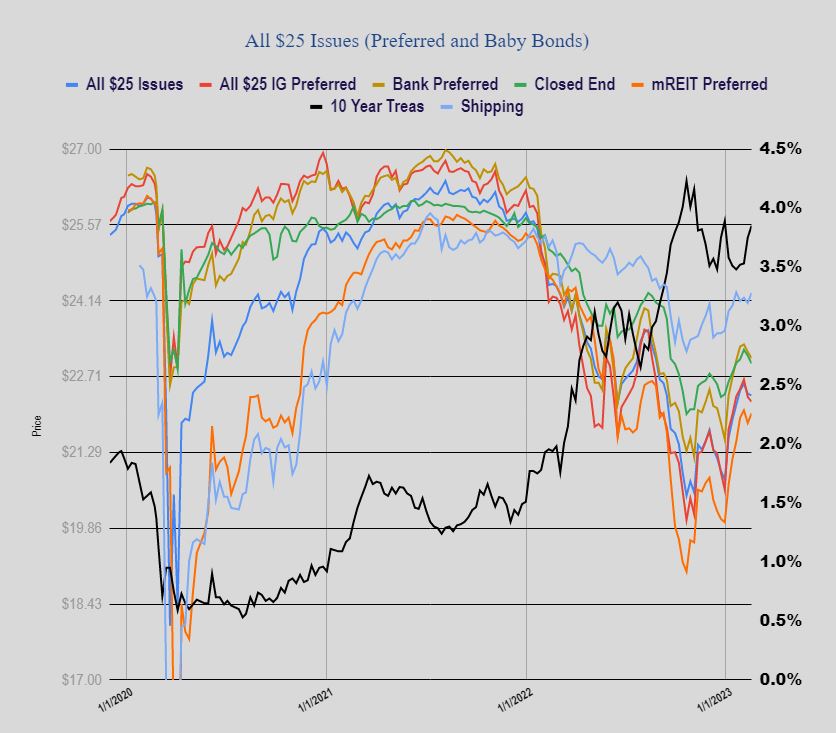

Investing is a mental game–and mentally everyone is worried this week. Of course not much has really changed since last week–but all the folks who were deniers of higher interest rates last week have now done an about face to say ‘higher for longer’. Certainly we can see they are much higher today with the 10 year treasury yield ramping up to 3.93%–up 10 basis points. Finally all the Fed yakkers are getting to folks.

Right now the average $25 share is off almost a 1/2%–surprisingly it isn’t worse.

I’m doing what I always do – watching for potential buys – but not very motivated to pull the trigger since we are being paid to be in cash and there are no real ‘bargains’ out there at this moment.

I am watching the Affiliated Managers (AMG) baby bonds and the Federal Agricultural Mortgage (AGM) preferreds. I had decent positions in these issues up until a couple weeks ago when I trimmed off a bunch to capture some nice 10-12% capital gains–now I am looking to re-enter when they set back some more.

The MGR 5.875% Affiliated Managers baby bond has set back 6% in the last 2 weeks from up above $25 not sure at what point I buy more of it–no rush–maybe a dollar lower would be a decent place to enter a Good Til Cancelled buy order.