prospectus offering price is $25, it is a little un-nerving bidding on something that is yet to trade.

I tried to place a limit order on Schwab and no dice mi amigo.

Volume is now 24,800 according to Schwab.

WTH?

I am on the phone with TDA and they are clueless. The ticker quote show 24K vol but no bid/ask

110k now. I thought they might be desk call orders, guess not.

TDA (and Schwab)doing some weird stuff on AATRL- low is actually 58.01at 12:21:24EST, they report 59.98

odd lots don’t send HOD/LOD

Spoke to Schwab bond desk – they can confirm that it is trading somewhere (???) but cannot see a price. The rep told me it broke “syndicate” but it may just being sold directly to some buyers before it trades on the OTC.

6.5% is too low…I’m thinking of putting a limit order in around $23.25 to get the yield up around 6.99%…

I know, I’m a dreamer… but 6.5 is so low compared to the ECC dividend/distro…

Which really means I’ll try and buy the Preferred under $25.00 and enjoy the security of the Preferred rather than the Rolaid factor of ECC…

ECCPP otc ticker.

“Offering is expected to close on June 16, 2021”

What exactly does this mean? Does it mean it won’t be available with a temporary ticker on the OTC market until 6/16?

Seems not, as aview just posted the OTC ticker as ECCPP.

Altho- last week there was one that traded a day earlier than that stated date.

TD has the symbol- no B/A, BUT shows 9.8K vol ??? Why vol?

It’s in the Schwab system now, but no vol or B/A

Fidelity Bond Desk just told me June 16th…hurry up and wait?

Typo: the maturity date is in 2031.