Well we got through last week in fine fashion–of course it was a holiday shortened trading week with July 4th on Thursday. We had a gaggle of employment news–all of which helped to calm fears of higher interest rates–a bit of relief for us income investors.

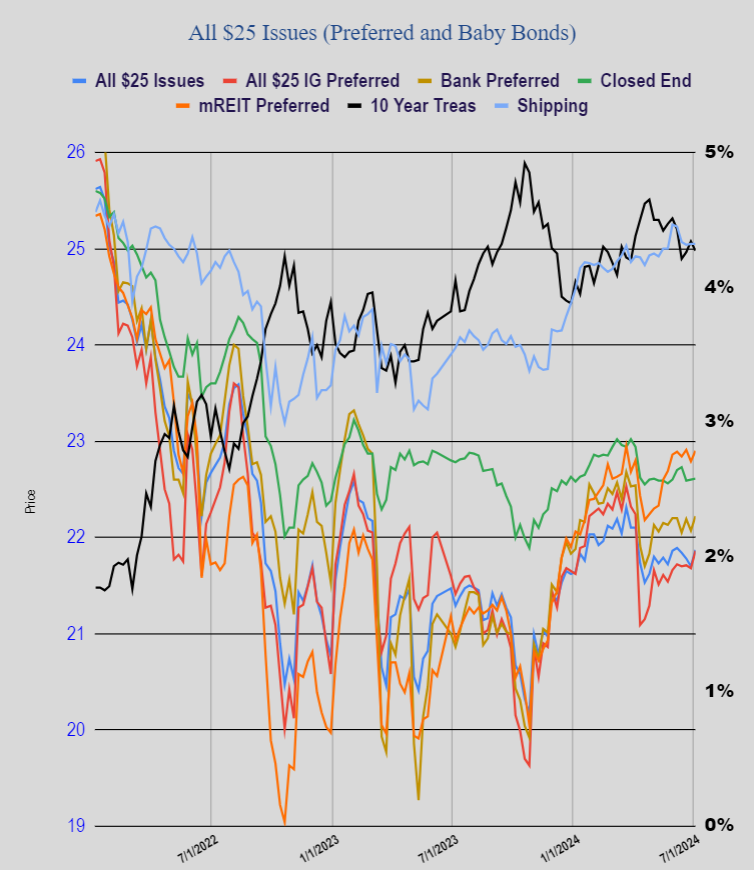

The S&P500 gained just shy of 2% last week–obviously a good week. It will be interesting to see if this can be maintained. Folks proclaim “stocks are overvalued’–but it is true higher and higher prices can go on a long time in particular with ‘dry powder’ on the sidelines at very high levels. If we were to see the 10 year treasury fall down toward 4% it is reasonable to assume more and more money will move toward exchange traded securities of all, common equities as well as high yield preferreds and baby bonds. BUT it will take a reduction in the Fed Funds rate to maximize $$ movement as short term rates will remain high until we see that reduction in Fed Funds.

The 10 year treasury fell by 7 basis points last week from the previous Friday–not much, but down sharply – 21 basis points from the weekly high on Monday. This move lower was proper basis the economic data – the previous move higher was based on fears of higher inflation regardless of who gets elected in November.

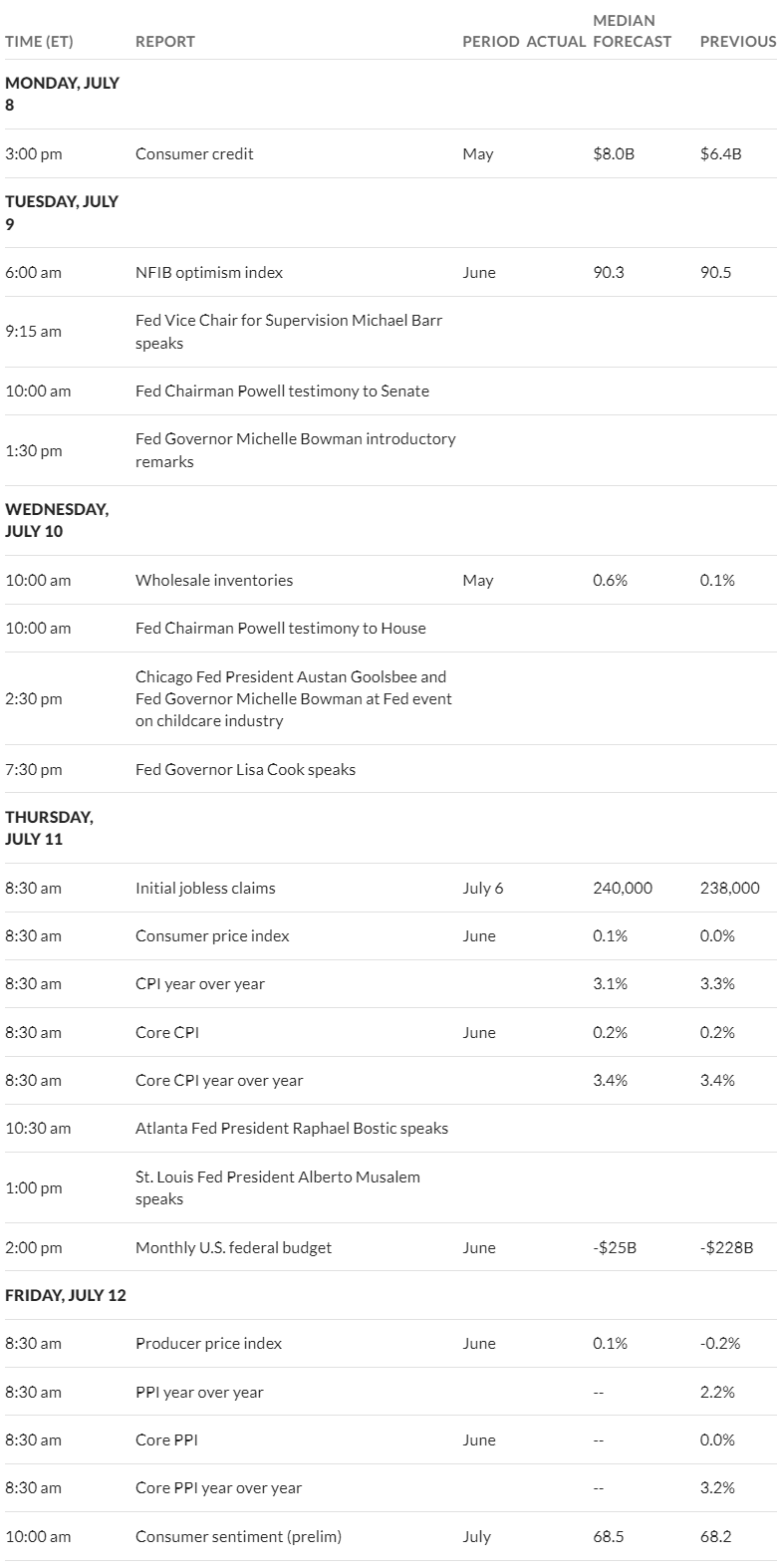

This week we will get more important news in the consumer price index (CPI) as well as the producer price index (PPI). Additionally Fed Chair Powell will give testimony to the senate and house. The table is being set for a September Fed Funds rate cut.

The Fed Balance sheet fell by $22 billion last week–as almost always the 3-4 week average continues to fall at the planned $65 billion/month. It will be only another 4 months and it will be under $7 trillion–quite a milestone.

Last week we finally began to get some upward traction – albeit modest. The average $25/share preferred and baby bond rose by 17 cents. Investment grade issues rose 18 cents, banks rose 15 cents mREITs rose 11 cents.

No new issues were priced last week.

When it comes to stocks are overvalued I think it has more to do with people chasing future earnings.

“The forward 12-month P/E ratio for the S&P 500 is 21.2. This P/E ratio is above the 5-year average (19.3) and above the 10-year average (17.9).”

Factset info above.

It is like something “changed” after covid. 2014 is a totally different era then 2024. That these companies can just keep making “a lot” more money and nothing will get in their way. Yet we see darlings people used to love like Nike and Disney start to stumble. What happens when the mag 7 just misstep a wee bit?

fc,

What is the non-Mag 7 P/E though? My guess more in line with those averages.

“The S&P 500 has a forward price-to-earnings (P/E) ratio of about 15.5x excluding the Magnificent Seven, while the Magnificent Seven has a P/E of about 35x, according to data compiled by FactSet as of January 2, 2024.”

So yes, your instinct is correct. But isn’t is more then likely the most common investor owns ETFs and mutual funds that are most likely heavy with Mag 7?

I guess I am just thinking along the lines that common sense is being thrown out the window once again with certain tech companies. Reminds me of that letter from SUNW back in the day.

Only an educated guess but I’m assuming investors are forgiving those high P/E’s for the Mag 7 companies because they (meaning high flyers in this case) historically blow through any P/E or even no Earnings at all (which was the case with Amazon not too long ago). The S&P 493 is really now a Value index in my opinion. Your initial point made above in my opinion, is correct, in that one misstep and boom. But honestly, if I were a market prognosticator, I’d be a buyer of those value stocks on any weakness. Unless this economy were to get into a protracted slowdown. None of this we know of course. I’m wrong a lot, thats why I am always buying and selling in any market conditions. I’ve given up long ago trying to understand and predict market movements. Found it best to just stay in, stick to my principles of playing small ball with many different things and take some losses every now and then.

I agree on the other 493 having a more normal valuation. I just think the average ETF/MF investors owns a lot more of that 7 then they think. They will only realize it when a misstep takes place for the mag 7.

On top of that I think stock investors, main street types, also are heavy in these names individually. Hell, I think almost everyone is buying these names otherwise you cannot possibly compete with their returns. Even managers must be in them otherwise get fired for under performance with their peers.

So yea. Nobody can predict the future. I am in all of these names in retirement accounts myself. Hard not to be. I am just saying something feels off. People do not seem to care about valuations and what has to take place to grow into it and beyond. They just assume it will happen again and again. Quarter after quarter. It never works out that way. The mag 7 of yester years would be some oil companies and pharma companies.

Fc, 2nd quarter earnings are going to be coming out. I have been hearing banks are being looked to report reduced earnings and I heard and read over the weekend fees are going up on customers to pay for increased regulations. Let’s see what other business reports. Look at WY and PCH earnings to get an idea for the building business.

This has to start affecting the market.

Hi, can you post pricing table for NEE-S? Thank you!