Disclosure–I own this security and am ‘talking my book’ here. Not a recommendation as each investor determines their own risk/reward demands.

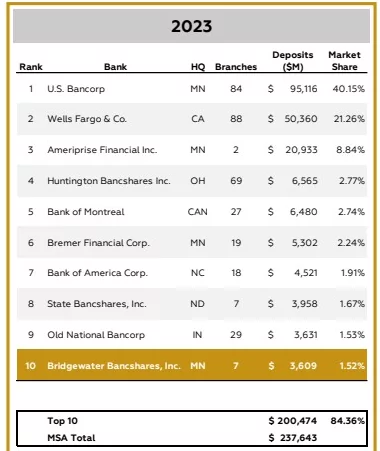

I am trying to figure out what I am missing with Bridgewater Bancorp (BWB), the smallish Minnesota bank that I have mentioned many times. Is it simply because I live in Minnesota? Certainly I have a bias in that regard–sometimes it seems like you ‘know’ a company better just because you drive by their banks from time to time. But in the banking scene in Minnesota this $4 billion banking company BWB is simply a pimple on the butt of an elephant.

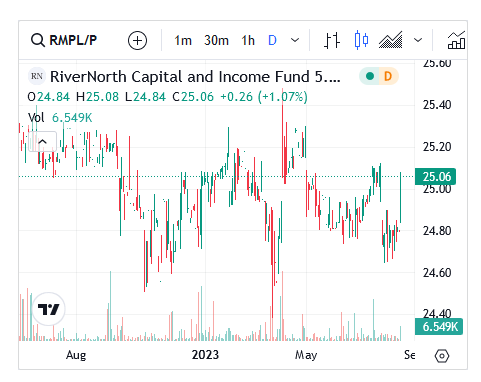

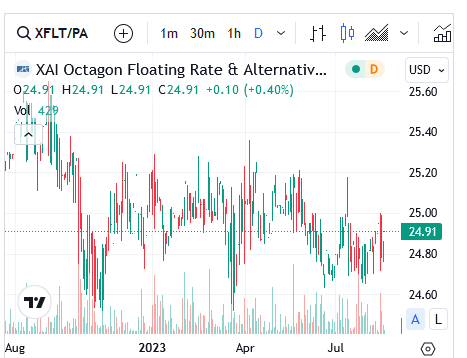

Is it because while many banking companys have had their preferreds jump nicely in the last couple weeks as interest rates have dropped little old BWB has gotten no bump at all and thus yields 9.55% at Fridays close? Why is my little banker preferred being punished?

Is it because someone ‘knows something’ I don’t know? Not very likely given the banker just published their 3rd quarter investor presentation 4 days ago—it is here.

Or is it simply because as Gridbird has correctly said many times ‘names matter’. Witness the Gabelli Funds CEF preferreds–really nothing special about these funds but the preferreds garner great respect—but the name-Mario Gabelli – the friendly gent we have wached on TV since ‘Wall Street Week” with Louis Rukeyser started in 1970 garners respect. Bridgewater Bancorporation – who the hell is that?

Well to get by the bolony stuff –what are their numbers? Is there big time trouble ahead? Well let’s check the data out!

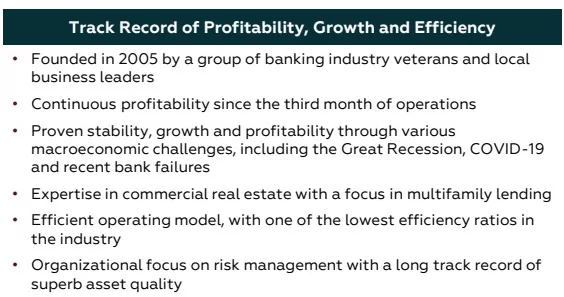

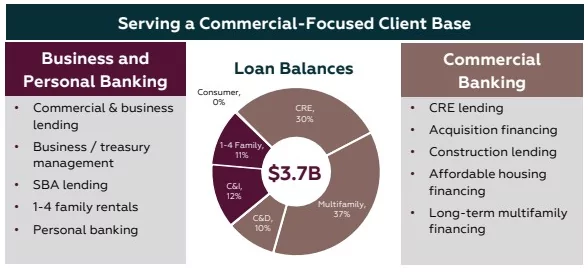

A thumbnail sketch of BWB–

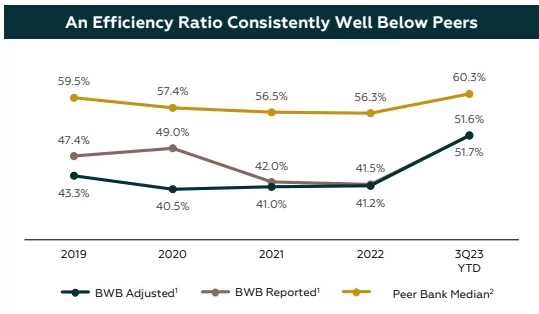

I have been quite amazed at the efficiency ratio of Bridgewater. Only in the last 6 months have I started watching this as a sign of a well run bank. BWB has always been low – although with the net interest margin getting squeezed in the last 18 months their efficiency ratio jumped – but still very low compared to competitors. I suspect they will get their net interest rate margin up during the next 6 months and their ratio will fall. The efficiency ratio is how much non interest expense is required to generate revenue.

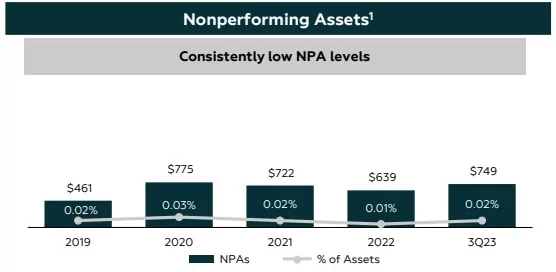

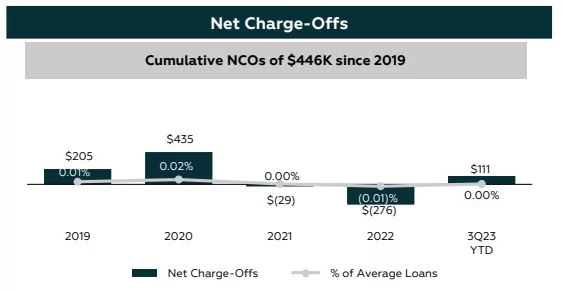

Then I look at the non performing assets and net charge offs – to say they are low would be an understatement. Less than 1/2 million charge offs since 2019–essentially zero.

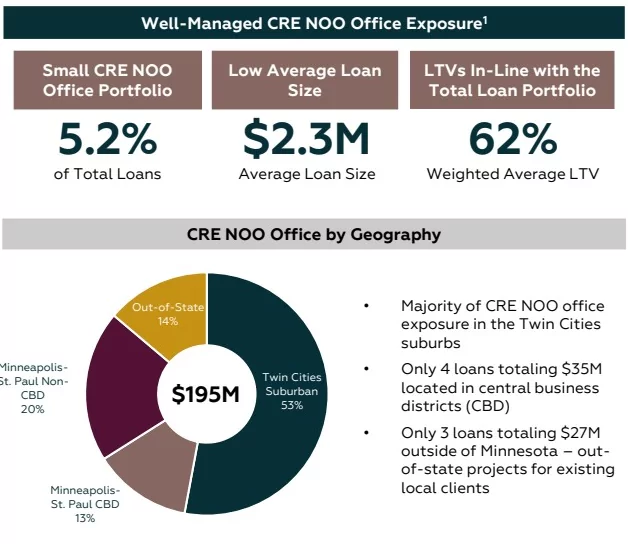

So does BWB make office loans all over the U.S.? No–only 14% of the office loans are out of state with the balance mainly in the Twin Cities–and only 13% of those are in the central business districts (downtown)-the balance are suburban. The average loan size is small with excellent loan-to-value (although one should be skeptical of LTV numbers of all lenders–values are falling and what was a 62% LTV might be 80% now).

Or maybe it is articles like this one that ran in the local newspaper a few days ago that has spooked investors (not sure everyone can access–I have a subscription). Although with a 2.98% of office loans in default across the Twin Cities right now the risk seems somewhat muted. Will defaults rise? I think they may double or even triple in the next year depending on where interest rates go. But as shown above the average non owner occupied office loan at BWB is $2.3 million – these are more like loans on small properties – realtors, bankers, dentists and the like – not office towers in the downtown area, which seem to be continually in trouble. I would expect BWB to experience some increases–but not super serious increases—when you are near zilch there is only one up to go.

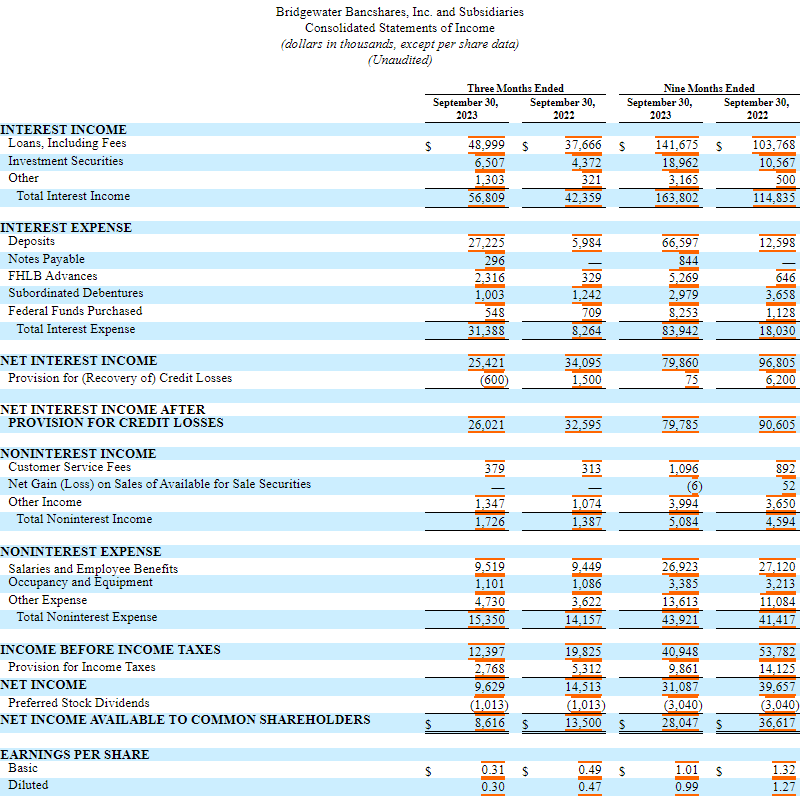

Yes earnings at BWB have been down—not unexpected as the costs of funds rose sharply–as it did for every lender. As you can see below the cost of funds rose 5X year over year. While interest income rose substantially it certainly didn’t keep pace with the cost of funds. This will change for BWB and all banks as the costs of funds falls and interest income rises. So assuming this is already occurring as rates have fallen I would expect improved net interest margins—at least for the next few quarters (then who knows for sure as the interest rates for the future are not really predictable). Below are the financials for the latest quarter and 9 months–softer–yes–terrible–no.

So with a careful review I added to my position on Friday and added more this morning (at 15.52) I am at now at 50% of a full position. We’ll see what happens and determine further moves.

Note that I am ‘talking my book’–this is not a recommendation, but at 9.55% current yield the risk/reward seems good – I would think a 10-20% capital gain is attainable in the next 3 months or so (plus dividends).