Well here we go on another week–whether one is taking the opportunity to add to some CDs with coupons around 5.3% or hunting and purchasing quality preferreds and baby bonds at bargain prices there will be something available for everyone!!

Last week was a somewhat uneventful week–in spite of the release of the supposed preferred inflation indicator of the Fed–the personal consumption expenditures (PCE) with its various inflation indicating components. Overall I would say economic news last week was a bit soft–we’ll see if that continues this week.

The S&p500 moved almost 1% higher last week–actually +.94% from the close the previous Friday. Can it go higher? Of course it can–for folks who think that shorting equities is a sure fire bet I can only say you better have deep pockets–the trend and the momentum is higher and where it stops no one knows.

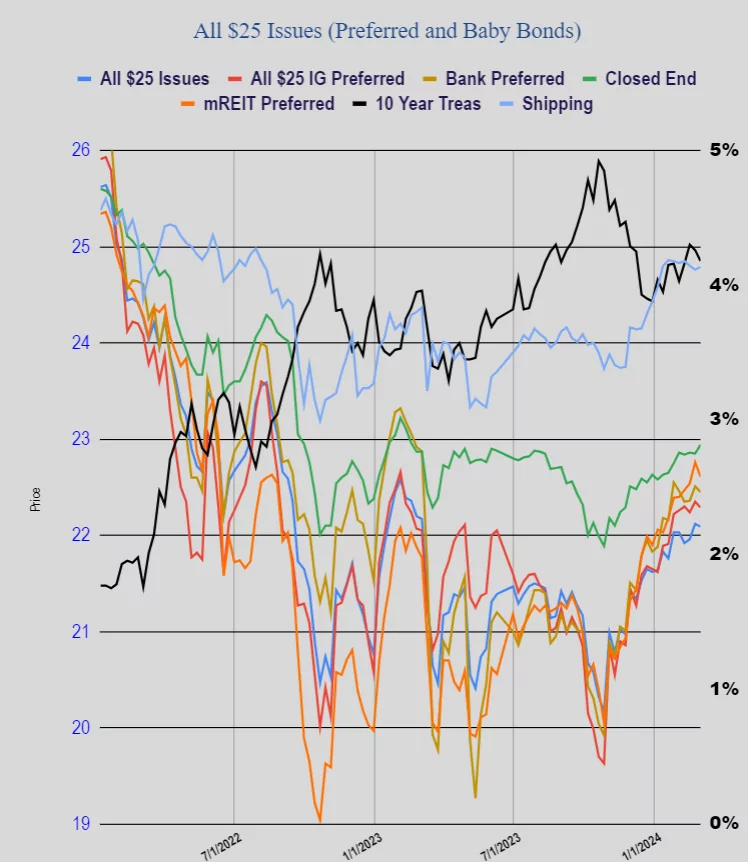

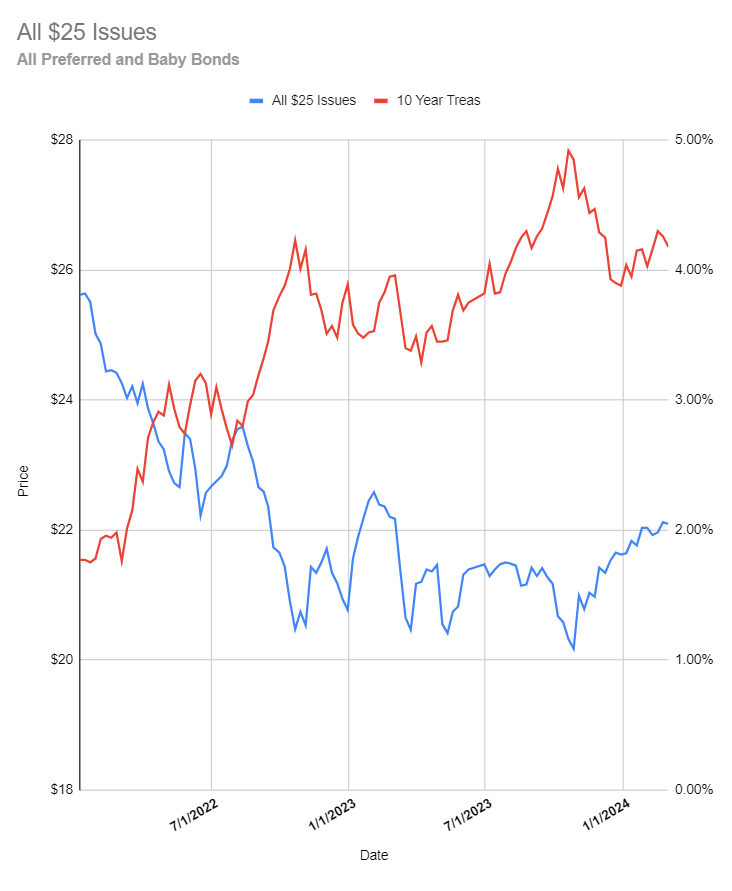

Interest rates moved lower last week with the 10 year treasury yield closing the week around 4.18% which is 8 basis points lower than the Friday before. The trading range on the week remained relatively muted as it traded between 4.18% to 4.32% closing on the low as economic news was a bit soft.

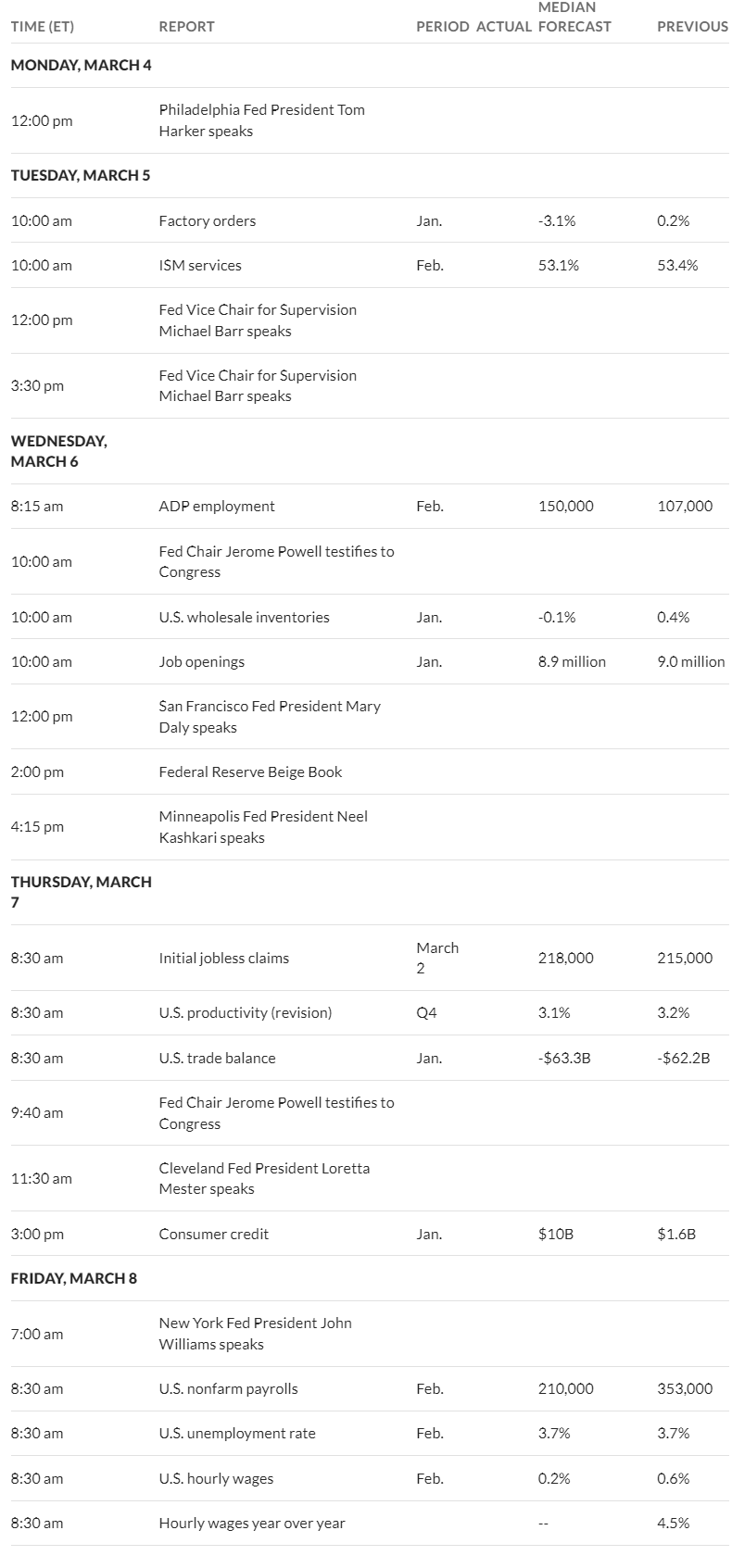

This week we have both the ADP employment report as well as the ‘official’ government employment numbers on Friday. This coupled with testimony before congress by Jay Powell are the big items on the economic calendar this week. Remember that last month the jobs number was a total blowout to the upside–so we could see some massive revisions to those numbers.

Fed balance sheet assets fell by $14 billion last week after a larger than normal drop of over $50 billion.

$25/share preferreds and baby bonds moved by only a tiny amount last week with the average share moving 3 cents lower. Overall a 3 cent move is simply ‘noise’. Investment grade moved 6 cents lower, banks moved 6 cents lower with mREIT preferreds moving 15 cents lower.

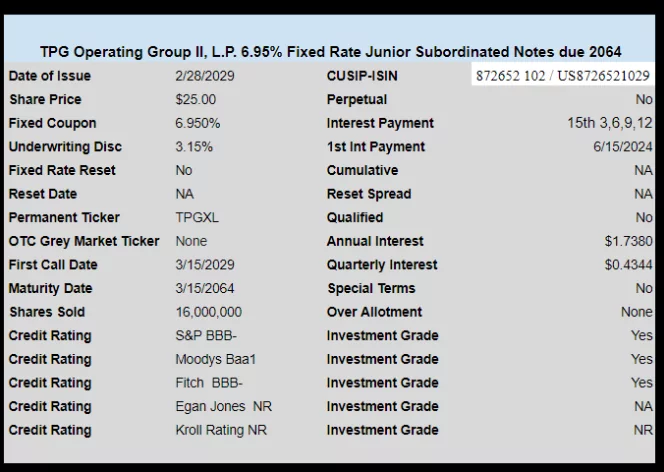

We had 1 new issue priced last week as asset manager TPG sold a 6.95% baby bond. The issue is not yet trading, but we may see it sometime this week–below are the details.

for those needing a short term stash option, new CD offer from TDA;

Encore Bank 5.35%, 3 month, monthly pay