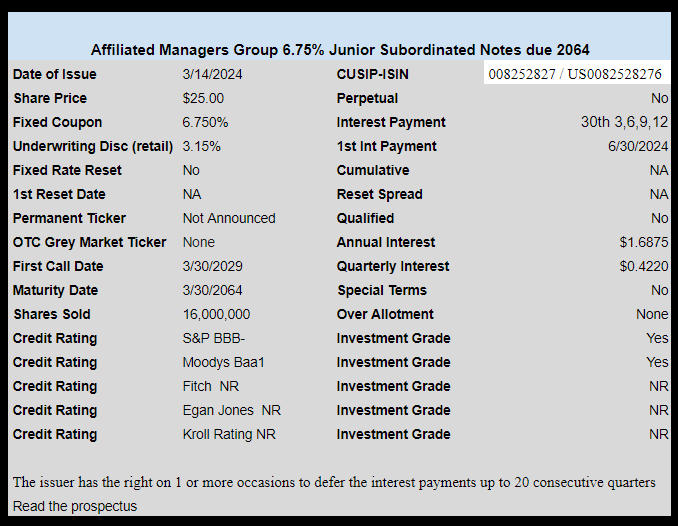

Affiliated Managers Group (AMG) priced their previously announced baby bonds.

The junior subordinated notes price at 6.75% with a maturity date in 2064 and an early redemption date available to the company in 2029. Bonds are investment grade.

The pricing term sheet is here.

MGRE is the symbol, starting trading today. For me, a pass at $25.43

Any word on a symbol – temp or otherwise? Thanks!

Yeah I see a symbol but it doesn’t show a price when entered. But the price showed around 25.10 so it is trading, somewhere!

Anyone mind sharing the symbol? I can’t seem to find it on the link. TIA

Now I’m seeing over 25.70

Is it just me or is this BB getting more interest than ATHS? I realize ATHS is a reset but you get paid more until 2029 where you take that gamble it will reset above 6%. It is also rated higher but it is Athene which some shy away from or might already be heavy in it?

Just try to buy at Schwab through the bond desk, they are useless they could not see it even though I could see it on the residential website.

I called back and this time got a different representative who was able to enter a request. I will post if the request is actually successful. Thanks.

If anyone is interested I bought some at Schwab through the bond department near par

Do they charge for their assistance?

I didn’t any commission.

I tried today and he said there was a fee included in the quote that he couldn’t waive.

Was just able to place a bid at $25.18 through the bond desk. If it fills, I”ll pay a $4.95 commission. Had to beg to get the broker $25 fee waived. Not sure if it will fill, I’ll post later.

Checked a few minutes later, filled $25.15

Did you call the number on the website? They could not help me.

yesterday I bought some PRIFH at $23

Priority Income Fund 6.00% Series H Term Preferred Stock Due 2026

YTM around 9%

Living on the wild side Peppino?

https://seekingalpha.com/article/4543183-priority-income-fund-an-8-1-percent-yield-to-call-on-the-2029-preferred-shares

always on the wild side!

Thanks P for the chuckle!

Question I should know the answer to: Do baby bonds trade with accrued interest or do they trade flat like preferreds…ie. Is the accrued in the price you pay? Thanks

Generally baby bonds trade flat

Thanks

GLPPRA 9.75% floating preferred called today for April 15. Shoot! I was making 12.0% on it!

Bought in Nov for $24.97. Should have sold Jan 30 at 26.92. Wasn’t paying attention and dropped to $25.40 today for accrued div. Hmmm.

wow it wasnt on Quontum ?

FIDO already has CUSIP in the system. Tried to place an order online but the computer says “Not in inventory”.

It will be interesting to see the demand for this paper. It does meet the BARE minimum for the gotta have IG crowd.

It has ALL the sucky things one could throw in a bond;

interest deferral

junior sub

not a 7% yield

maturity is in the distant future..2064

BBB——

FWIW I do have some of their issues, but bought at fire sale prices. Most likely will not sell those already purchased. YMMV DYODD

For trading purposes I think that this will be fine for buying at the initial offering then SELL SELL SELL.

What say you?

Almost all preferred stock is perpetual. On this board, I keep seeing the concern of long maturity dates for baby bonds but rarely see the concern that most preferred issues are perpetual. Long maturity is shorter than no maturity (perpetual).

Is there some data that suggests baby bonds are called less frequently and are on the market longer than preferred stocks? I have found none and yes I have looked.

So, what say I? Agree with everything but the duration concern. I know I am looking at this differently than almost all the posters on the site. Just sharing my rather tiny minority viewpoint.

Hmmmm interesting thoughts…

I never rely on an issuer to call as I don’t time interest rates. I did think about what if this was called in 2009. If that works for you, then more power to you.

So let’s say I keep the bond until it’s called. I get 5 yrs @ 6.75%. I would rather just buy a 5 yr NMFCZ @ fido @ 7.35% from the bond desk.

As far as price volatility, all long bonds move around. This may present itself with another trading opportunity.

Nonetheless we all have our preferences.

This is priced and trades as a preferred stock. $25 a share and buy/sell just like any other stock, ETF, or preferred share. That is why I compare the maturity dates of these instruments to the maturity dates of preferreds (which generally have NO maturity dates).

I have no plans to hold any of these beyond 1st call date and generally exit them before that.

I am not sure that I am into the comparing apples to oranges camp using your method. I believe you have a logical fallacy on the comparison, but if it works for you more power to ya.

I just gave an example that it is pretty easy right now to beat 6.75 on five year paper. I don’t care too much about the packaging of the investment (10/25/50/100) only the risk and cash return.

Yes, as I said, my views are in the tiny minority of this board. I am comfortable with how I view and compare things.

No worries Steve. You’ve been a good sport. You’ve got my respect just for that.

In all honesty, I sometimes use your method when there are no easy substitutes.

We all have our secret or not so secret recipes. 🙂

Yes but compare to their other 3 pfds…. its attractive. I heard 24 7/8 by 25 1/8 late. Its the type trade where you have to put in a limit price and hope it gets hit if you really want it.

I was trying to figure out the rhyme or reason Entergy calls their far out maturity baby bonds early last night and I failed. It seems baby bonds are just as likely to get called as preferred. Otherwise one would think we would have a batter selection maturing over the next 10 years then we see today? Most are way out there remaining.

Personally I view these instruments as the same as a perpetual preferred. A junior subordinated note for all practical realities is a preferred stock masquerading as debt. With the only material difference being the company pockets the tax break instead of a QDI preferred stock owner. So which to buy is based on other factors with one being here the reset adjustment, ones tax bracket, what account bought in, credit profile comfort level, etc. etc.

@GB and others

This,,,,”the company pockets the tax break”. So true so true…

I didn’t want to go there as it adds another level of complexity.

I would also say IMHO that debt usually has the advantage, especially for those buying off a legal list in a fiduciary role. These fiduciaries are big buyers of IG debt and provide a stable source of debt buyers.

I am not 100% sure, but aren’t preferreds even if they are IG off the legal list. My trust company foo is not so strong. 🙁

I am not familiar with such info, but historically speaking companies and institutions owned considerably more preferreds than individuals. Well back into last century there was considerably more of a tax break savings owning preferreds for corporates than for individuals. I would think sub notes arent really sent to market for interest of certain buyers, but for cap stack reasons and tax efficiency for the sellers. These sub notes issued generally receive the same 50/50 debt/equity ratio assignment as preferreds do for credit rating purposes. But unlike the preferred, they still pocket the tax deduction,

Definitely no. Besides who cares Entergy pfd have always traded rich

SteveA; I am 75, anything longer than 10 years is perpetual to me 🙂