Once again an important economic number is set to be released in 30 minutes–the monthly employment report.

Expectations are for 200,000 new jobs created in December with the unemployment rate staying flat at 3.7%. Yesterday ADP reported 235,000 new jobs versus a forecast of 153,000 (for what ADP is worth).

Yesterday was another green day for most preferreds and baby bonds—3 in a row. Whether we will see a 4th up day is totally dependent on the employment report–we will likely see wild swings in equities today—right now futures are totally flat. Interest rates are up 1-2 basis points.

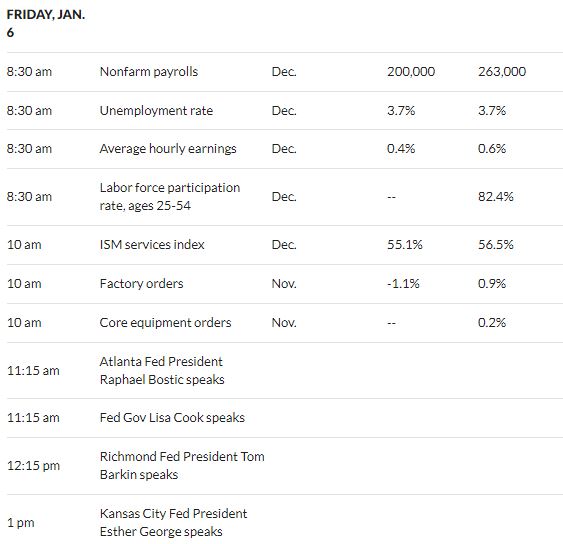

Below you can see many economic items will be released today and we will have a plethora of Federal Reserve yakkers–hopefully they won’t be controversial–but who knows for sure.

In the past week short-term rates and short-term rates have decoupled. Short-term rates have risen while long-term have dropped. The rise in short-term rates are mainly determined by the Fed, while long-term rates are determined bu the market. IMO, the market is saying that expecataions for long term inflation is declining. This is good for preferred securities and bonds!

Cheers!

Correction: “In the past week short-term rates and long-term rates have decoupled”

(This mistake would be no suprise to my wife, as she deals with several a day)

We are focusing on numbers like employment and wages yet what is important to the fed is inflation. We see inflation numbers down the fed might just do a 25 bump in rates.

Unless we get a great CPI report next week, I believe the Fed will raise rates by 50. The fall in unemployment will cover the move politically. If I am Powell, I am much more worried about the possibility in the near future that the Fed would need to raise rates even after the unemployment rate starts to rise. Get 50 out of the way now. I would want to take this opportunity to get ahead a little bit so that the rest of rate decisions relate to choices between 0 and 25.

Potter, My company locks in contracts in Dec. for stock delivered in Jan. I am still waiting for my cost basis to work off of for this month. Looking at commodity pricing for Dec. I say my guess is .02 bump for this month.

My conclusion is based on politics, not econometrics. I believe that a great untold story was the pressure that the White House brought to bear on Powell in the Fall of 2021. The Fed had an insider trading “scandal” and the White House’s Build Back Better program was failing. The ‘blind eye view’ that inflation was transitory was necessary to promote BBB. In the meantime, four Fed seats were up for appointment.

Now that the seats have been filled, Powell is again somewhat independent except for his budget which is negative and will require Congressional approval. If we add to that an increase in unemployment, I expect Powell to bend to (bi-partisan) Congressional ire at the thought of raising rates when unemployment is increasing. Color me cynical, but it always seems to pay to underestimate American politicians.

I think we will get at least 50bps from the Fed regardless of how loud mass media squeals and tries to spin the CPI numbers next week. My real question is when do current online bank Money Market rates begin to decline from from their current 3%+ and along the same line of questioning, when do online bank 5 year CDs at their current 4.25% or so rates go into decline as well? I think we’ll get one more more bump out of each after the Feb FOMC meeting but I’m very uncertain regardless of the Fed’s forward guidance or dot plot where the banks and Market will go from there.

Thought they telegraphed 25 bps at each of the next 2 meetings. That’s how I interpreted it.

Charles, Here’s one.

Texas 7/16-in 4-ft x 8-ft OSB Sheathing…

April 2022: $46.95

January 2023: $7.75

Commodities can be a bloodbath. Had one distributor with 26 truckloads of roofing in his yard last July and that was just one branch. They were being told Insulation ( probably rigid, oil by product ) was 6 months out on delivery.

Specialty products like Fire rated ACX I was quoted yesterday 111.85 each subject to prior sale and 72 hr quote. People trying to keep margin up and not take a loss. Gives me an idea, very few manufacturers of that product. Wonder what the stock is for Hoover treated wood products.

Looks like the numbers were basically strong. You’d think we’d be heading down but things are ramping…even TSLA bad news not hurting the Naz.