Wells Fargo & Company has announced the pricing for the previously announced preferred stock issue.

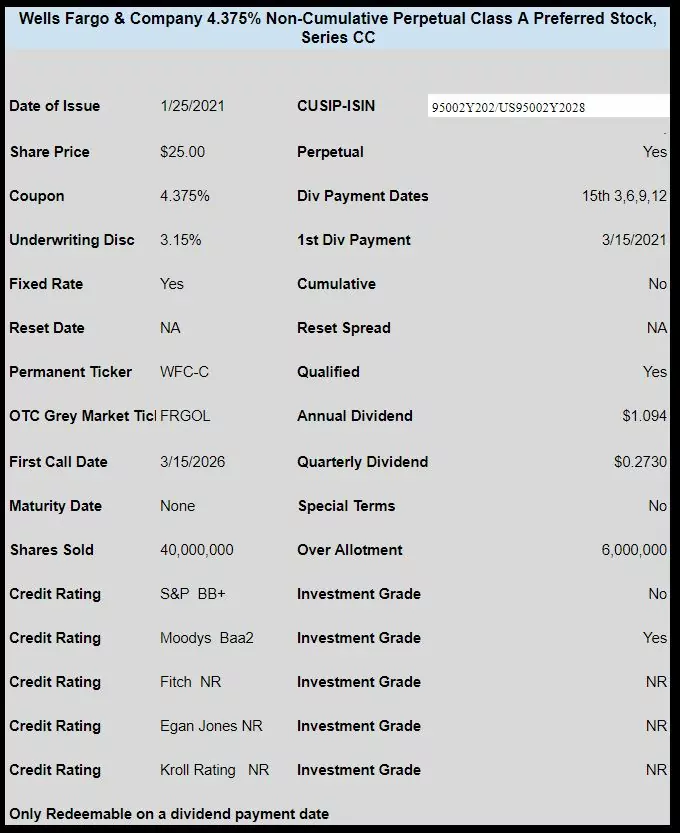

The issue priced at 4.375% for a split investment grade issue (Baa2 (IG) from Moodys and BB+ from Standard and Poors).

As is typical from the big banks the issue is giant sized with 40 million being sold with an over allotment of 6 million shares available.

The shares trade immediately under temporary OTC ticker of FRGOL. Shares will trade under permanent ticker of WFC-C in a week to 10 days (most likely).

The pricing term sheet can be found here.

Last week WFC sold a $3.5 billion issue of 3.90% Fixed Rate Reset $1,000 preferred with the same ‘use of proceeds’ language as the new issue–‘may be used to call preferred shares’. In combination with todays $1 billion share sale they have $4.5 billion in new money to call shares – no doubt some issues will be called.

It is likely they will call the 5.70% WFC-W issue, the 5.25% WFC-P issue and the 5.20% WFC-N issue on 3/15/2021 (a dividend payment date), the W issue is callable on 3/15/2021 and the other 2 are currently redeemable. All of these are trading around $25.40 so there is little call risk.

Why buy this when I can buy WFC-L at a yield above 5%?

If you are math challenged or don’t have $1,450 to buy one share of the L.

Be careful buying low coupon new issues in this low interest rate environment. You could be holding it forever with principal loss. Its tough if you need income right now. Should I buy or should I wait for interest rates to possibly increase. Who knows.

I kind of look at it as a portion of my portfolio that could pay 4.7% forever and one needs to be prepared for that.

There is not much of my portfolio that I am OK with this kind of return but there is a small part that I am OK with it. Its a SWAN in that regard.

In a year it could be 25.25 and I move on – who knows.

Bill, that is the hard part of mentioning purchases as we tend to extrapolate that particular issue into what ones complete income portfolio is. As long as one has a plan and understands what they are doing along with the consequences its probably a sound plan. We all can guess but no one can accurately predict near, mid, or long term yields. My dad would say with his preferreds back in the day, “I dont care if they go to a penny, as long as I am getting my 6%.”. And he meant it. Fortunately he didnt have to prove it. Others may think they can do that, but find out too late they werent as committed to ignoring paper capital losses as they anticipated.

I go from sub high IG 4% perpetual to 11% plus dirt bag baby bonds, so I personally play in many sandboxes at the same time.

Grid – Absolutely correct! Everyone’s objectives are different starting with something as basic as weather one is using the holding for wealth generation or income. I’m pretty sure we have both in this community!

HELP: QUESTION

Please, when a new issue is annuncied (as now FRGOL/WFC-C) it appears in this complete/excellent overview summary (box, above here); after some time (months, years), where/how can this initial frame/box COMPLETE be found/recovered? on this website; never again appears in “SEARCH”s!!!

T.Y.V.M.

Miguel, -have you tried using the box on the right hand, under tweets ? It will bring back the initial comments on that issue

Miguel, as JaMad points out, the search box located beneath the Twitter feed in the right nav is an ‘open search’ text box, and should find the string you’re searching for (in this case ‘FRGOL’) anywhere on the site.

Once this issue is trading under its permanent ticker, there are two other methods you can use:

a) use the Security Finder page: the link is in the top nav, second from the right. The direct URL is https://innovativeincomeinvestor.com/income-security-finder/. Once there, use the various controls to filter down the securities list to what you’re looking for.

b) use the ‘Parent Ticker’ search box in the right nav (above the Twitter feed). This is the same as going to the Security Finder page and entering the parent ticker there. You may only ever need to use this method, but I point out the Security Finder in case you ever need to look across the universe of issues Tim tracks and filter by various parameters.

I don’t understand why you’d buy this instead of OPP-A with the same coupon, cumulative dividend, and asset coverage protection.

A closed end leveraged bond fund with 270 million in assets compared to Wells a 120 billion dollar TBTF bank??

Because WFC pfd is more than ten times larger. Bid ask much closer. Has a 10 other issues and some 5,000 cusips with which to compare. Its not the same thing. That being said OPP.A looks pretty good!

If You Prefer to use faulty measurements such as company size to determine whether a security is a better value, then I can’t help you.

That’s hysterical. Did I ask for help??

Just because you didn’t ask, it doesn’t mean you don’t need it. You said several nonsensical things; I hope you figure out what they are at some point.

I bought a bit at 24.72 on fidelity just to throw in the sock drawer

OTC symbol FRGOL

$24.73 for 200 vanguard @ 9:50 AM 1/26

Yep.

Picked up 2 lots of 200 at $24.70 near close; trades as FRGOL on Vanguard

Thanks for tip Tim.