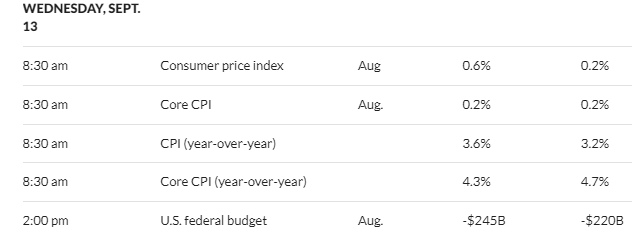

The 10 year treasury barely moved yesterday–trading in about a 3 basis point range. Today may be a totally different day with the consumer price index being released in an hour. The headline number is forecast to go much higher year over year and core is forecast to be lower.

Any substantial deviation from forecast will send interest rates much higher or some lower. We’ll see.

Oil is up again this morning – knocking on the door of $90/barrel which is getting very near a 52 week high. This is a bit scary as fuel prices at the pump translate into reduced consumer confidence fairly quickly–it is a quick and very visible hit to the pocketbook. I know in Minnesota we saw prices at the pump up 30 to 50 cents/gallon recently as a number of refinery’s were down at the same time–that was fairly painful and it occurred quickly-overnight.

No investment decisions are made on any one number and this time it is not any different–no moves by me today, but today will factor into the decisions over the next week or two.

I am back to selling some of my XOM, I bought cheap, so it’s time to lighten up some more. unfortunately, I have run out of LT tax losses I can harvest in my taxable account to offset it. I guess its a nice problem to have.

I got gas this morning on my way home – $5.05 at costco in San Jose. Up about 25 cents from last week. I am still driving my old pickup, so I feel it. My wife laughs at me because drives a plug-in hybrid she got last year. it usually charges in just over an hour at home, and that gets her around most of the time. Last weekend she bought her third (10 gal) tank of gas since last October.

Today’s activity was to add more GDVprK to my wife’s IRA. I chose this instead of the CD route for several reasons. Investment grade with 700% coverage. The 5.6% yield on cost is good until at least 2026. The low 4.25% coupon makes it less likely to be called (I think). If it is called, since the price was $19.00, there would be a 31% capital gain consolation prize. Thoughts?

sensible. it’s the sort of share where you could always buy more if it goes down. I own the fund too.

Agree with your thoughts. Investment grade, capital gain potential, low call probability with todays environment, and good,steady, fixed payment may be good for many years to come. As a retired person, makes for less worry and better sleep habits. Whats not to like about it.

Jersey—a good safe play – over time a fair coupon and of course if rates move lower some capital gain to boot.

I own GDV-K in my ROTH, slightly underwater at this time, but not concerned as it will likely be passed to my kids in due course.